Answered step by step

Verified Expert Solution

Question

1 Approved Answer

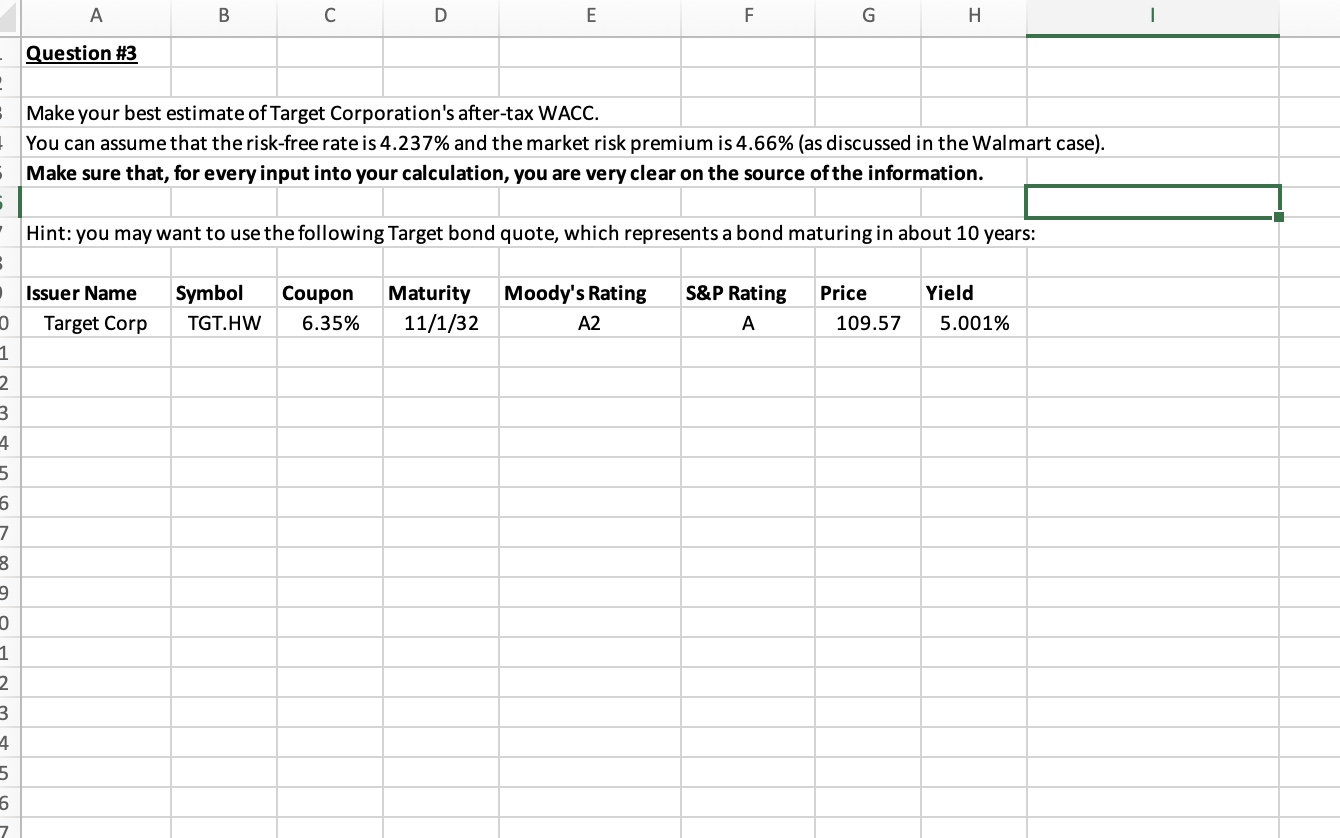

A B C D E F G H | Question #3 3 Make your best estimate of Target Corporation's after-tax WACC. You can assume

A B C D E F G H | Question #3 3 Make your best estimate of Target Corporation's after-tax WACC. You can assume that the risk-free rate is 4.237% and the market risk premium is 4.66% (as discussed in the Walmart case). Make sure that, for every input into your calculation, you are very clear on the source of the information. Hint: you may want to use the following Target bond quote, which represents a bond maturing in about 10 years: 0 Issuer Name Target Corp Symbol TGT.HW Coupon 6.35% Maturity 11/1/32 Moody's Rating A2 S&P Rating A Price Yield 109.57 5.001% 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started