A:

B:

B:

C:

C:

D:

D:  E:

E:

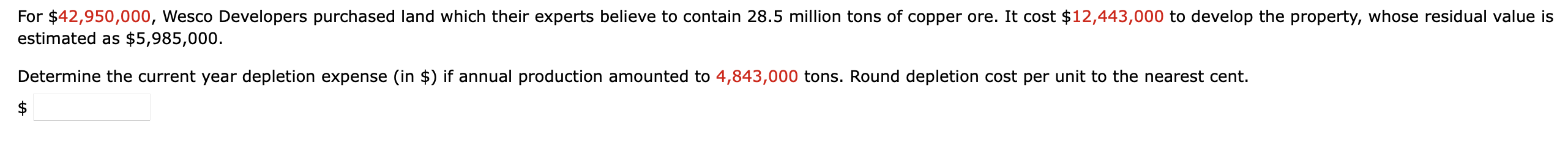

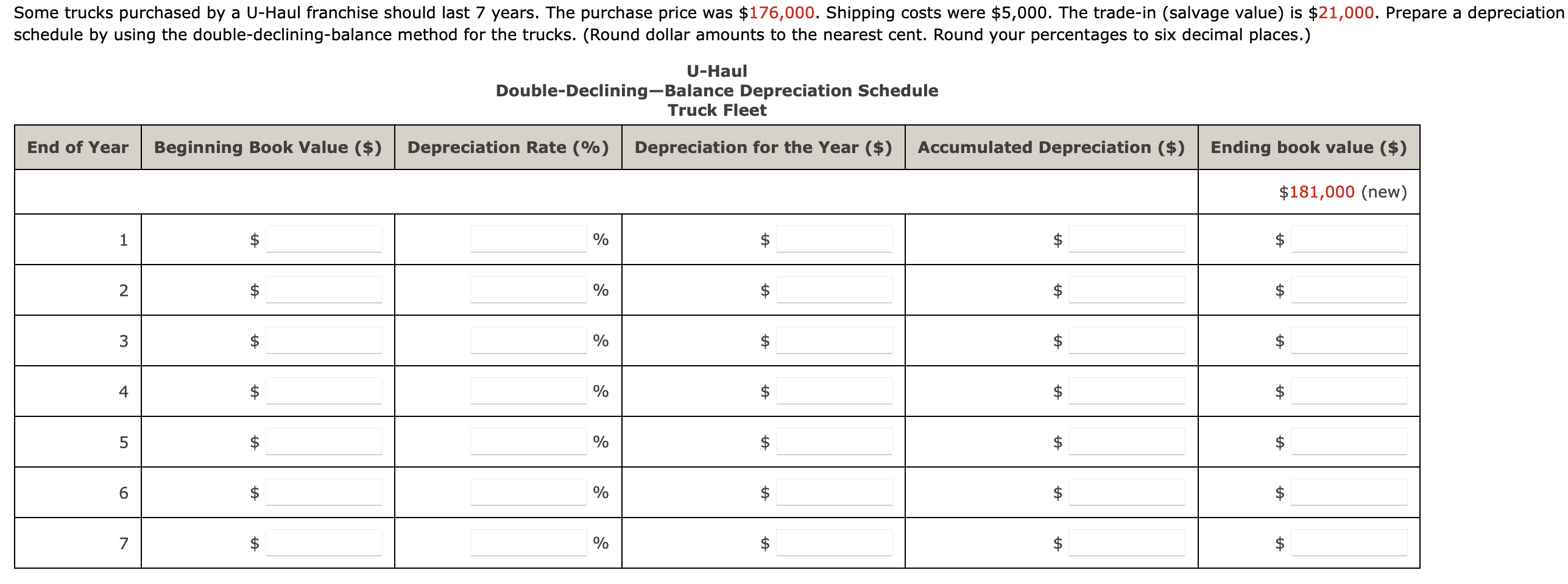

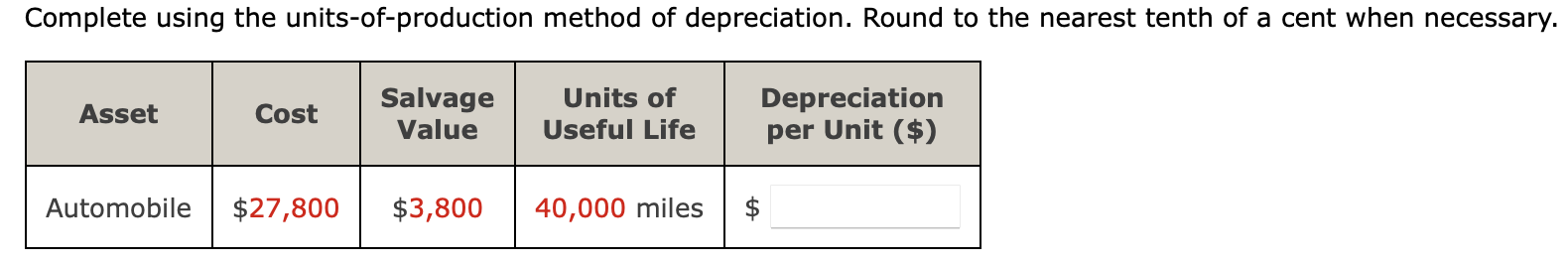

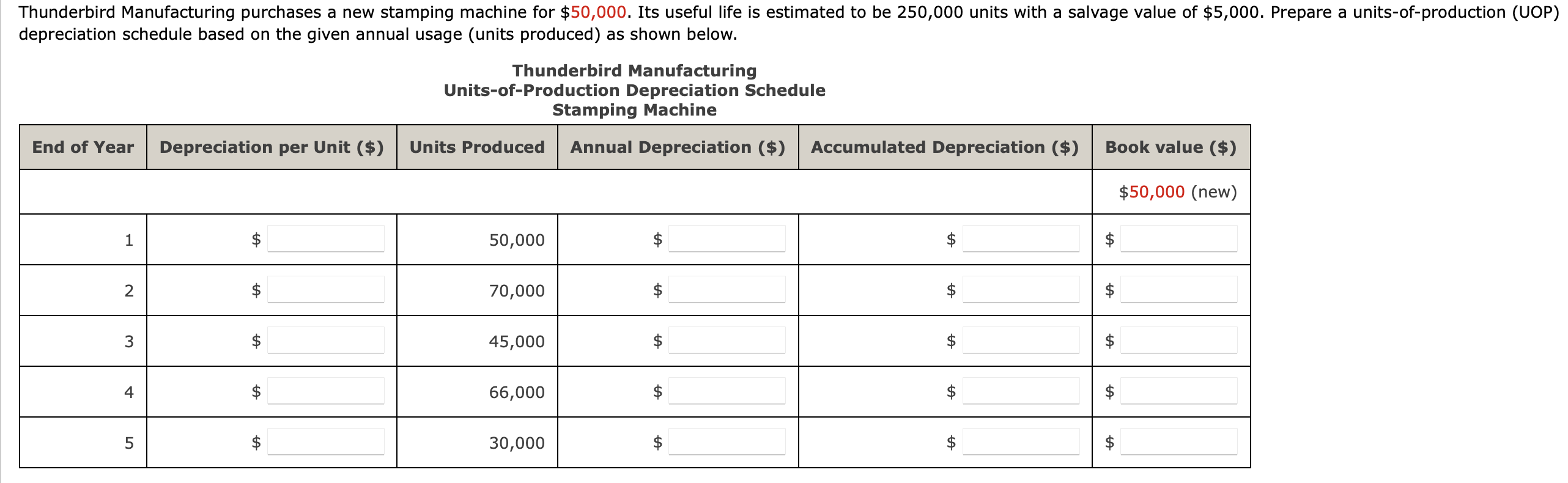

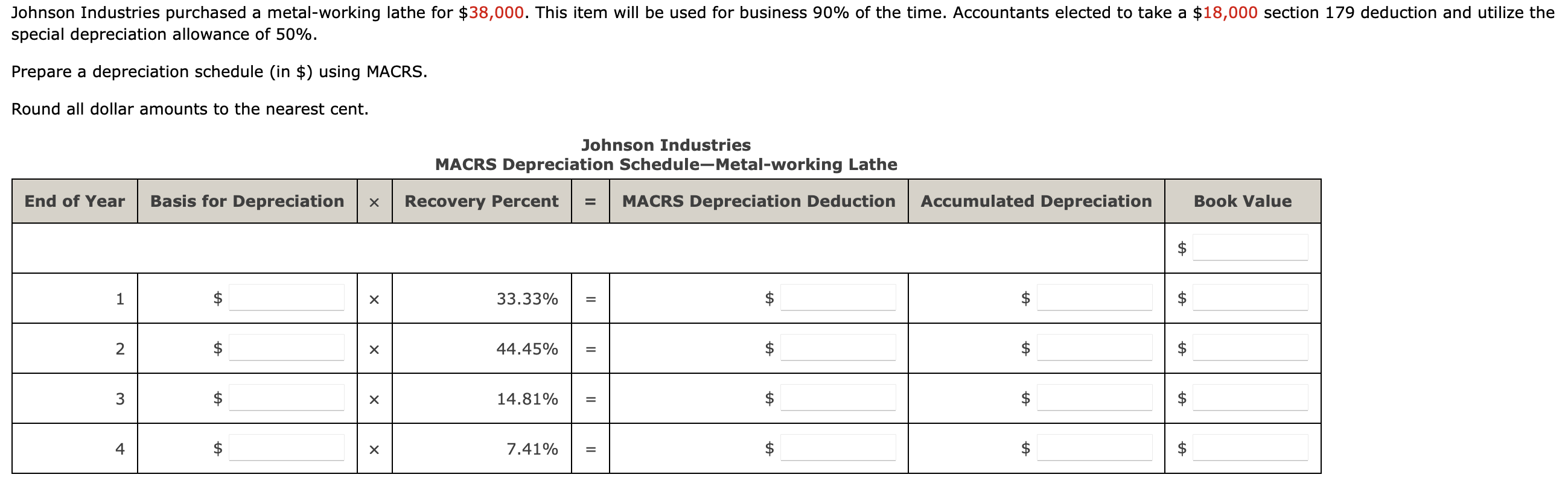

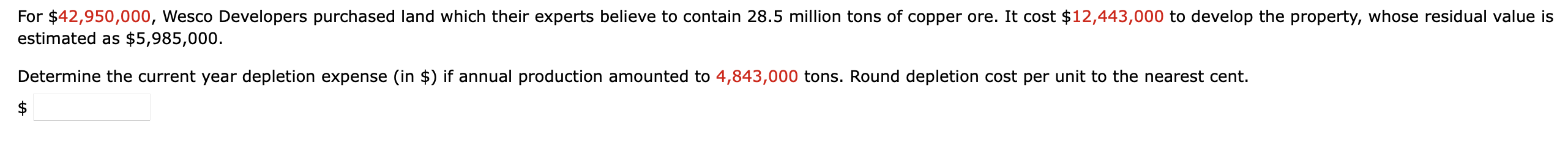

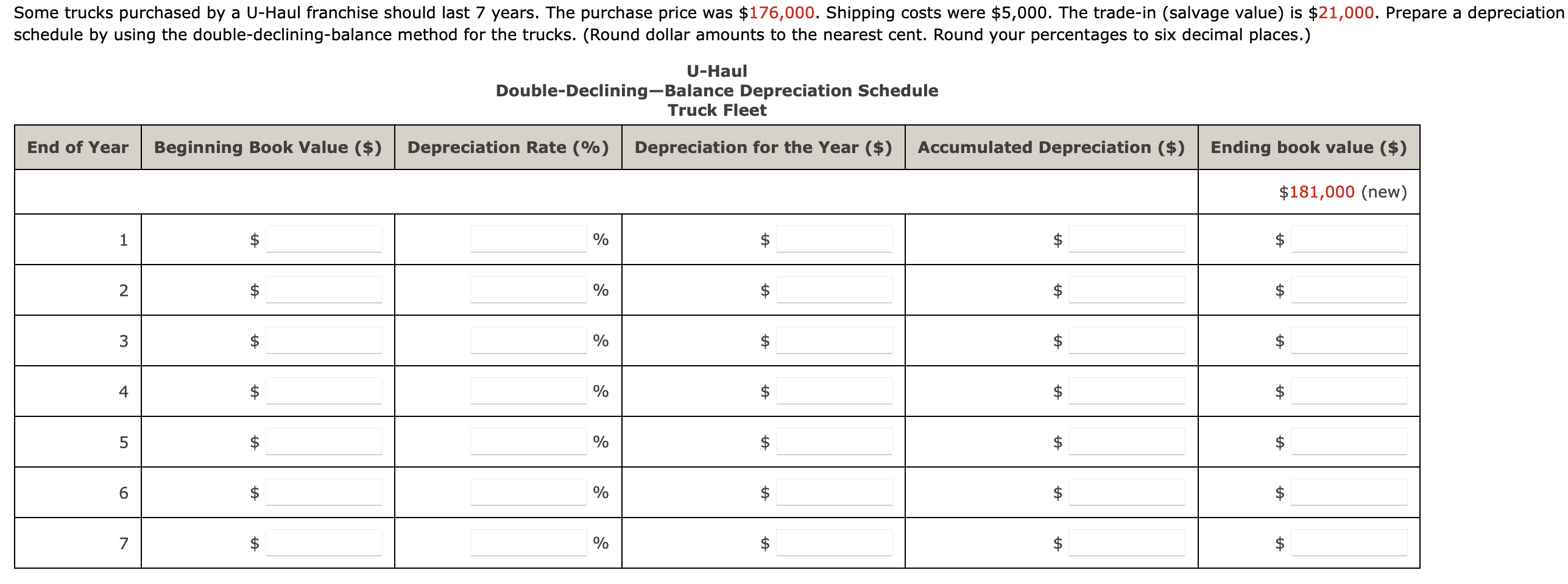

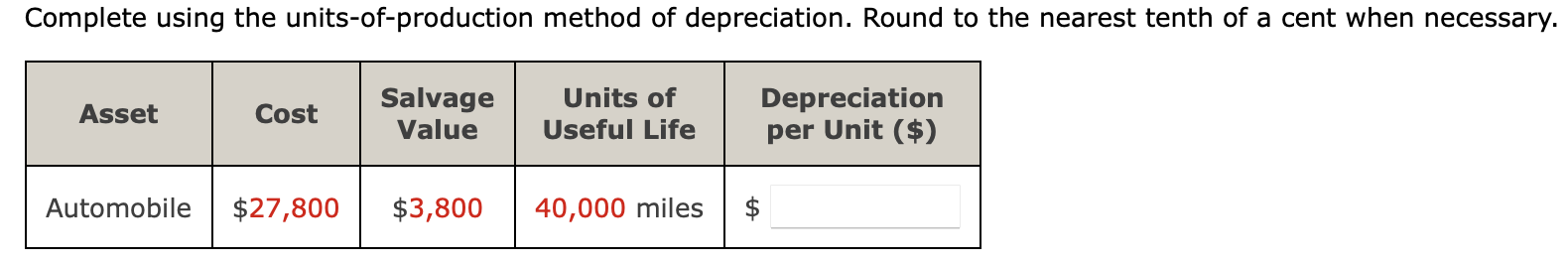

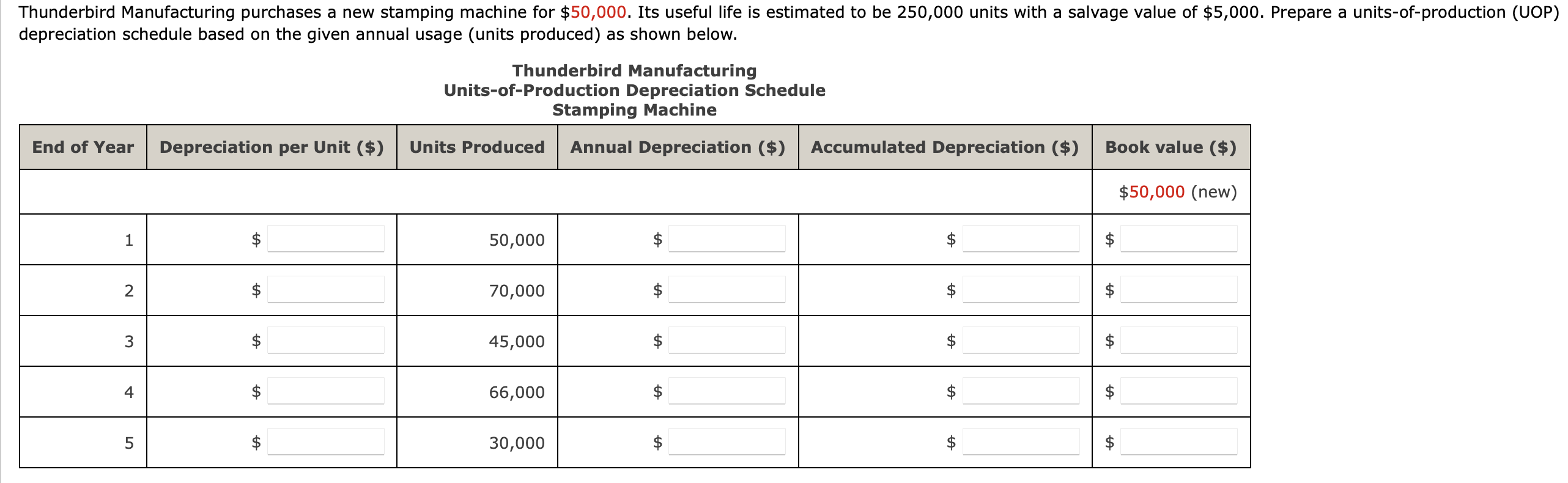

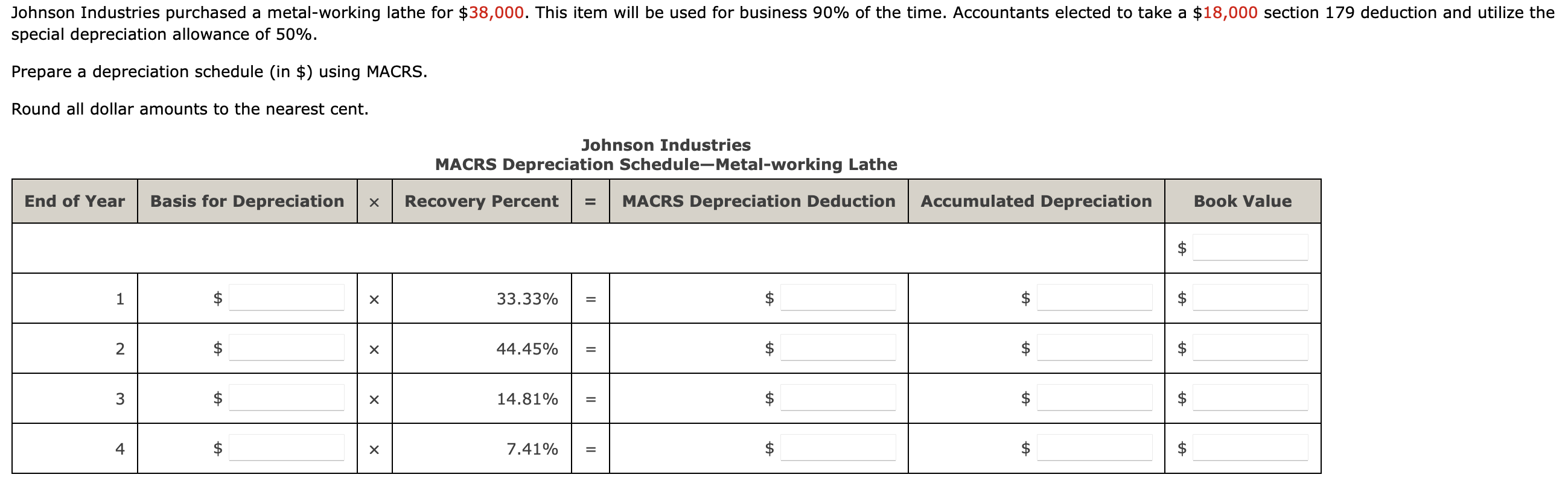

Some trucks purchased by a U-Haul franchise should last 7 years. The purchase price was $176,000. Shipping costs were $5,000. The trade-in (salvage value) is $21,000. Prepare a depreciation schedule by using the double-declining-balance method for the trucks. (Round dollar amounts to the nearest cent. Round your percentages to six decimal places.) U-Haul Double-Declining-Balance Depreciation Schedule Truck Fleet End of Year Beginning Book Value ($) Depreciation Rate (%) Depreciation for the Year ($) Accumulated Depreciation ($) Ending book value ($) $181,000 (new) 1 % $ $ 2 2 A % $ $ 3 $ % $ $ $ $ 4 A % $ " 5 A % $ 6 % $ $ 7 % $ Complete using the units-of-production method of depreciation. Round to the nearest tenth of a cent when necessary. Asset Cost Salvage Value Units of Useful Life Depreciation per Unit ($) Automobile $27,800 $3,800 40,000 miles $ Thunderbird Manufacturing purchases a new stamping machine for $50,000. Its useful life is estimated to be 250,000 units with a salvage value of $5,000. Prepare a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below. Thunderbird Manufacturing Units-of-Production Depreciation Schedule Stamping Machine End of Year Depreciation per Unit ($) Units Produced Annual Depreciation ($) Accumulated Depreciation ($) Book value ($) $50,000 (new) 1 50,000 $ 2 70,000 $ $ $ 3 $ 45,000 $ $ $ 4 66,000 $ $ $ 5 $ A 30,000 $ $ Johnson Industries purchased a metal-working lathe for $38,000. This item will be used for business 90% of the time. Accountants elected to take a $18,000 section 179 deduction and utilize the special depreciation allowance of 50%. Prepare a depreciation schedule (in $) using MACRS. Round all dollar amounts to the nearest cent. Johnson Industries MACRS Depreciation Schedule-Metal-working Lathe End of Year Basis for Depreciation Recovery Percent = MACRS Depreciation Deduction Accumulated Depreciation Book Value 1 33.33% $ $ $ 2 44.45% $ $ 3 14.81% = $ $ $ 4 $ 7.41% = $ $ $ A For $42,950,000, Wesco Developers purchased land which their experts believe to contain 28.5 million tons of copper ore. It cost $12,443,000 to develop the property, whose residual value is estimated as $5,985,000. Determine the current year depletion expense (in $) if annual production amounted to 4,843,000 tons. Round depletion cost per unit to the nearest cent. $ Some trucks purchased by a U-Haul franchise should last 7 years. The purchase price was $176,000. Shipping costs were $5,000. The trade-in (salvage value) is $21,000. Prepare a depreciation schedule by using the double-declining-balance method for the trucks. (Round dollar amounts to the nearest cent. Round your percentages to six decimal places.) U-Haul Double-Declining-Balance Depreciation Schedule Truck Fleet End of Year Beginning Book Value ($) Depreciation Rate (%) Depreciation for the Year ($) Accumulated Depreciation ($) Ending book value ($) $181,000 (new) 1 % $ $ 2 2 A % $ $ 3 $ % $ $ $ $ 4 A % $ " 5 A % $ 6 % $ $ 7 % $ Complete using the units-of-production method of depreciation. Round to the nearest tenth of a cent when necessary. Asset Cost Salvage Value Units of Useful Life Depreciation per Unit ($) Automobile $27,800 $3,800 40,000 miles $ Thunderbird Manufacturing purchases a new stamping machine for $50,000. Its useful life is estimated to be 250,000 units with a salvage value of $5,000. Prepare a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below. Thunderbird Manufacturing Units-of-Production Depreciation Schedule Stamping Machine End of Year Depreciation per Unit ($) Units Produced Annual Depreciation ($) Accumulated Depreciation ($) Book value ($) $50,000 (new) 1 50,000 $ 2 70,000 $ $ $ 3 $ 45,000 $ $ $ 4 66,000 $ $ $ 5 $ A 30,000 $ $ Johnson Industries purchased a metal-working lathe for $38,000. This item will be used for business 90% of the time. Accountants elected to take a $18,000 section 179 deduction and utilize the special depreciation allowance of 50%. Prepare a depreciation schedule (in $) using MACRS. Round all dollar amounts to the nearest cent. Johnson Industries MACRS Depreciation Schedule-Metal-working Lathe End of Year Basis for Depreciation Recovery Percent = MACRS Depreciation Deduction Accumulated Depreciation Book Value 1 33.33% $ $ $ 2 44.45% $ $ 3 14.81% = $ $ $ 4 $ 7.41% = $ $ $ A For $42,950,000, Wesco Developers purchased land which their experts believe to contain 28.5 million tons of copper ore. It cost $12,443,000 to develop the property, whose residual value is estimated as $5,985,000. Determine the current year depletion expense (in $) if annual production amounted to 4,843,000 tons. Round depletion cost per unit to the nearest cent. $

B:

B: C:

C: D:

D:  E:

E: