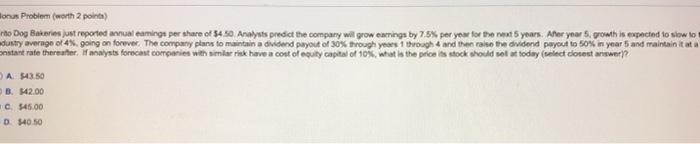

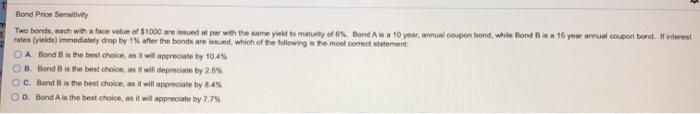

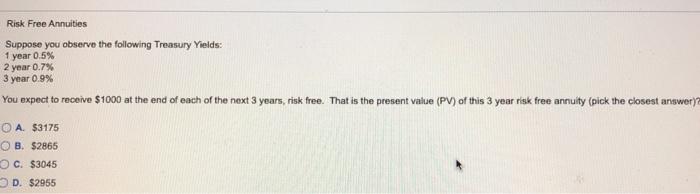

lones Problem (worth 2 points) no Dog Bakeries just reported annualeamings per share of 5450 Analysts predict the company will grow earnings by 7.5% per year for the next 5 years. Aher year 5 growth is expected to show to dustry average of 4%. going on forever. The company plans to maintain a dividend payout of 30% trough years 1 through and then raise the dividend payout to 50% in year 5 and maintain it at a start rate theater analysts forecast companies with similarik have a cost of equity capital of 10% what is the price is stock should solut today (select closest answer A543.50 B. $42.00 C. $45.00 D$40.50 Bond Price Sensitivity The bonds, each with a face value of 51000 w sued et par with the same yield to maturity of Bond A is a 10 year, annual coupon bond, while Bond Bs 16 your annual coupon bonderest rutes bildes immediately drop by 1% after the bonds are sted, which of the following is the most correct tertent OA Bond is the best choice, as it will appreciate by 10.4% On Blond is the best choice will depreciate by 2.0 oc Bond is the best choice, as it will appreciate by 8.4% D. Bond A is the best choice as it will appreciate by 7.7% Risk Free Annuities Suppose you observe the following Treasury Yields: 1 year 0.5% 2 year 0.7% 3 year 0.9% You expect to receive $1000 at the end of each of the next 3 years, risk free. That is the present value (PV) of this 3 year risk free annuity (pick the closest answer) A $3175 B. $2865 C. $3045 D. $2955 lones Problem (worth 2 points) no Dog Bakeries just reported annualeamings per share of 5450 Analysts predict the company will grow earnings by 7.5% per year for the next 5 years. Aher year 5 growth is expected to show to dustry average of 4%. going on forever. The company plans to maintain a dividend payout of 30% trough years 1 through and then raise the dividend payout to 50% in year 5 and maintain it at a start rate theater analysts forecast companies with similarik have a cost of equity capital of 10% what is the price is stock should solut today (select closest answer A543.50 B. $42.00 C. $45.00 D$40.50 Bond Price Sensitivity The bonds, each with a face value of 51000 w sued et par with the same yield to maturity of Bond A is a 10 year, annual coupon bond, while Bond Bs 16 your annual coupon bonderest rutes bildes immediately drop by 1% after the bonds are sted, which of the following is the most correct tertent OA Bond is the best choice, as it will appreciate by 10.4% On Blond is the best choice will depreciate by 2.0 oc Bond is the best choice, as it will appreciate by 8.4% D. Bond A is the best choice as it will appreciate by 7.7% Risk Free Annuities Suppose you observe the following Treasury Yields: 1 year 0.5% 2 year 0.7% 3 year 0.9% You expect to receive $1000 at the end of each of the next 3 years, risk free. That is the present value (PV) of this 3 year risk free annuity (pick the closest answer) A $3175 B. $2865 C. $3045 D. $2955