Answered step by step

Verified Expert Solution

Question

1 Approved Answer

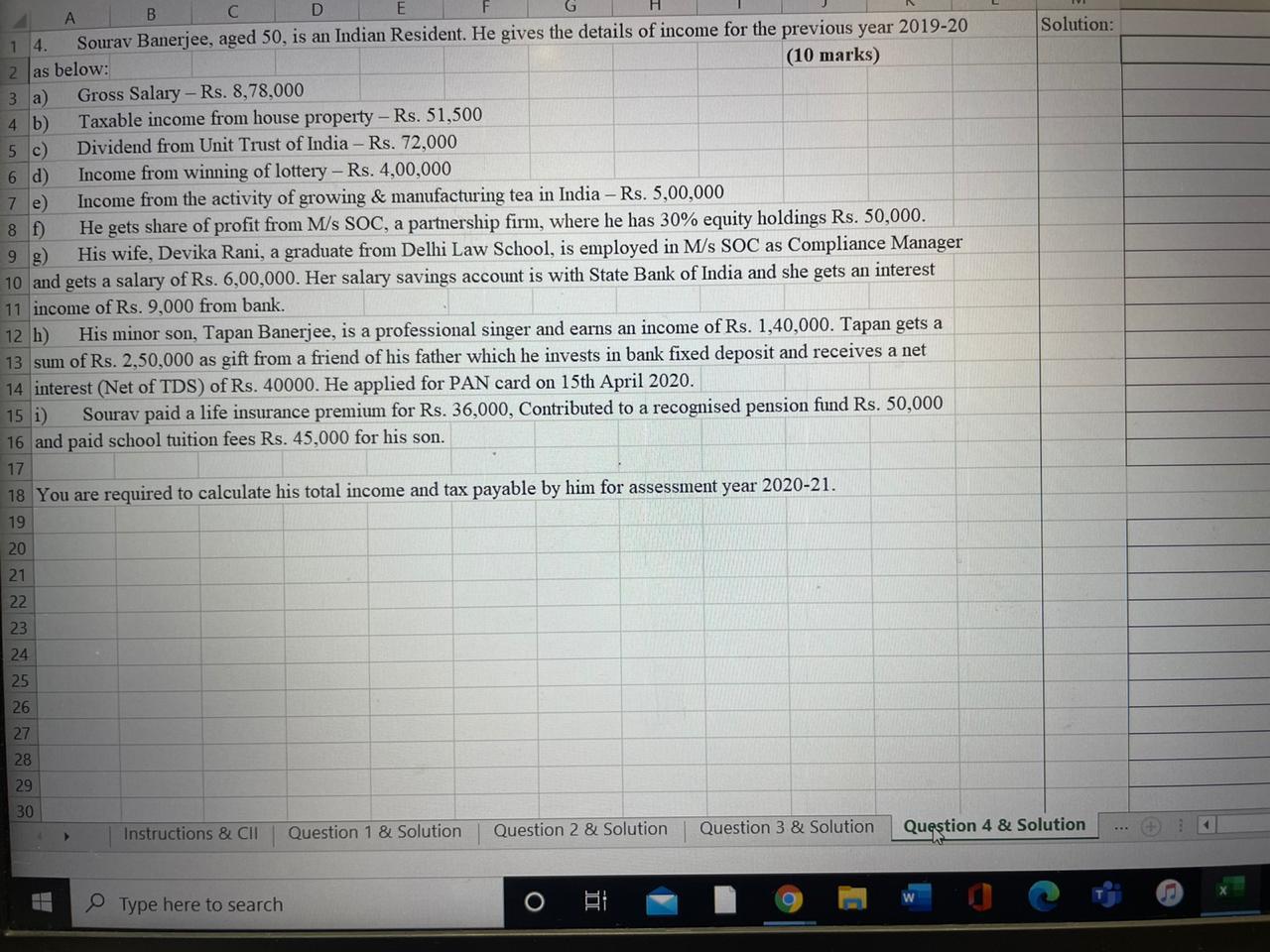

A B C D E F G (10 marks) 14. Sourav Banerjee, aged 50, is an Indian Resident. He gives the details of income

A B C D E F G (10 marks) 14. Sourav Banerjee, aged 50, is an Indian Resident. He gives the details of income for the previous year 2019-20 2 as below: 3 a) Gross Salary Rs. 8,78,000 4 b) Taxable income from house property- Rs. 51,500 5 c) Dividend from Unit Trust of India - Rs. 72,000 6 d) Income from winning of lottery - Rs. 4,00,000 7 e) Income from the activity of growing & manufacturing tea in India - Rs. 5,00,000 8 f) He gets share of profit from M/s SOC, a partnership firm, where he has 30% equity holdings Rs. 50,000. 9 g) His wife, Devika Rani, a graduate from Delhi Law School, is employed in M/s SOC as Compliance Manager 10 and gets a salary of Rs. 6,00,000. Her salary savings account is with State Bank of India and she gets an interest 11 income of Rs. 9,000 from bank. 12 h) His minor son, Tapan Banerjee, is a professional singer and earns an income of Rs. 1,40,000. Tapan gets a 13 sum of Rs. 2,50,000 as gift from a friend of his father which he invests in bank fixed deposit and receives a net 14 interest (Net of TDS) of Rs. 40000. He applied for PAN card on 15th April 2020. 15 i) Sourav paid a life insurance premium for Rs. 36,000, Contributed to a recognised pension fund Rs. 50,000 16 and paid school tuition fees Rs. 45,000 for his son. 17 18 You are required to calculate his total income and tax payable by him for assessment year 2020-21. 19 20 21 22 23 24 2222223 Instructions & CII Question 1 & Solution Question 2 & Solution Question 3 & Solution Type here to search O TT Solution: Question 4 & Solution W C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started