Answered step by step

Verified Expert Solution

Question

1 Approved Answer

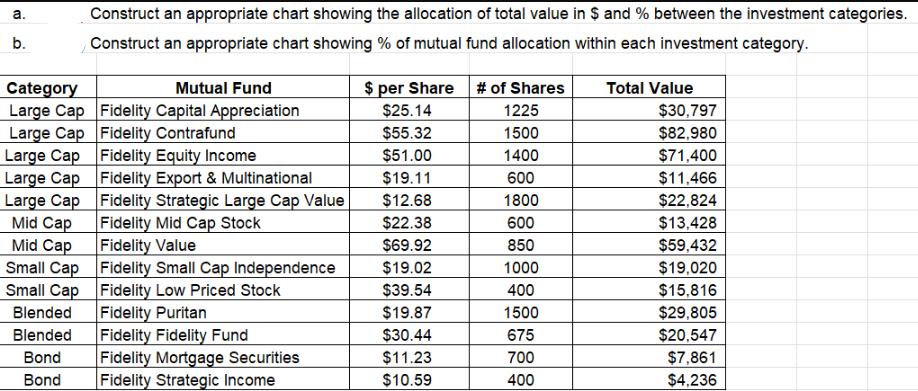

a. b. Category Large Cap Large Cap Large Cap Large Cap Large Cap Mid Cap Mid Cap Small Cap Small Cap Construct an appropriate

a. b. Category Large Cap Large Cap Large Cap Large Cap Large Cap Mid Cap Mid Cap Small Cap Small Cap Construct an appropriate chart showing the allocation of total value in $ and % between the investment categories. Construct an appropriate chart showing % of mutual fund allocation within each investment category. Mutual Fund Fidelity Capital Appreciation Fidelity Contrafund Fidelity Equity Income Fidelity Export & Multinational Fidelity Strategic Large Cap Value Fidelity Mid Cap Stock Fidelity Value Fidelity Small Cap Independence Fidelity Low Priced Stock Fidelity Puritan Fidelity Fidelity Fund Fidelity Mortgage Securities Blended Blended Bond Bond Fidelity Strategic Income $ per Share # of Shares $25.14 1225 $55.32 1500 $51.00 1400 $19.11 600 1800 600 850 1000 400 1500 $12.68 $22.38 $69.92 $19.02 $39.54 $19.87 $30.44 $11.23 $10.59 675 700 400 Total Value $30,797 $82,980 $71,400 $11,466 $22,824 $13,428 $59,432 $19,020 $15,816 $29,805 $20,547 $7,861 $4,236

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started