Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A & B Companies: Impairment of Goodwill Veronique G. Frucot, Leland G. Jordan, and Marc I. Lebow ABSTRACT: Accounting for goodwill has long been a

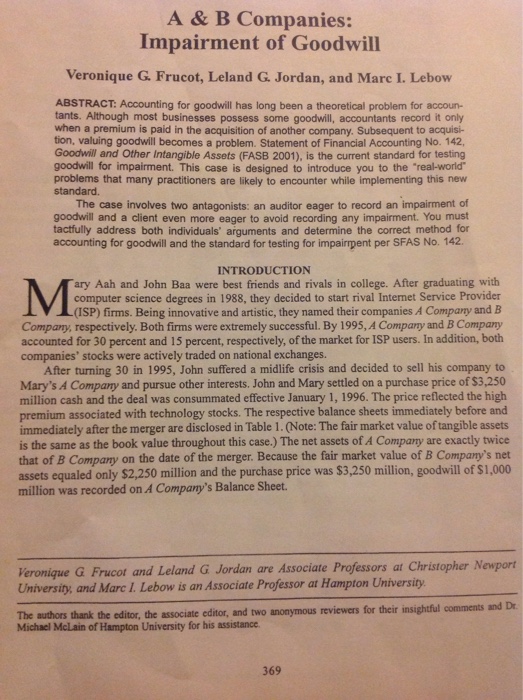

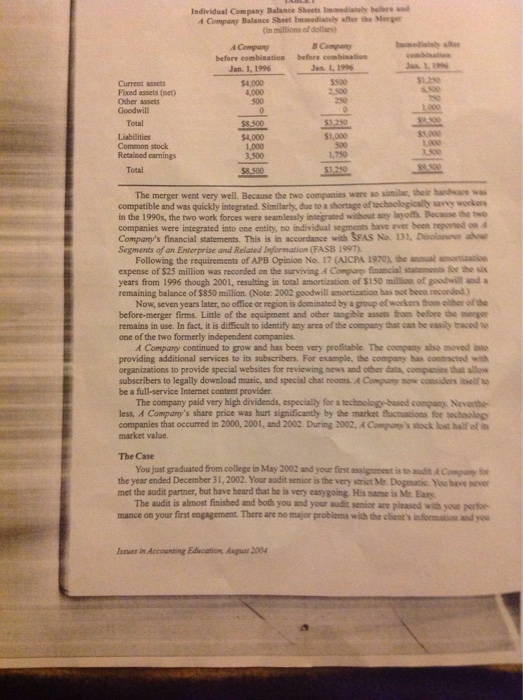

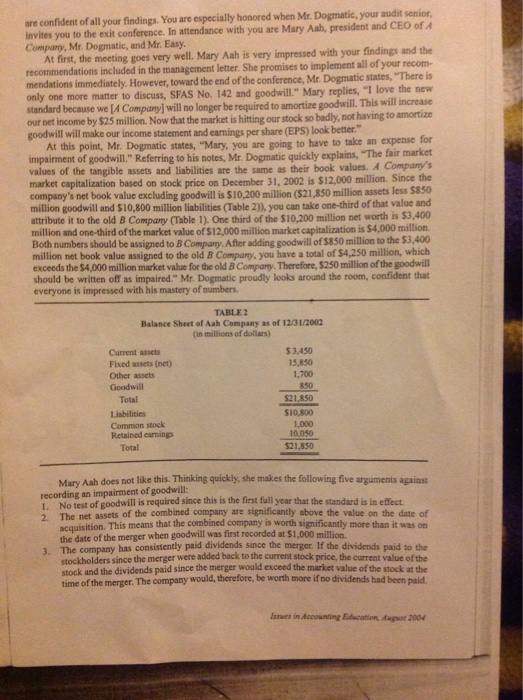

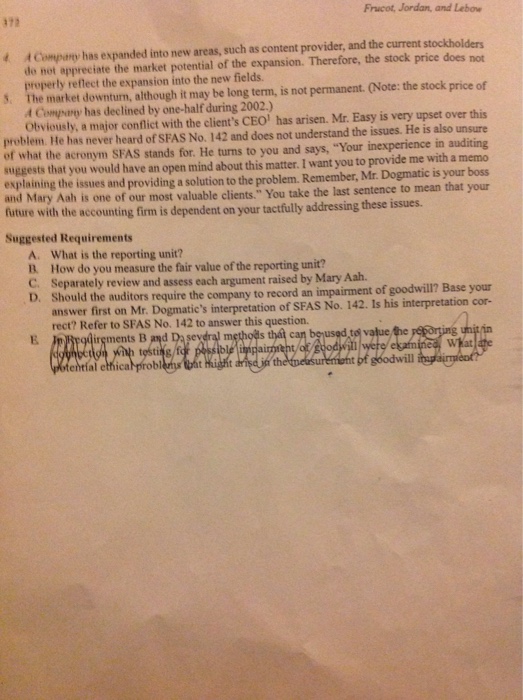

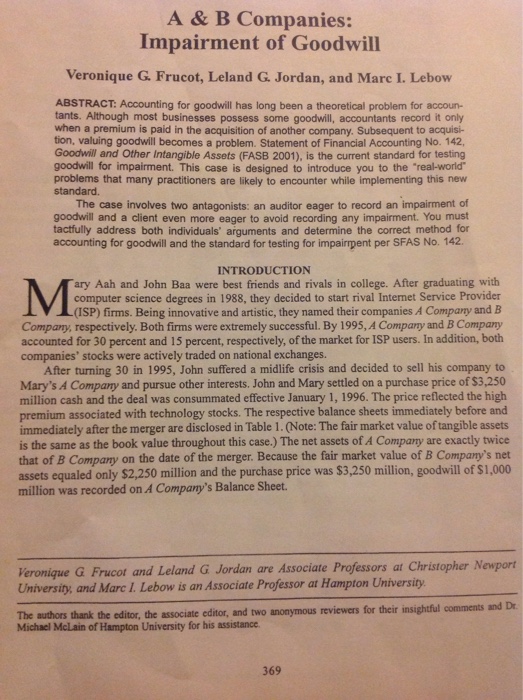

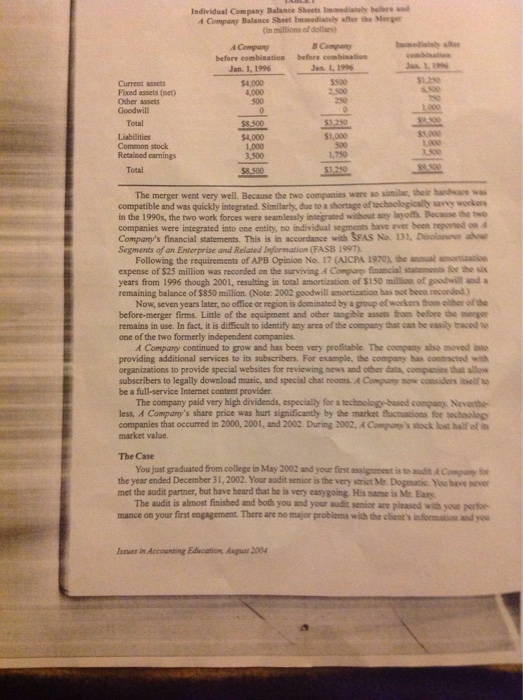

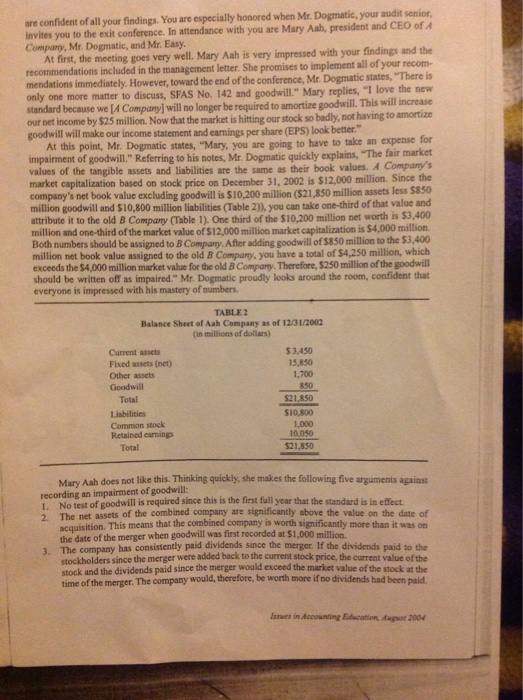

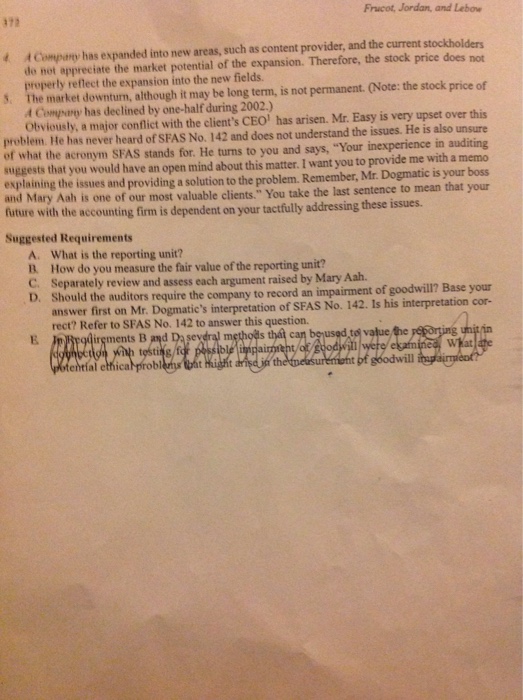

A & B Companies: Impairment of Goodwill Veronique G. Frucot, Leland G. Jordan, and Marc I. Lebow ABSTRACT: Accounting for goodwill has long been a theoretical problem for accoun- tants. Although most businesses possess some goodwill, accountants record it only when a premium is paid in the acquisition of another company. Subsequent to acquisi- tion, valuing goodwill becomes a problem. Statement of Financial Accounting No. 142, Goodwill and Other Intangible Assets (FASB 2001), is the current standard for testing goodwill for impairment. This case is designed to introduce you to the "real-world" problems that many practitioners are likely to encounter while implementing this new standard. The case involves two antagonists: an auditor eager to record an impairment of goodwill and a client even more eager to avoid recording any impairment. You must tactfully address both individuals' arguments and determine the correct method for accounting for goodwill and the standard for testing for impairment per SFAS No. 142. INTRODUCTION ary Aah and John Baa were best friends and rivals in college. After graduating with computer science degrees in 1988, they decided to start rival Internet Service Provider (ISP) firms. Being innovative and artistic, they named their companies A Company and B Company, respectively. Both firms were extremely successful. By 1995, A Compary and B Company accounted for 30 percent and 15 percent, respectively, of the market for ISP users. In addition, both companies' stocks were actively traded on national exchanges. After turning 30 in 1995, John suffered a midlife crisis and decided to sell his company to Mary's A Company and pursue other interests. John and Mary settled on a purchase price of $3,250 million cash and the deal was consummated effective January 1, 1996. The price reflected the high premium associated with technology stocks. The respective balance sheets immediately before and immediately after the merger are disclosed in Table 1 . Note: The fair market value of tangible assets is the same as the book value throughout this case.) The net assets of A Company are exactly twice that of B Company on the date of the merger. Because the fair market value of B Company's net assets equaled only $2,250 million and the purchase price was $3,250 million, goodwill of $1,000 million was recorded on A Company's Balance Sheet. Veronique G Frucot and Leland G Jordan are Associate Professors at Christopher Newport University, and Marc I. Lebow is an Associate Professor at Hampton University The authors thank the editor, the associate editor, and two anonymous reviewers for their insightful comments editor, and two anonymous reviewers for their insightful comments and Dr Michael McLain of Hampton University for his assistance. 369

A & B Companies: Impairment of Goodwill Veronique G. Frucot, Leland G. Jordan, and Marc I. Lebow ABSTRACT: Accounting for goodwill has long been a theoretical problem for accoun- tants. Although most businesses possess some goodwill, accountants record it only when a premium is paid in the acquisition of another company. Subsequent to acquisi- tion, valuing goodwill becomes a problem. Statement of Financial Accounting No. 142, Goodwill and Other Intangible Assets (FASB 2001), is the current standard for testing goodwill for impairment. This case is designed to introduce you to the "real-world" problems that many practitioners are likely to encounter while implementing this new standard. The case involves two antagonists: an auditor eager to record an impairment of goodwill and a client even more eager to avoid recording any impairment. You must tactfully address both individuals' arguments and determine the correct method for accounting for goodwill and the standard for testing for impairment per SFAS No. 142. INTRODUCTION ary Aah and John Baa were best friends and rivals in college. After graduating with computer science degrees in 1988, they decided to start rival Internet Service Provider (ISP) firms. Being innovative and artistic, they named their companies A Company and B Company, respectively. Both firms were extremely successful. By 1995, A Compary and B Company accounted for 30 percent and 15 percent, respectively, of the market for ISP users. In addition, both companies' stocks were actively traded on national exchanges. After turning 30 in 1995, John suffered a midlife crisis and decided to sell his company to Mary's A Company and pursue other interests. John and Mary settled on a purchase price of $3,250 million cash and the deal was consummated effective January 1, 1996. The price reflected the high premium associated with technology stocks. The respective balance sheets immediately before and immediately after the merger are disclosed in Table 1 . Note: The fair market value of tangible assets is the same as the book value throughout this case.) The net assets of A Company are exactly twice that of B Company on the date of the merger. Because the fair market value of B Company's net assets equaled only $2,250 million and the purchase price was $3,250 million, goodwill of $1,000 million was recorded on A Company's Balance Sheet. Veronique G Frucot and Leland G Jordan are Associate Professors at Christopher Newport University, and Marc I. Lebow is an Associate Professor at Hampton University The authors thank the editor, the associate editor, and two anonymous reviewers for their insightful comments editor, and two anonymous reviewers for their insightful comments and Dr Michael McLain of Hampton University for his assistance. 369

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started