Answered step by step

Verified Expert Solution

Question

1 Approved Answer

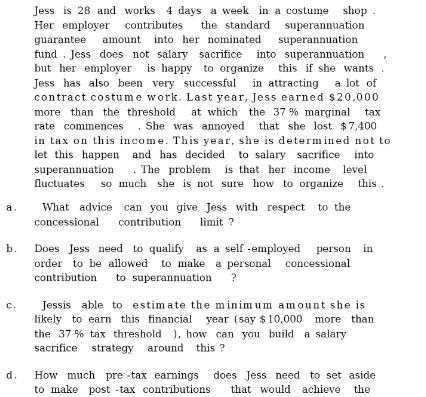

a. b. C. d. Jess is 28 and works 4 days a week in a costume shop Her employer contributes the standard superannuation guarantee

a. b. C. d. Jess is 28 and works 4 days a week in a costume shop Her employer contributes the standard superannuation guarantee amount into her nominated superannuation fund Jess does not salary sacrifice into superannuation but her employer is happy to organize is happy to organize this if she wants Jess has also been very successful in attracting a lot of contract costume work. Last year, Jess earned $20,000 more than the threshold at which the 37% marginal tax rate commences. She was annoyed that she lost $7,400 in tax on this income. This year, she is determined not to let this happen and has decided to salary sacrifice into superannuation . The problem is that her income level fluctuates so much she is not sure how to organize this. What advice can you give Jess with respect to the concessional contribution limit? self-employed as a self-employed person in a personal concessional Does Jess need to qualify as a order to be allowed to make contribution to superannuation ? Jessis able to estimate the minimum amount she is likely to earn this financial year (say $10,000 more than the 37% tax threshold ), how can you build a salary sacrifice strategy around this ? How much pre-tax earnings does Jess need to set aside to make post -tax contributions that would achieve the

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Jess should be aware of the concessional contribution limit which is currently set at 27500 per ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started