Answered step by step

Verified Expert Solution

Question

1 Approved Answer

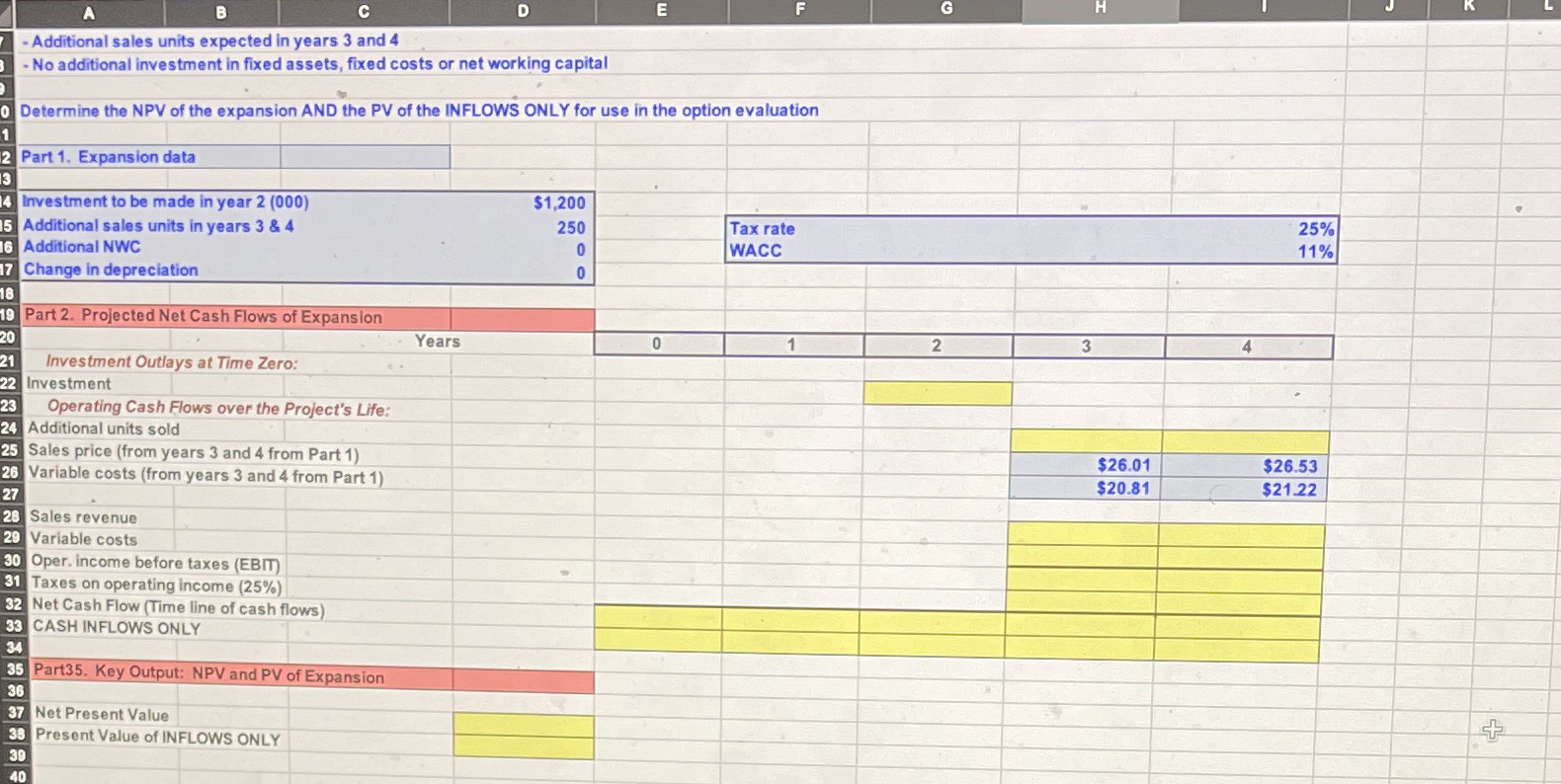

A B C D E F G H 7-Additional sales units expected in years 3 and 4 B No additional investment in fixed assets,

A B C D E F G H 7-Additional sales units expected in years 3 and 4 B No additional investment in fixed assets, fixed costs or net working capital D O Determine the NPV of the expansion AND the PV of the INFLOWS ONLY for use in the option evaluation 1 2 Part 1. Expansion data 13 4 Investment to be made in year 2 (000) 15 Additional sales units in years 3 & 4 16 Additional NWC 7 Change in depreciation 18 19 Part 2. Projected Net Cash Flows of Expansion 20 21 Investment Outlays at Time Zero: 22 Investment 23 Operating Cash Flows over the Project's Life: 24 Additional units sold 25 Sales price (from years 3 and 4 from Part 1) 26 Variable costs (from years 3 and 4 from Part 1) 27 28 Sales revenue 29 Variable costs 30 Oper. income before taxes (EBIT) 31 Taxes on operating income (25%) 32 Net Cash Flow (Time line of cash flows) 33 CASH INFLOWS ONLY 34 35 Part35. Key Output: NPV and PV of Expansion 36 37 Net Present Value 38 Present Value of INFLOWS ONLY 39 40 Years $1,200 250 0 Tax rate WACC 0 1 2 3 4 25% 11% $26.01 $20.81 $26.53 $21.22 - +

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the expansion and the Present Value PV of the INFLOWS ONLY we need to consider the cash flows associated wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started