Answered step by step

Verified Expert Solution

Question

1 Approved Answer

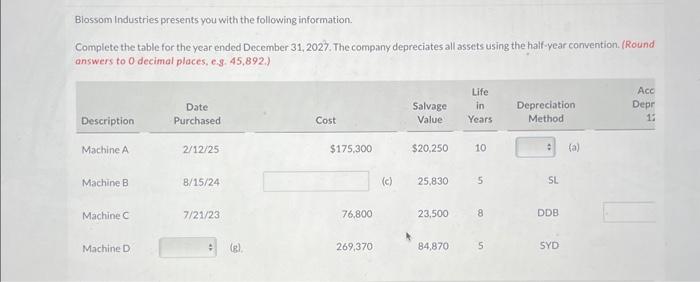

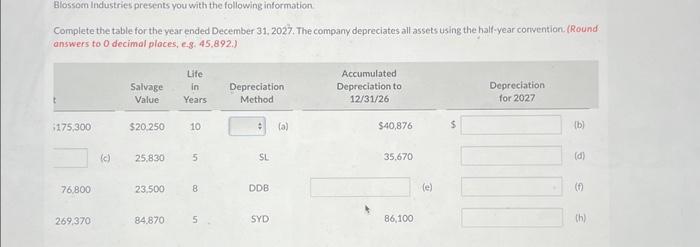

A B C D answers all the parts to the question please Blossom Industries presents you with the following information. Complete the table for the

A

B

C

D

answers all the parts to the question please

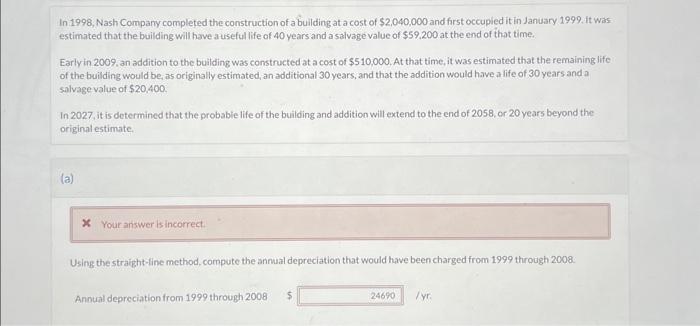

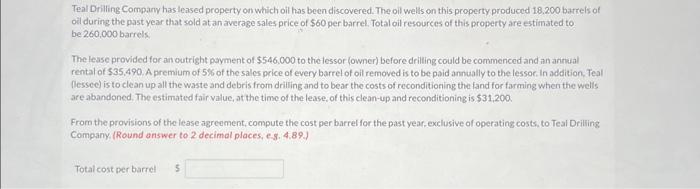

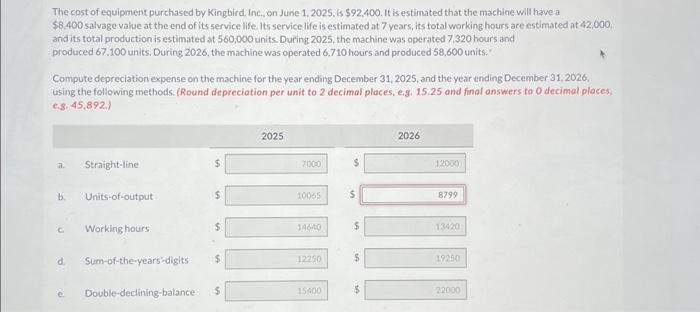

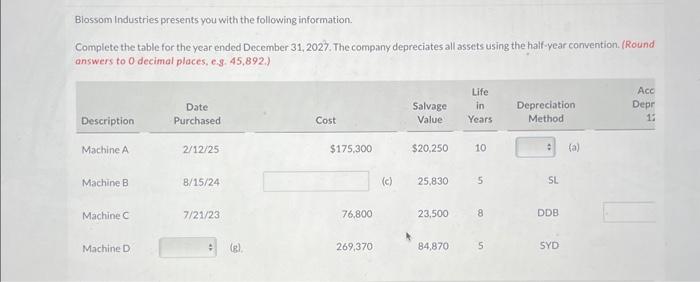

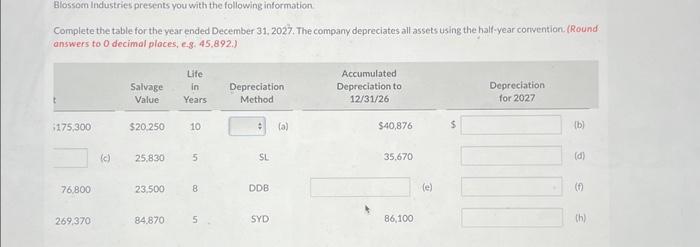

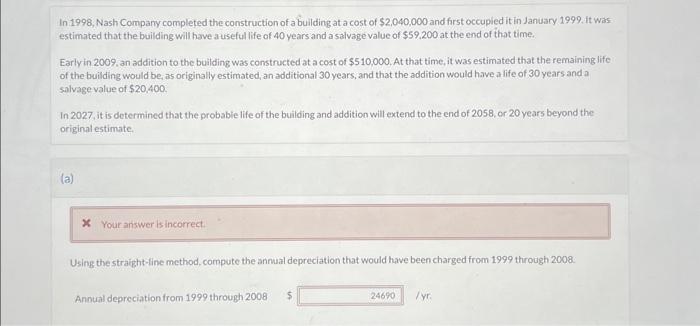

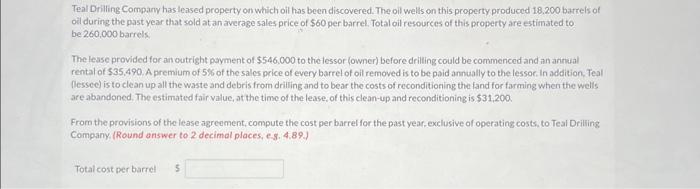

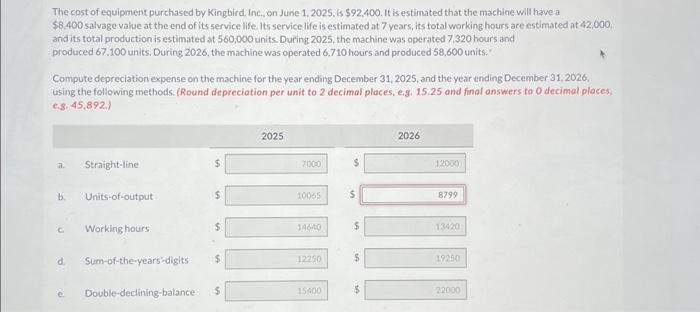

Blossom Industries presents you with the following information. Complete the table for the year ended December 31,2027. The company depreciates all assets using the half-year convention. (Round answers to 0 decimal places, e.g. 45,892. Complete the table for the year ended December 31, 2027. The company depreciates all assets using the half-year corvention. (Round answers to 0 decimal ploces, eg. 45,892 .I In 1998, Nash Company completed the construction of a building at a cost of $2,040,000 and first occupied it in January 1999 . it wis estimated that the building will have auseful life of 40 years and a salvage value of $59.200 at the end of that time. Earlyin 2009, an addition to the building was constructed at a cost of $510,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $20,400. In 2027, it is determined that the probabie life of the building and addition will extend to the end of 2058 , or 20 years beyond the original estimate. (a) Using the straight-line method, compute the anmual depreciation that would have been charged from 1999 through 2008. Annual depreciation from 1999 through 2008 Teal Drilling Compary has leased property on which oil has been discovered. The oil wells on this property produced 18.200 barrels of oil during the past year that sold at an average sales price of $60 per barrel. Total oil resources of this property are estimated to be 260,000 barrels: The lease provided for an outright payment of $546,000 to the lessor (owner) before drilling could be commenced and an annual rental of $35,490. A premium of 5% of the sales price of every barrel of oil removed is to be paid annually to the lessor. In addition. Teal (Dessee) is to clean up all the waste and debris from drilling and to bear the costs of reconditioning the fand for farming when the wells are abandoned. The estimated fair value, at the time of the lease, of this clean-up and reconditioning is $31,200. From the provisions of the lease agreement, compute the cost per barrel for the past year, exclusive of operating costs, to Teal Drilling Company, (Round answer to 2 decimal places, es. 4.89.) Total cost per barrel The cost of equipment purchased by Kingbird, Inc., on June 1.2025 . is $92,400. It is estimated that the machine will have a $8,400 salvage value at the end of its service life. Its service life is estimated at 7 years, its total working hours are estimated at 42,000 , and its total production is estimated at 560,000 units. During 2025, the machine was operated 7,320 hours and produced 67.100 units. During 2026, the machine was operated 6,710 hours and produced 58,600 units." Compute depreciation expense on the machine for the year ending December 31, 2025, and the year ending December 31,2026 , using the following methods. (Round depreciation per unit to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places. e.8. 45,8921 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started