Answered step by step

Verified Expert Solution

Question

1 Approved Answer

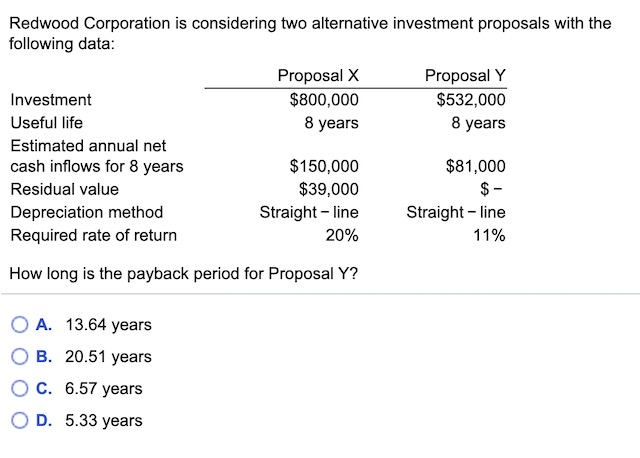

A. B. C. D. E. F. G. H. I. J. Redwood Corporation is considering two alternative investment proposals with the following data: Proposal X Proposal

A.

B.

C.

D.

E.

F.

G.

H.

I.

J.

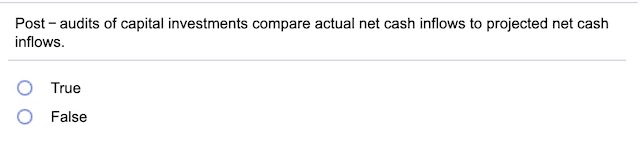

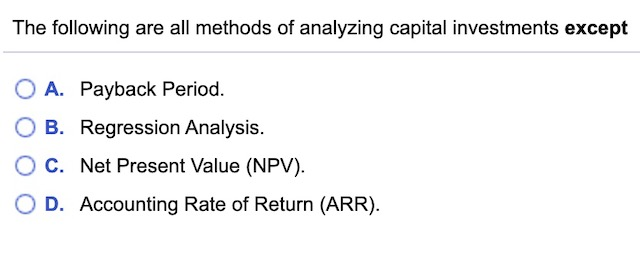

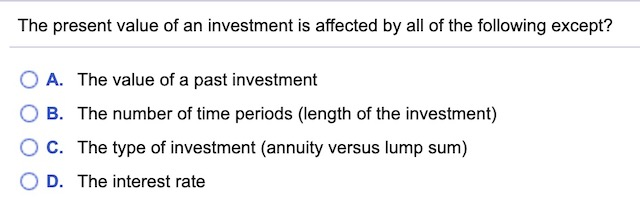

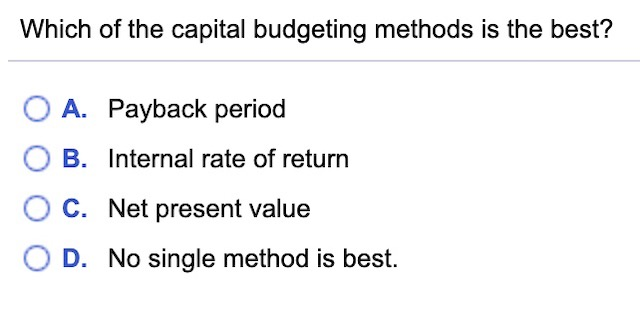

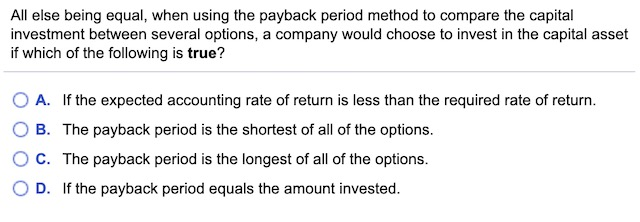

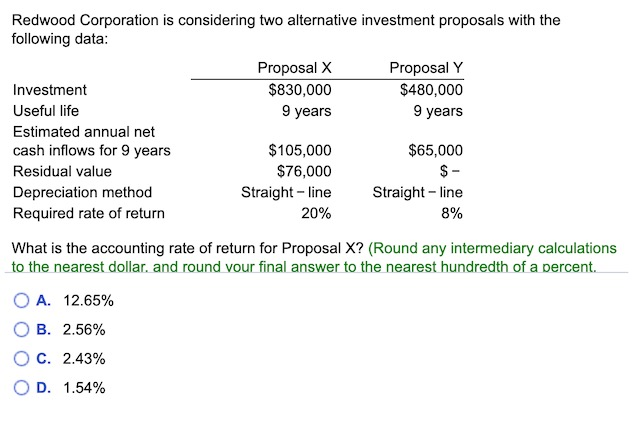

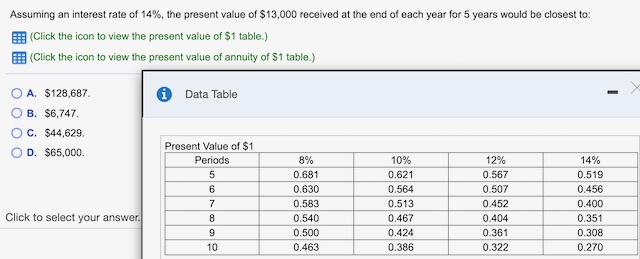

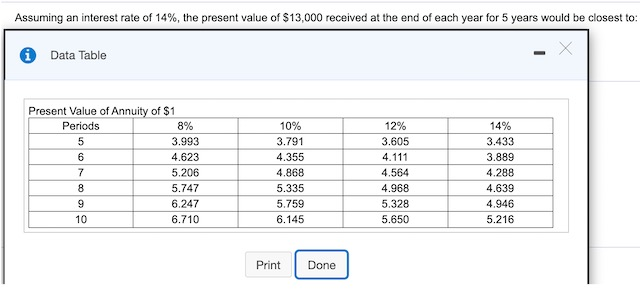

Redwood Corporation is considering two alternative investment proposals with the following data: Proposal X Proposal Y Investment $800,000 $532,000 Useful life 8 years 8 years Estimated annual net cash inflows for 8 years $150,000 $81,000 Residual value $39,000 Depreciation method Straight line Straight-line Required rate of return 20% 11% $- How long is the payback period for Proposal Y? O A. 13.64 years OB. 20.51 years O C. 6.57 years OD. 5.33 years Post - audits of capital investments compare actual net cash inflows to projected net cash inflows. O O True False The following are all methods of analyzing capital investments except O A. Payback Period. OB. Regression Analysis. O C. Net Present Value (NPV). OD. Accounting Rate of Return (ARR). The present value of an investment is affected by all of the following except? O A. The value of a past investment O B. The number of time periods (length of the investment) OC. The type of investment (annuity versus lump sum) OD. The interest rate Which of the capital budgeting methods is the best? O A. Payback period OB. Internal rate of return OC. Net present value OD. No single method is best. All else being equal, when using the payback period method to compare the capital investment between several options, a company would choose to invest in the capital asset if which of the following is true? O A. If the expected accounting rate of return is less than the required rate of return. OB. The payback period is the shortest of all of the options. O c. The payback period is the longest of all of the options. OD. If the payback period equals the amount invested. Redwood Corporation is considering two alternative investment proposals with the following data: Proposal X Proposal Y Investment $830,000 $480,000 Useful life 9 years 9 years Estimated annual net cash inflows for 9 years $105,000 $65,000 Residual value $76,000 $- Depreciation method Straight-line Straight-line Required rate of return 20% 8% What is the accounting rate of return for Proposal X? (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent. O A. 12.65% OB. 2.56% OC. 2.43% OD. 1.54% In what ways are the Net Present Value and Internal Rate of Return methods of capital budgeting alike? O A. They both factor in the time value of money. OB. They both compute the project's unique rate of return. OC. They both focus on GAAP. OD. They both measure the profitability index. Assuming an interest rate of 14%, the present value of $13,000 received at the end of each year for 5 years would be closest to: (Click the icon to view the present value of $1 table.) (Click the icon to view the present value of annuity of $1 table.) * Data Table O A. $128,687 OB. $6,747. OC. $44,629 OD. $65,000. Present Value of $1 Periods 7 8% 0.681 0.630 0.583 0.540 0.500 0.463 10% 0.621 0.564 0.513 0.467 0.424 0.386 12% 0.567 0.507 0.452 0.404 0.361 0.322 14% 0.519 0.456 0.400 0.351 0.308 0.270 Click to select your answer. 9 10 Assuming an interest rate of 14%, the present value of $13,000 received at the end of each year for 5 years would be closest to: i Data Table Present Value of Annuity of $1 Periods 8% 5 3.993 4.623 7 5 206 5.747 6.247 10 6.710 10% 3.791 4.355 4.868 5.335 5.759 6.145 12% 3.605 4.111 4.564 4.968 5.328 5.650 14% 3.433 3.889 4.288 4.639 4.946 5.216 Print Done The interest rate that makes the net present value of the investment equal to zero is the internal rate of return. O O True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started