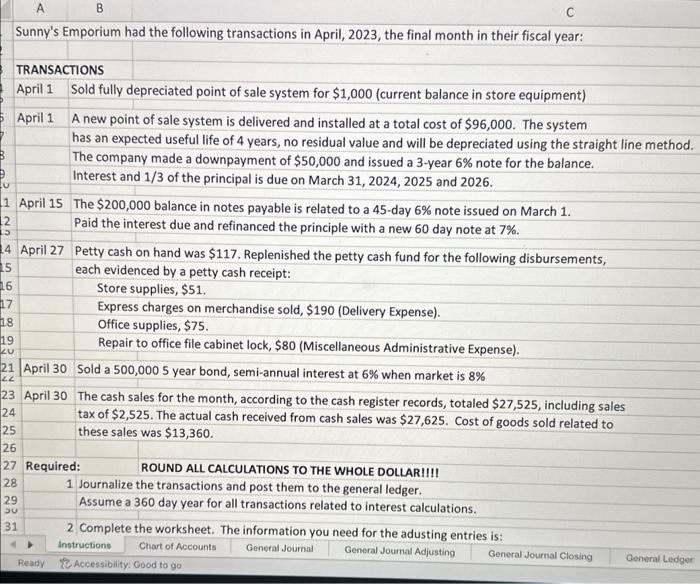

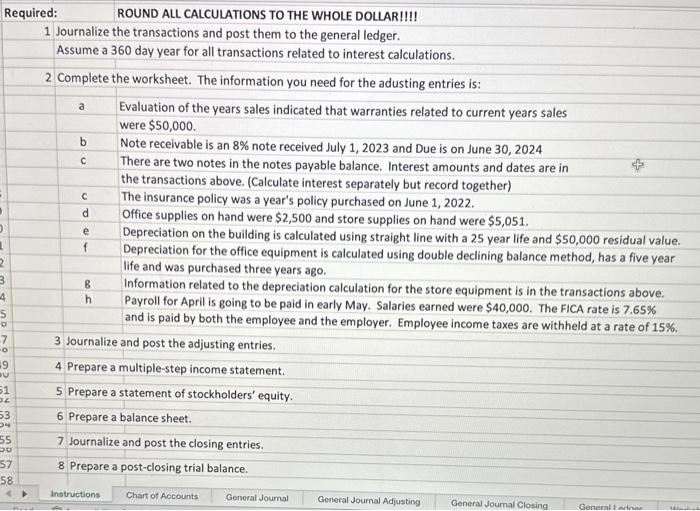

A B C Sunny's Emporium had the following transactions in April, 2023, the final month in their fiscal year: TRANSACTIONS April 1 Sold fully depreciated point of sale system for $1,000 (current balance in store equipment) April 1 A new point of sale system is delivered and installed at a total cost of $96,000. The system has an expected useful life of 4 years, no residual value and will be depreciated using the straight line method. The company made a downpayment of $50,000 and issued a 3-year 6% note for the balance. Interest and 1/3 of the principal is due on March 31,2024,2025 and 2026. April 15 The $200,000 balance in notes payable is related to a 45 -day 6% note issued on March 1. Paid the interest due and refinanced the principle with a new 60 day note at 7%. April 27 Petty cash on hand was \$117. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt: Store supplies, \$51. Express charges on merchandise sold, $190 (Delivery Expense). Office supplies, $75. Repair to office file cabinet lock, $80 (Miscellaneous Administrative Expense). April 30 Sold a 500,0005 year bond, semi-annual interest at 6% when market is 8% April 30 The cash sales for the month, according to the cash register records, totaled $27,525, including sales tax of $2,525. The actual cash received from cash sales was $27,625. Cost of goods sold related to these sales was $13,360. Required: ROUND ALL CALCULATIONS TO THE WHOLE DOLLARIIII 1 Journalize the transactions and post them to the general ledger. Assume a 360 day year for all transactions related to interest calculations. 2 Complete the worksheet. The information you need for the adusting entries is: Required: ROUND ALL CALCULATIONS TO THE WHOLE DOLLAR!!!! 1 Journalize the transactions and post them to the general ledger. Assume a 360 day year for all transactions related to interest calculations. 2 Complete the worksheet. The information you need for the adusting entries is: a Evaluation of the years sales indicated that warranties related to current years sales were $50,000. b Note receivable is an 8% note received July 1,2023 and Due is on June 30,2024 c There are two notes in the notes payable balance. Interest amounts and dates are in the transactions above. (Calculate interest separately but record together) The insurance policy was a year's policy purchased on June 1,2022. Office supplies on hand were $2,500 and store supplies on hand were $5,051. Depreciation on the building is calculated using straight line with a 25 year life and $50,000 residual value. Depreciation for the office equipment is calculated using double declining balance method, has a five year life and was purchased three years ago. 8 Information related to the depreciation calculation for the store equipment is in the transactions above. h Payroll for April is going to be paid in early May. Salaries earned were $40,000. The FICA rate is 7.65% and is paid by both the employee and the employer. Employee income taxes are withheld at a rate of 15%. 3 Journalize and post the adjusting entries. 4 Prepare a multiple-step income statement. 5 Prepare a statement of stockholders' equity. 6 Prepare a balance sheet. 7 Journalize and post the closing entries. 8 Prepare a post-closing trial balance. A B C Sunny's Emporium had the following transactions in April, 2023, the final month in their fiscal year: TRANSACTIONS April 1 Sold fully depreciated point of sale system for $1,000 (current balance in store equipment) April 1 A new point of sale system is delivered and installed at a total cost of $96,000. The system has an expected useful life of 4 years, no residual value and will be depreciated using the straight line method. The company made a downpayment of $50,000 and issued a 3-year 6% note for the balance. Interest and 1/3 of the principal is due on March 31,2024,2025 and 2026. April 15 The $200,000 balance in notes payable is related to a 45 -day 6% note issued on March 1. Paid the interest due and refinanced the principle with a new 60 day note at 7%. April 27 Petty cash on hand was \$117. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt: Store supplies, \$51. Express charges on merchandise sold, $190 (Delivery Expense). Office supplies, $75. Repair to office file cabinet lock, $80 (Miscellaneous Administrative Expense). April 30 Sold a 500,0005 year bond, semi-annual interest at 6% when market is 8% April 30 The cash sales for the month, according to the cash register records, totaled $27,525, including sales tax of $2,525. The actual cash received from cash sales was $27,625. Cost of goods sold related to these sales was $13,360. Required: ROUND ALL CALCULATIONS TO THE WHOLE DOLLARIIII 1 Journalize the transactions and post them to the general ledger. Assume a 360 day year for all transactions related to interest calculations. 2 Complete the worksheet. The information you need for the adusting entries is: Required: ROUND ALL CALCULATIONS TO THE WHOLE DOLLAR!!!! 1 Journalize the transactions and post them to the general ledger. Assume a 360 day year for all transactions related to interest calculations. 2 Complete the worksheet. The information you need for the adusting entries is: a Evaluation of the years sales indicated that warranties related to current years sales were $50,000. b Note receivable is an 8% note received July 1,2023 and Due is on June 30,2024 c There are two notes in the notes payable balance. Interest amounts and dates are in the transactions above. (Calculate interest separately but record together) The insurance policy was a year's policy purchased on June 1,2022. Office supplies on hand were $2,500 and store supplies on hand were $5,051. Depreciation on the building is calculated using straight line with a 25 year life and $50,000 residual value. Depreciation for the office equipment is calculated using double declining balance method, has a five year life and was purchased three years ago. 8 Information related to the depreciation calculation for the store equipment is in the transactions above. h Payroll for April is going to be paid in early May. Salaries earned were $40,000. The FICA rate is 7.65% and is paid by both the employee and the employer. Employee income taxes are withheld at a rate of 15%. 3 Journalize and post the adjusting entries. 4 Prepare a multiple-step income statement. 5 Prepare a statement of stockholders' equity. 6 Prepare a balance sheet. 7 Journalize and post the closing entries. 8 Prepare a post-closing trial balance