Answered step by step

Verified Expert Solution

Question

1 Approved Answer

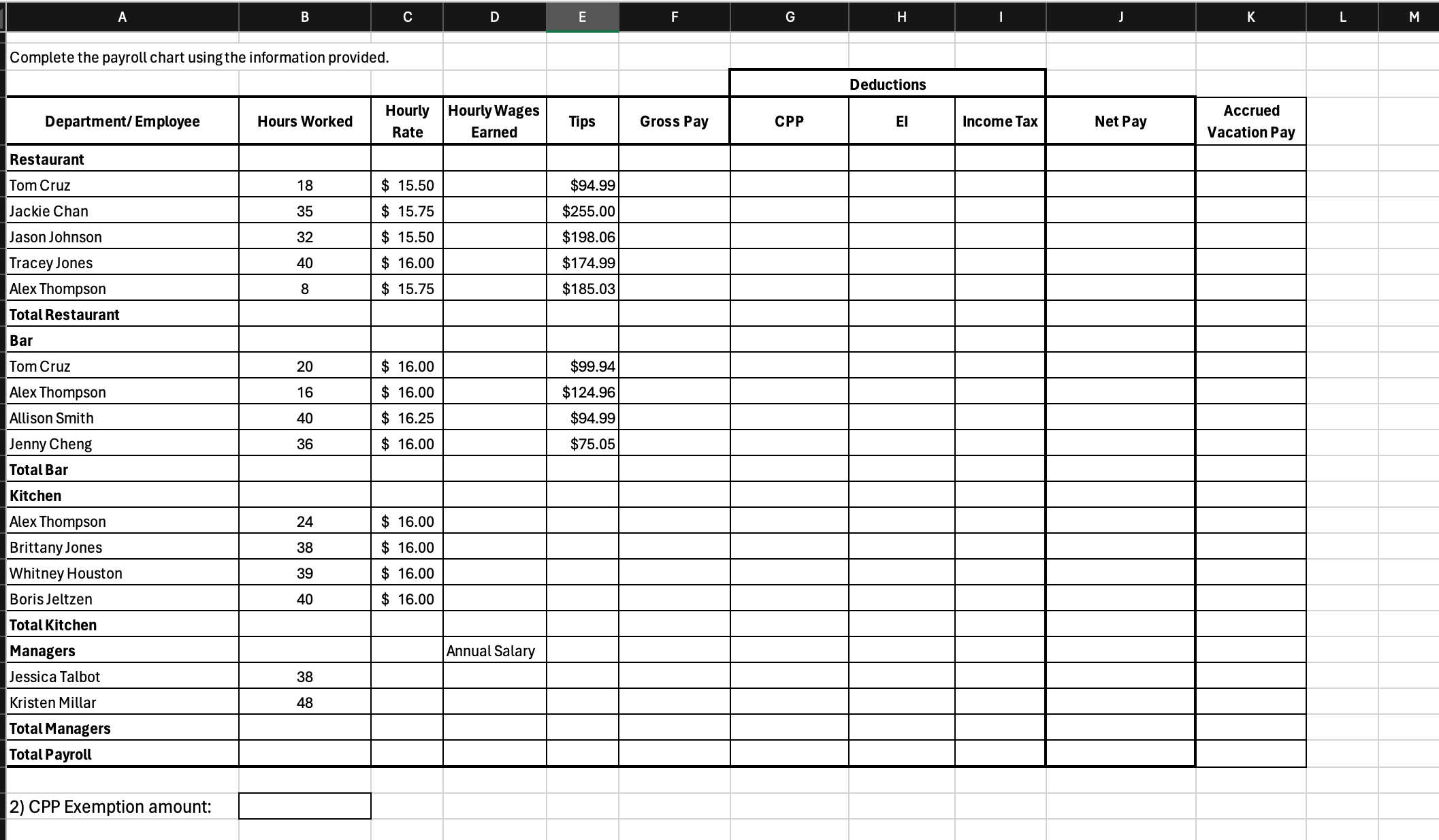

A B Complete the payroll chart using the information provided. Department/Employee Restaurant 0 D E F G H J K L M Deductions Hours

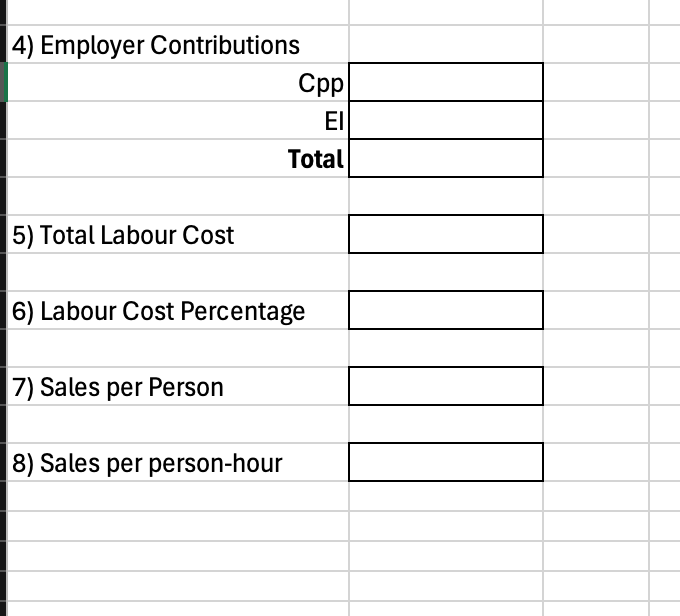

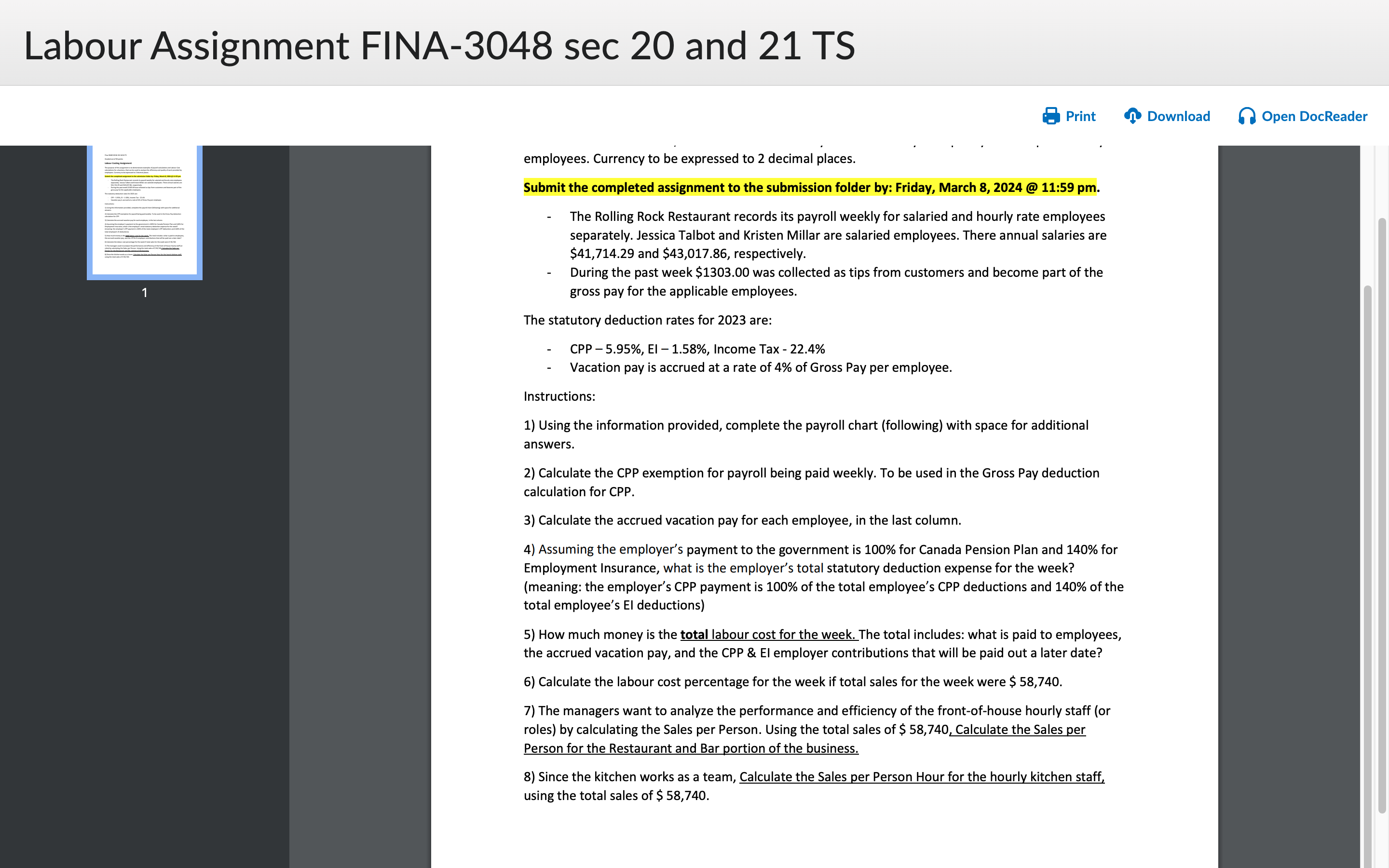

A B Complete the payroll chart using the information provided. Department/Employee Restaurant 0 D E F G H J K L M Deductions Hours Worked Hourly Hourly Wages Rate Earned Tips Gross Pay CPP Income Tax Net Pay Accrued Vacation Pay Tom Cruz 18 $ 15.50 $94.99 Jackie Chan 35 $ 15.75 $255.00 Jason Johnson 32 $ 15.50 $198.06 Tracey Jones 40 $ 16.00 $174.99 Alex Thompson 8 $ 15.75 $185.03 Total Restaurant Bar Tom Cruz 20 $ 16.00 $99.94 Alex Thompson 16 $ 16.00 $124.96 Allison Smith 40 $ 16.25 $94.99 Jenny Cheng 36 $ 16.00 $75.05 Total Bar Kitchen Alex Thompson 24 $ 16.00 Brittany Jones 38 $ 16.00 Whitney Houston 39 $ 16.00 Boris Jeltzen 40 $ 16.00 Total Kitchen Managers Jessica Talbot 38 Kristen Millar 48 Total Managers Total Payroll 2) CPP Exemption amount: Annual Salary 4) Employer Contributions Cpp Total 5) Total Labour Cost 6) Labour Cost Percentage 7) Sales per Person 8) Sales per person-hour Labour Assignment FINA-3048 sec 20 and 21 TS Print Download Open DocReader 1 employees. Currency to be expressed to 2 decimal places. Submit the completed assignment to the submission folder by: Friday, March 8, 2024 @ 11:59 pm. - The Rolling Rock Restaurant records its payroll weekly for salaried and hourly rate employees separately. Jessica Talbot and Kristen Millar are salaried employees. There annual salaries are $41,714.29 and $43,017.86, respectively. During the past week $1303.00 was collected as tips from customers and become part of the gross pay for the applicable employees. The statutory deduction rates for 2023 are: - CPP -5.95%, El - 1.58%, Income Tax - 22.4% Vacation pay is accrued at a rate of 4% of Gross Pay per employee. Instructions: 1) Using the information provided, complete the payroll chart (following) with space for additional answers. 2) Calculate the CPP exemption for payroll being paid weekly. To be used in the Gross Pay deduction calculation for CPP. 3) Calculate the accrued vacation pay for each employee, in the last column. 4) Assuming the employer's payment to the government is 100% for Canada Pension Plan and 140% for Employment Insurance, what is the employer's total statutory deduction expense for the week? (meaning: the employer's CPP payment is 100% of the total employee's CPP deductions and 140% of the total employee's El deductions) 5) How much money is the total labour cost for the week. The total includes: what is paid to employees, the accrued vacation pay, and the CPP & El employer contributions that will be paid out a later date? 6) Calculate the labour cost percentage for the week if total sales for the week were $ 58,740. 7) The managers want to analyze the performance and efficiency of the front-of-house hourly staff (or roles) by calculating the Sales per Person. Using the total sales of $58,740, Calculate the Sales per Person for the Restaurant and Bar portion of the business. 8) Since the kitchen works as a team, Calculate the Sales per Person Hour for the hourly kitchen staff, using the total sales of $ 58,740.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started