Answered step by step

Verified Expert Solution

Question

1 Approved Answer

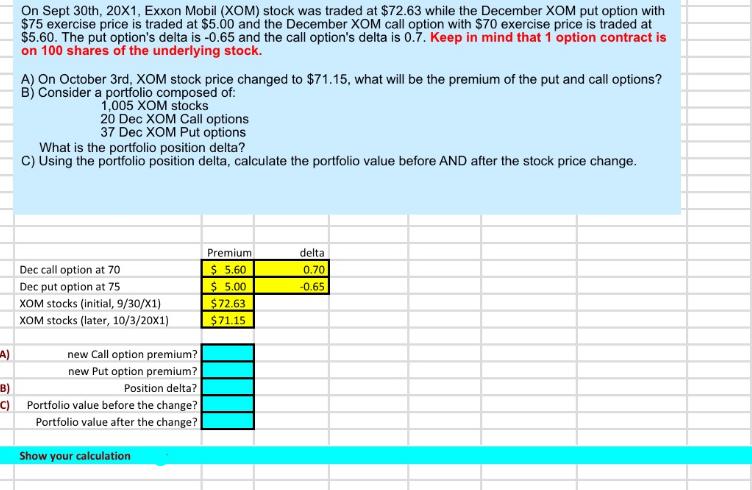

A) B) C) On Sept 30th, 20X1, Exxon Mobil (XOM) stock was traded at $72.63 while the December XOM put option with $75 exercise

A) B) C) On Sept 30th, 20X1, Exxon Mobil (XOM) stock was traded at $72.63 while the December XOM put option with $75 exercise price is traded at $5.00 and the December XOM call option with $70 exercise price is traded at $5.60. The put option's delta is -0.65 and the call option's delta is 0.7. Keep in mind that 1 option contract is on 100 shares of the underlying stock. A) On October 3rd, XOM stock price changed to $71.15, what will be the premium of the put and call options? B) Consider a portfolio composed of: 1,005 XOM stocks 20 Dec XOM Call options 37 Dec XOM Put options What is the portfolio position delta? C) Using the portfolio position delta, calculate the portfolio value before AND after the stock price change. Dec call option at 70 Dec put option at 75 XOM stocks (initial, 9/30/X1) XOM stocks (later, 10/3/20X1) new Call option premium? new Put option premium? Position delta? Portfolio value before the change? Portfolio value after the change? Show your calculation Premium $ 5.60 $ 5.00 $72.63 $71.15 delta 0.70 -0.65

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the premium of the put and call options after the stock price change we need to adjust the premiums based on the change in the stock pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started