Answered step by step

Verified Expert Solution

Question

1 Approved Answer

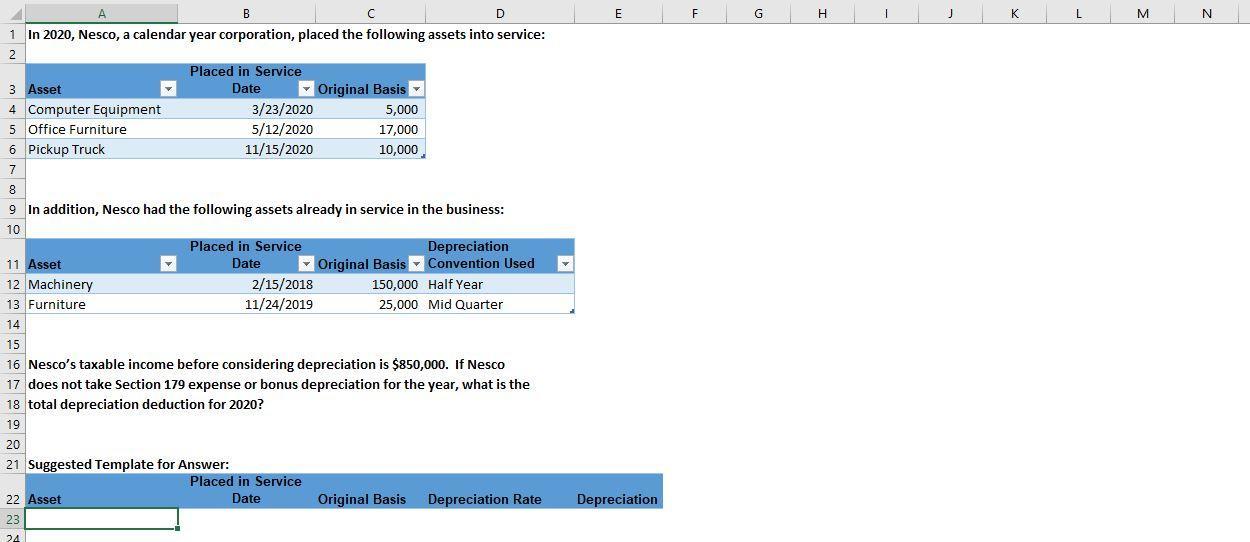

A B D 1 In 2020, Nesco, a calendar year corporation, placed the following assets into service: 2 3 Asset 4 Computer Equipment 5

A B D 1 In 2020, Nesco, a calendar year corporation, placed the following assets into service: 2 3 Asset 4 Computer Equipment 5 Office Furniture 6 Pickup Truck 7 Placed in Service Date 3/23/2020 5/12/2020 11/15/2020 22 Asset 23 24 Placed in Service Date 8 9 In addition, Nesco had the following assets already in service in the business: 10 2/15/2018 11/24/2019 Original Basis Placed in Service Date 5,000 17,000 10,000 11 Asset 12 Machinery 13 Furniture 14 15 16 Nesco's taxable income before considering depreciation is $850,000. If Nesco 17 does not take Section 179 expense or bonus depreciation for the year, what is the 18 total depreciation deduction for 2020? 19 20 21 Suggested Template for Answer: Depreciation Original Basis Convention Used 150,000 Half Year 25,000 Mid Quarter Original Basis Depreciation Rate E Depreciation F G H 1 J K L M N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started