Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A B C federal income tax rate is 24%. How much estimated tax (in $) must Marc send to the IRS each quarter? The SUTA

A

B

C

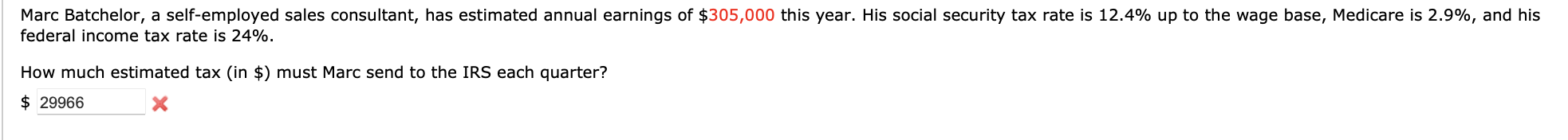

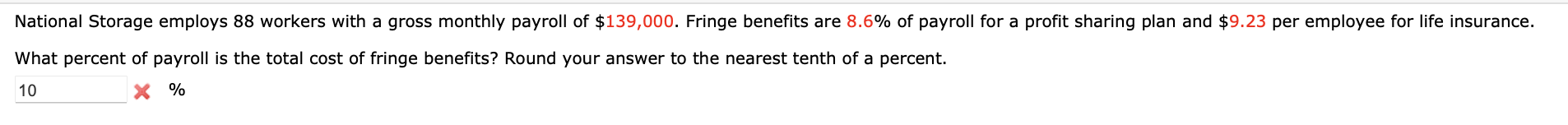

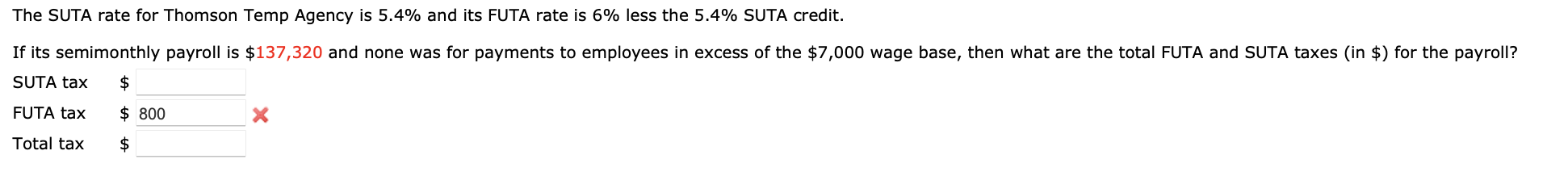

federal income tax rate is 24%. How much estimated tax (in \$) must Marc send to the IRS each quarter? The SUTA rate for Thomson Temp Agency is 5.4% and its FUTA rate is 6% less the 5.4% SUTA credit. If its semimonthly payroll is $137,320 and none was for payments to employees in excess of the $7,000 wage base, then what are the total FUTA and SUTA taxes (in $ ) for the payroll? SUTA tax \$ FUTA tax $ Total tax $ National Storage employs 88 workers with a gross monthly payroll of $139,000. Fringe benefits are 8.6% of payroll for a profit sharing plan and $9.23 per employee for life insurance. What percent of payroll is the total cost of fringe benefits? Round your answer to the nearest tenth of a percent. %

federal income tax rate is 24%. How much estimated tax (in \$) must Marc send to the IRS each quarter? The SUTA rate for Thomson Temp Agency is 5.4% and its FUTA rate is 6% less the 5.4% SUTA credit. If its semimonthly payroll is $137,320 and none was for payments to employees in excess of the $7,000 wage base, then what are the total FUTA and SUTA taxes (in $ ) for the payroll? SUTA tax \$ FUTA tax $ Total tax $ National Storage employs 88 workers with a gross monthly payroll of $139,000. Fringe benefits are 8.6% of payroll for a profit sharing plan and $9.23 per employee for life insurance. What percent of payroll is the total cost of fringe benefits? Round your answer to the nearest tenth of a percent. % Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started