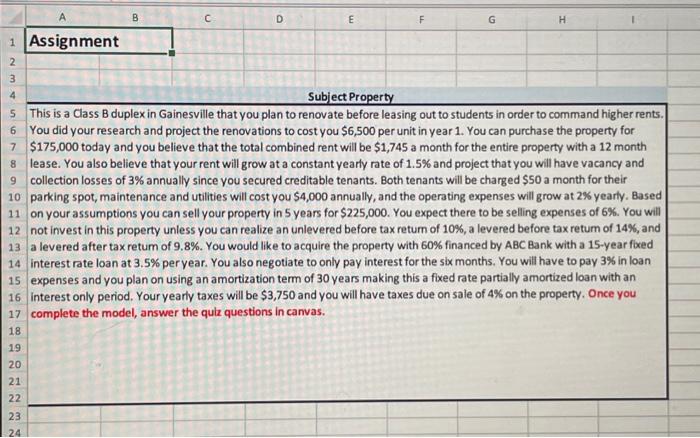

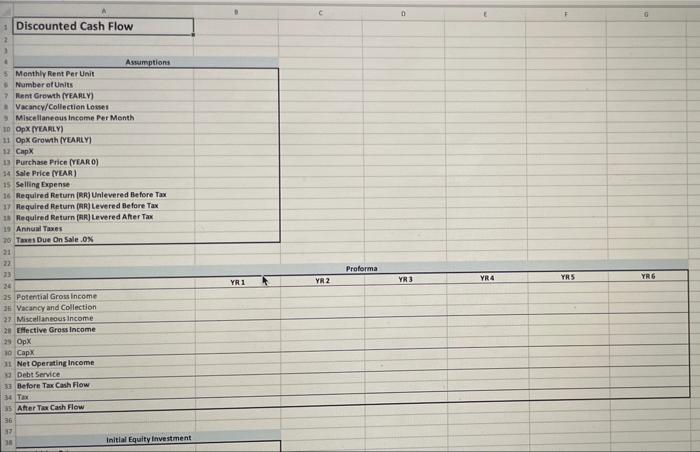

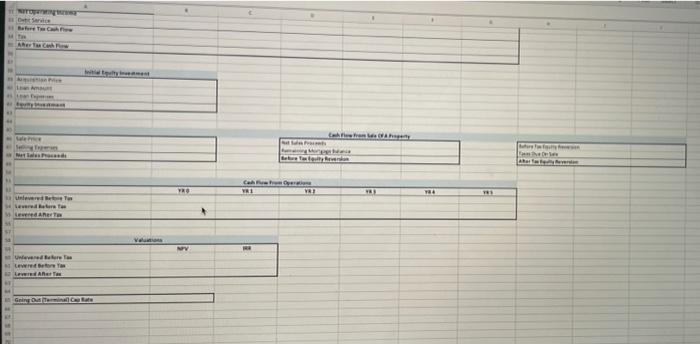

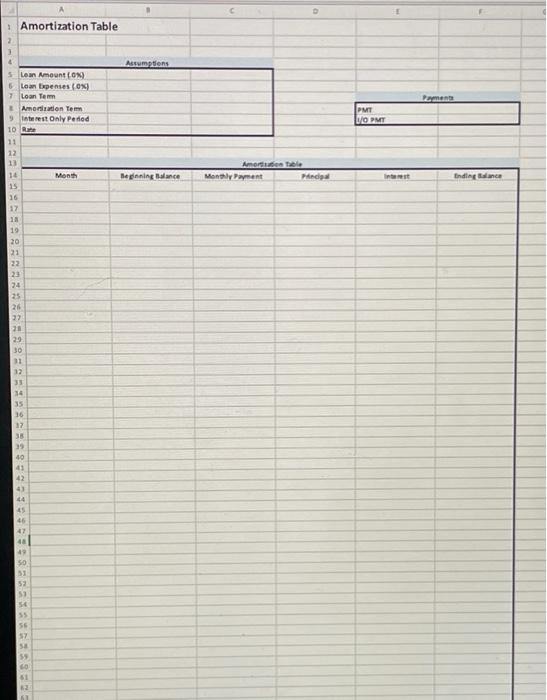

A B c D E G H 1 Assignment 2 3 4 Subject Property $ This is a Class B duplex in Gainesville that you plan to renovate before leasing out to students in order to command higher rents. 6 You did your research and project the renovations to cost you $6,500 per unit in year 1. You can purchase the property for 7 $175,000 today and you believe that the total combined rent will be $1,745 a month for the entire property with a 12 month 8 lease. You also believe that your rent will grow at a constant yearly rate of 1.5% and project that you will have vacancy and 9 collection losses of 3% annually since you secured creditable tenants. Both tenants will be charged $50 a month for their 10 parking spot, maintenance and utilities will cost you $4,000 annually, and the operating expenses will grow at 2% yearly. Based 11 on your assumptions you can sell your property in 5 years for $225,000. You expect there to be selling expenses of 6%. You will 12 not invest in this property unless you can realize an unlevered before tax retum of 10%, a levered before tax retum of 14%, and 13 a levered after tax retum of 9.8%. You would like to acquire the property with 60% financed by ABC Bank with a 15-year fixed 14 interest rate loan at 3.5% per year. You also negotiate to only pay interest for the six months. You will have to pay 3% in loan 15 expenses and you plan on using an amortization term of 30 years making this a fixed rate partially amortized loan with an 16 Interest only period. Your yearly taxes will be $3,750 and you will have taxes due on sale of 4% on the property. Once you 17 complete the model, answer the qulz questions in canvas. 18 19 20 21 22 23 24 M D Discounted Cash Flow Assumption 5 Monthly Rent Per Unit Number of Units 7 Rent Growth (YEARLY) Vacancy/Collection Lorses 3 Miscellaneous Income Per Month 10 OpX YEARLY) 11 Opx Growth (YEARLY) 12 CapX 1 Purchase Price (YEAR O) 14 Sale Price [YEAR) 15 Selling Expense 16 Required Return IRR) Unlevered Before Tax 17 Required Return (RR) Levered Before Tax 15 Required Return (RR) Levered After Tax 19 Annual Taxes 10 Tas Due On Sale.OX Proforma YR 3 YR 4 YRS YR 2 YRG YR1 23 24 25 Potential Gross income Vacancy and Collection 27 Miscellaneous Income 20 Effective Gross income 29 10 Capx 11 Net Operating Income Debt Service 3 Before Tax Cash Flow 34 TX 35 After Tax Cash Flow 36 17 Initial Equity Investment Ayer w YO TR1 YRI ya Univered er er werd Ant Valio AN Uwere to Newer tortas LAT GD Amortization Table 2 3 Assumptions 5 Lem Amount (ON Loan Expenses (0) 7 Loan Term Amortization Tem 9 Interest Only Peded 10 R 11 12 PMI LOPMI Amortion Monthly Payment Month Beginning Balance Pindi st Ending dance 16 25 16 17 18 19 20 21 23 24 25 26 27 20 29 30 11 12 33 34 35 36 37 35 39 40 42 43 45 45 7 45 49 50 31 52 53 54 56 37 59 40 51 A B c D E G H 1 Assignment 2 3 4 Subject Property $ This is a Class B duplex in Gainesville that you plan to renovate before leasing out to students in order to command higher rents. 6 You did your research and project the renovations to cost you $6,500 per unit in year 1. You can purchase the property for 7 $175,000 today and you believe that the total combined rent will be $1,745 a month for the entire property with a 12 month 8 lease. You also believe that your rent will grow at a constant yearly rate of 1.5% and project that you will have vacancy and 9 collection losses of 3% annually since you secured creditable tenants. Both tenants will be charged $50 a month for their 10 parking spot, maintenance and utilities will cost you $4,000 annually, and the operating expenses will grow at 2% yearly. Based 11 on your assumptions you can sell your property in 5 years for $225,000. You expect there to be selling expenses of 6%. You will 12 not invest in this property unless you can realize an unlevered before tax retum of 10%, a levered before tax retum of 14%, and 13 a levered after tax retum of 9.8%. You would like to acquire the property with 60% financed by ABC Bank with a 15-year fixed 14 interest rate loan at 3.5% per year. You also negotiate to only pay interest for the six months. You will have to pay 3% in loan 15 expenses and you plan on using an amortization term of 30 years making this a fixed rate partially amortized loan with an 16 Interest only period. Your yearly taxes will be $3,750 and you will have taxes due on sale of 4% on the property. Once you 17 complete the model, answer the qulz questions in canvas. 18 19 20 21 22 23 24 M D Discounted Cash Flow Assumption 5 Monthly Rent Per Unit Number of Units 7 Rent Growth (YEARLY) Vacancy/Collection Lorses 3 Miscellaneous Income Per Month 10 OpX YEARLY) 11 Opx Growth (YEARLY) 12 CapX 1 Purchase Price (YEAR O) 14 Sale Price [YEAR) 15 Selling Expense 16 Required Return IRR) Unlevered Before Tax 17 Required Return (RR) Levered Before Tax 15 Required Return (RR) Levered After Tax 19 Annual Taxes 10 Tas Due On Sale.OX Proforma YR 3 YR 4 YRS YR 2 YRG YR1 23 24 25 Potential Gross income Vacancy and Collection 27 Miscellaneous Income 20 Effective Gross income 29 10 Capx 11 Net Operating Income Debt Service 3 Before Tax Cash Flow 34 TX 35 After Tax Cash Flow 36 17 Initial Equity Investment Ayer w YO TR1 YRI ya Univered er er werd Ant Valio AN Uwere to Newer tortas LAT GD Amortization Table 2 3 Assumptions 5 Lem Amount (ON Loan Expenses (0) 7 Loan Term Amortization Tem 9 Interest Only Peded 10 R 11 12 PMI LOPMI Amortion Monthly Payment Month Beginning Balance Pindi st Ending dance 16 25 16 17 18 19 20 21 23 24 25 26 27 20 29 30 11 12 33 34 35 36 37 35 39 40 42 43 45 45 7 45 49 50 31 52 53 54 56 37 59 40 51