A:

B:

B:

C:

C:

D:

D:

E:

E:

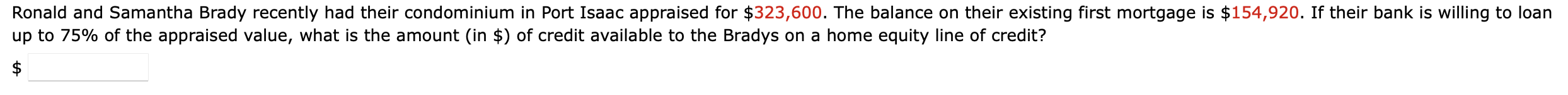

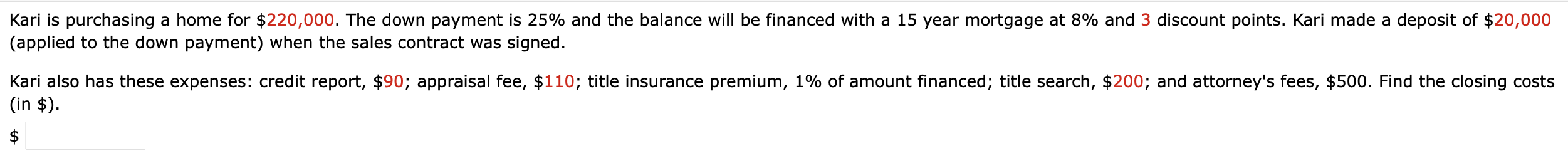

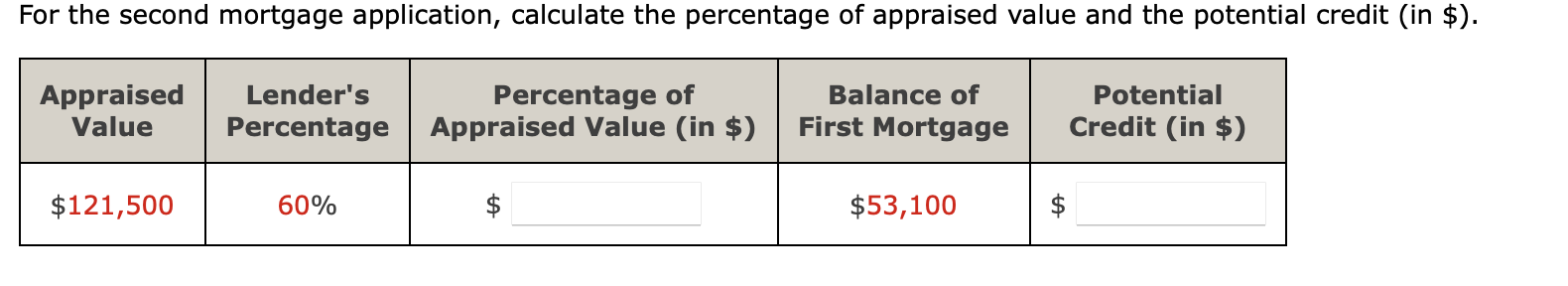

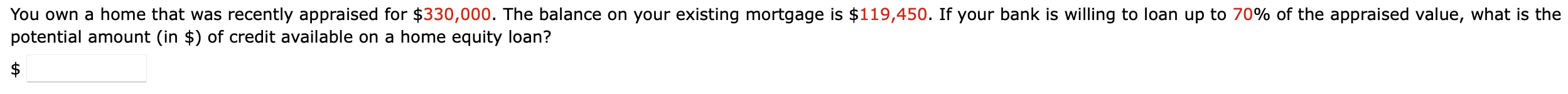

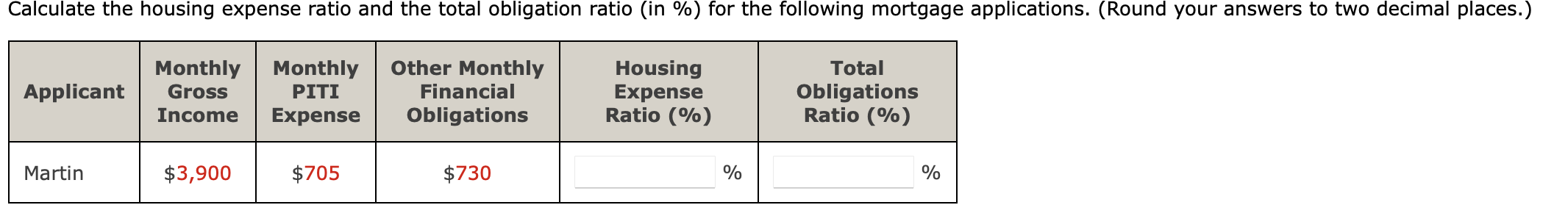

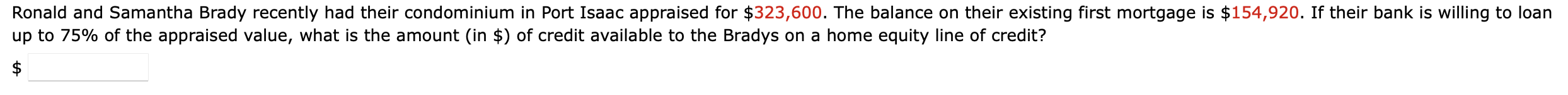

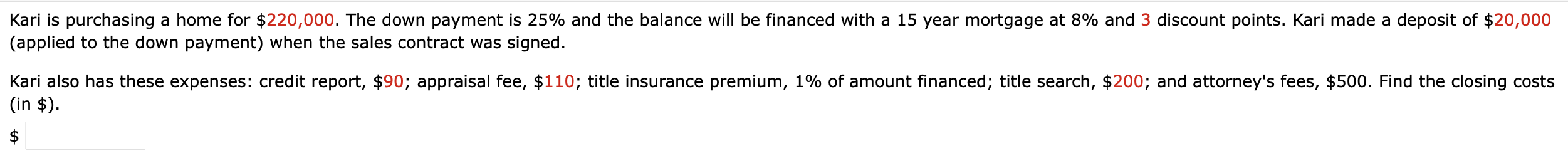

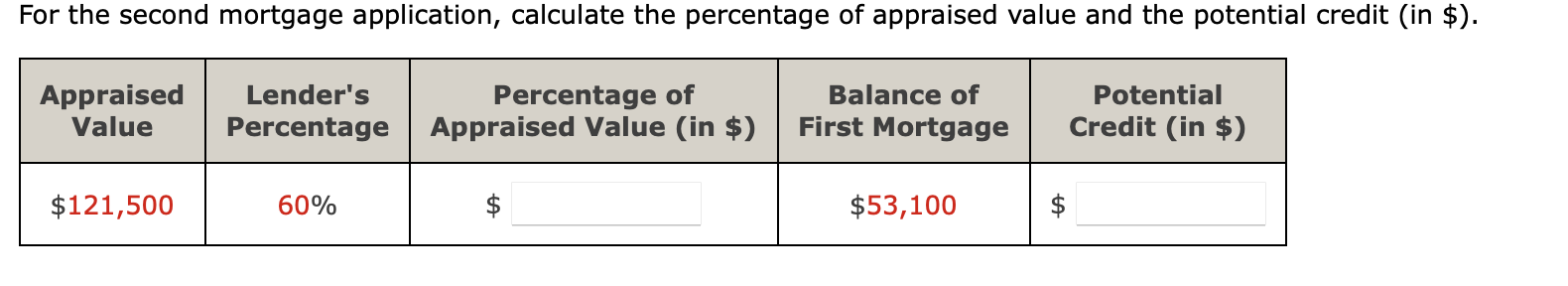

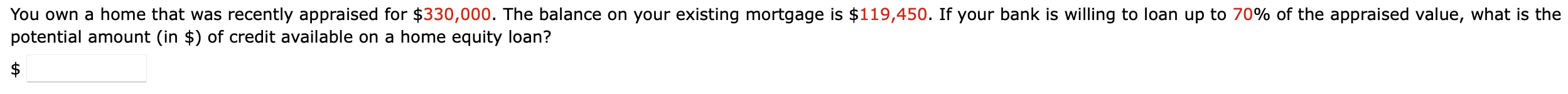

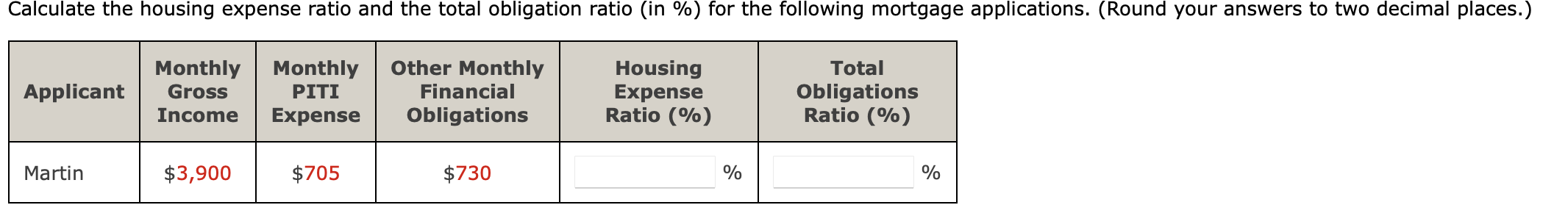

Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $90; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (in $). $ For the second mortgage application, calculate the percentage of appraised value and the potential credit (in $). Appraised Value Lender's Percentage Percentage of Appraised Value (in $) Balance of First Mortgage Potential Credit (in $) $121,500 60% $53,100 $ You own a home that was recently appraised for $330,000. The balance on your existing mortgage is $119,450. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? $ Calculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Applicant Monthly Gross Income Monthly PITI Expense Other Monthly Financial Obligations Housing Expense Ratio (%) Total Obligations Ratio (%) Martin $3,900 $705 $730 % % Ronald and Samantha Brady recently had their condominium in Port Isaac appraised for $323,600. The balance on their existing first mortgage is $154,920. If their bank is willing to loan up to 75% of the appraised value, what is the amount (in $) of credit available to the Bradys on a home equity line of credit? $ Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $90; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (in $). $ For the second mortgage application, calculate the percentage of appraised value and the potential credit (in $). Appraised Value Lender's Percentage Percentage of Appraised Value (in $) Balance of First Mortgage Potential Credit (in $) $121,500 60% $53,100 $ You own a home that was recently appraised for $330,000. The balance on your existing mortgage is $119,450. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? $ Calculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Applicant Monthly Gross Income Monthly PITI Expense Other Monthly Financial Obligations Housing Expense Ratio (%) Total Obligations Ratio (%) Martin $3,900 $705 $730 % % Ronald and Samantha Brady recently had their condominium in Port Isaac appraised for $323,600. The balance on their existing first mortgage is $154,920. If their bank is willing to loan up to 75% of the appraised value, what is the amount (in $) of credit available to the Bradys on a home equity line of credit? $

B:

B: C:

C: D:

D: E:

E: