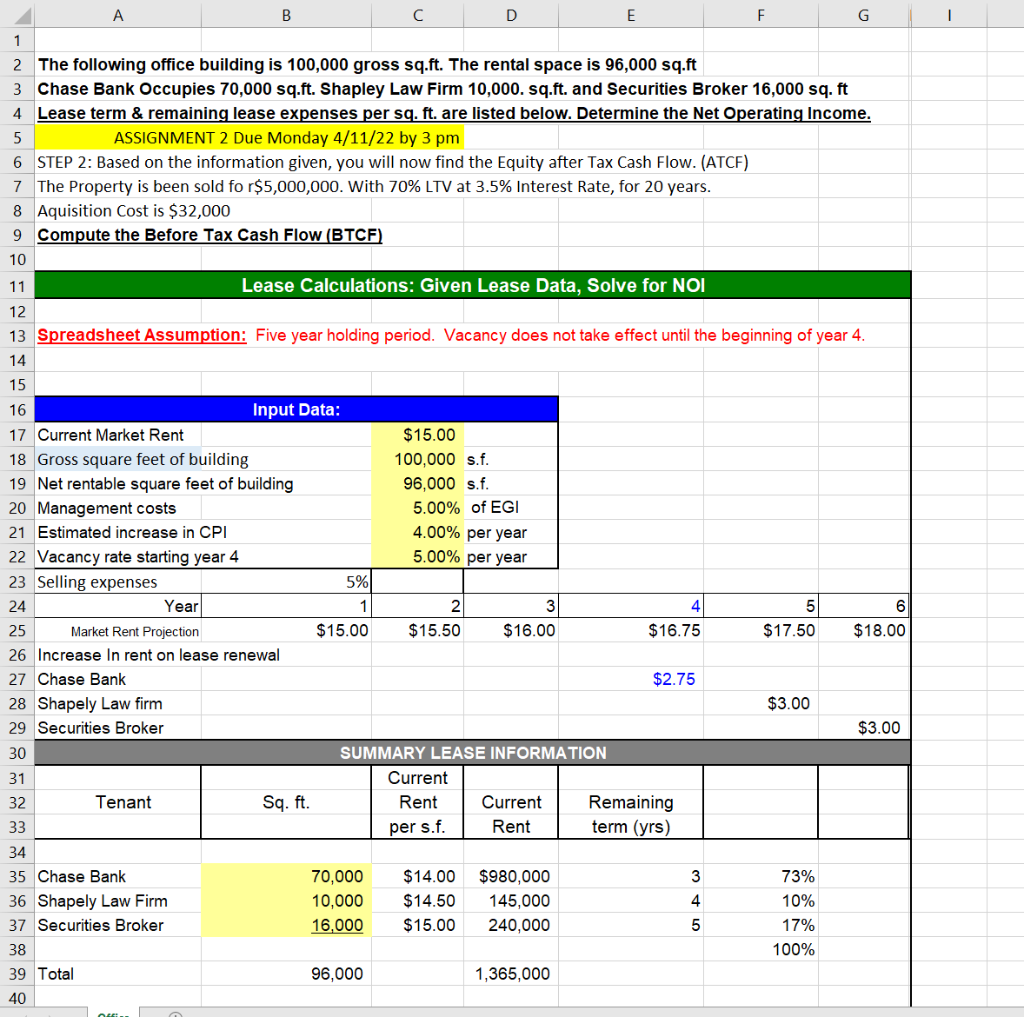

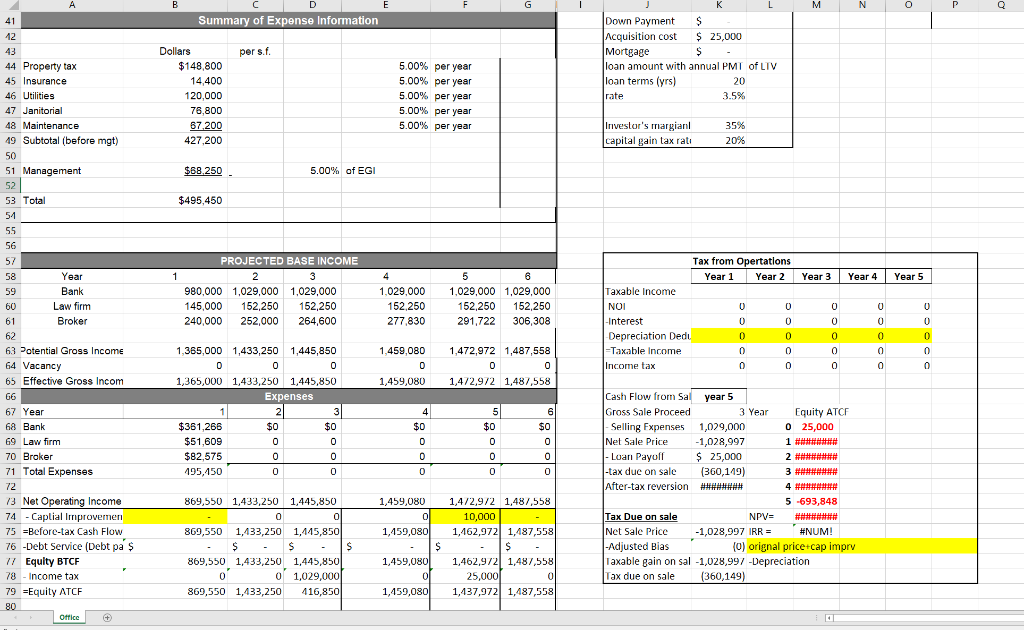

A B D E F G 1 1 2 The following office building is 100,000 gross sq.ft. The rental space is 96,000 sq.ft 3 Chase Bank Occupies 70,000 sq.ft. Shapley Law Firm 10,000. sq.ft. and Securities Broker 16,000 sq.ft 4 Lease term & remaining lease expenses per sq. ft. are listed below. Determine the Net Operating Income. 5 ASSIGNMENT 2 Due Monday 4/11/22 by 3 pm 6 STEP 2: Based on the information given, you will now find the Equity after Tax Cash Flow. (ATCF) 7 The Property is been sold fo r$5,000,000. With 70% LTV at 3.5% Interest Rate, for 20 years. 8 Aquisition Cost is $32,000 9 Compute the Before Tax Cash Flow (BTCF) 10 11 Lease Calculations: Given Lease Data, Solve for NOI 12 13 Spreadsheet Assumption: Five year holding period. Vacancy does not take effect until the beginning of year 4. 14 15 16 Input Data: 17 Current Market Rent $15.00 18 Gross square feet of building 100,000 s.f. 19 Net rentable square feet of building 96,000 s.f. 20 Management costs 5.00% of EGI 21 Estimated increase in CPL 4.00% per year 22 Vacancy rate starting year 4 5.00% per year 23 Selling expenses 5% 24 Year 1 2 3 4 5 6 25 Market Rent Projection $15.00 $15.50 $16.00 $16.75 $17.50 $18.00 26 Increase in rent on lease renewal 27 Chase Bank $2.75 28 Shapely Law firm $3.00 29 Securities Broker $3.00 30 SUMMARY LEASE INFORMATION 31 Current 32 Tenant Rent Current Remaining 33 per s.f. Rent term (yrs) 34 35 Chase Bank 70,000 $14.00 $980,000 3 73% 36 Shapely Law Firm 10,000 $14.50 145,000 4 10% 37 Securities Broker 16,000 $15.00 240,000 5 17% 38 100% 39 Total 96,000 1,365,000 40 Sq. ft. A B G M N O P Q D E Summary of Expense Information 41 per s.f. Down Payment $ Acquisition cost $ 25,000 Mortgage $ loan amount with annual PMT of LTV loan terms (yrs) 20 Jrate 3.5% Dollars $148,800 14,400 120,000 76,800 87.200 427,200 12 43 44 Property tax 45 Insurance 46 Utilities 47 Janitorial 48 Maintenance 49 Subtotal (before mgt) 50 51 Management 52 53 Total 51 55 56 5.00% per year 5.00% per year 5.00% per year 5.00% per year 5.00% per year Investor's margiant capital gain tax rati 35% 20% $68.250 5.00% of EGI $495,450 1 Year 3 Year 4 Year 5 PROJECTED BASE INCOME 2 3 3 980,000 1,029,000 1,029,000 145,000 152.250 152,250 240,000 252,000 264.600 4 1,029,000 152.250 277,830 5 6 1,029,000 1,029,000 152,250 152,250 291,722 306,308 0 0 Tax from Opertations Year 1 Year 2 Taxable income NOI 0 0 Interest 0 0 Depreciation Dedi 0 0 0 0 Taxable income 0 0 0 Income tax 0 0 0 0 0 0 0 0 U 0 0 0 0 0 0 0 0 0 1.459.080 0 1,459,080 1,472,972 1,487,558 0 0 0 1,472,972 1,487,558 57 58 Year 59 Bank 60 Law firm 61 Broker 62 63 Potential Gross Income 64 Vacancy 65 Effective Gross Incom 66 67 Year 68 Bank 69 Law firm 70 Broker 71 Total Expenses 72 13 Net Operating Income 74 - Caplial Improvemen - 75 =Before-tax Cash Flow 76 -Debt Service (Debt pa $ 77 Equity BTCF 78 - Income tax 79 =Equity ATCE 80 Office + 1,365,000 1,433,250 1,445,850 0 0 0 1,365,000 1,433,250 1,445,850 Expenses 1 2 3 $361,266 $0 $0 $51,609 0 0 0 0 $82,575 0 0 495,150 0 4 $0 0 0 0 5 $0 0 0 0 0 6 $0 0 0 0 0 1 ##### 0 Cash Flow from Sal year 5 Gross Sale Proceed 3 Year Equity ATCE Selling Expenses 1,029,000 0 25,000 Net Sale Price -1,028,997 - Loan Payoll $ 25,000 2 ######## -tax due on sale (360,149) After-tax reversion ######## 4 ######## 5 -693,848 Tax Due on sale NPV= ##### Net Sale Price -1,028,997 IRR #NUMI -Adjusted Bias (0) orignal price+cap imprv Taxable gain on sal -1,028,997 - Depreciation Tax due on sale (360,149) 1,459,080 0 1,459,080 869,550 1,433,250 1,445,850 0 0 869,550 1,433,250 1,445,850 $ $ 869,550 1,433,250 1,445,850 0 0 0 1,029,000 869,550 1,433,250 416,850 $ $ 1,472,972 1,487,558 10,000 1,462,972 1,487,558 $ 1,462,972 1,487,558 25,000 0 1,437,972 1,487,558 1,459,080 0 1,459,080 A B D E F G 1 1 2 The following office building is 100,000 gross sq.ft. The rental space is 96,000 sq.ft 3 Chase Bank Occupies 70,000 sq.ft. Shapley Law Firm 10,000. sq.ft. and Securities Broker 16,000 sq.ft 4 Lease term & remaining lease expenses per sq. ft. are listed below. Determine the Net Operating Income. 5 ASSIGNMENT 2 Due Monday 4/11/22 by 3 pm 6 STEP 2: Based on the information given, you will now find the Equity after Tax Cash Flow. (ATCF) 7 The Property is been sold fo r$5,000,000. With 70% LTV at 3.5% Interest Rate, for 20 years. 8 Aquisition Cost is $32,000 9 Compute the Before Tax Cash Flow (BTCF) 10 11 Lease Calculations: Given Lease Data, Solve for NOI 12 13 Spreadsheet Assumption: Five year holding period. Vacancy does not take effect until the beginning of year 4. 14 15 16 Input Data: 17 Current Market Rent $15.00 18 Gross square feet of building 100,000 s.f. 19 Net rentable square feet of building 96,000 s.f. 20 Management costs 5.00% of EGI 21 Estimated increase in CPL 4.00% per year 22 Vacancy rate starting year 4 5.00% per year 23 Selling expenses 5% 24 Year 1 2 3 4 5 6 25 Market Rent Projection $15.00 $15.50 $16.00 $16.75 $17.50 $18.00 26 Increase in rent on lease renewal 27 Chase Bank $2.75 28 Shapely Law firm $3.00 29 Securities Broker $3.00 30 SUMMARY LEASE INFORMATION 31 Current 32 Tenant Rent Current Remaining 33 per s.f. Rent term (yrs) 34 35 Chase Bank 70,000 $14.00 $980,000 3 73% 36 Shapely Law Firm 10,000 $14.50 145,000 4 10% 37 Securities Broker 16,000 $15.00 240,000 5 17% 38 100% 39 Total 96,000 1,365,000 40 Sq. ft. A B G M N O P Q D E Summary of Expense Information 41 per s.f. Down Payment $ Acquisition cost $ 25,000 Mortgage $ loan amount with annual PMT of LTV loan terms (yrs) 20 Jrate 3.5% Dollars $148,800 14,400 120,000 76,800 87.200 427,200 12 43 44 Property tax 45 Insurance 46 Utilities 47 Janitorial 48 Maintenance 49 Subtotal (before mgt) 50 51 Management 52 53 Total 51 55 56 5.00% per year 5.00% per year 5.00% per year 5.00% per year 5.00% per year Investor's margiant capital gain tax rati 35% 20% $68.250 5.00% of EGI $495,450 1 Year 3 Year 4 Year 5 PROJECTED BASE INCOME 2 3 3 980,000 1,029,000 1,029,000 145,000 152.250 152,250 240,000 252,000 264.600 4 1,029,000 152.250 277,830 5 6 1,029,000 1,029,000 152,250 152,250 291,722 306,308 0 0 Tax from Opertations Year 1 Year 2 Taxable income NOI 0 0 Interest 0 0 Depreciation Dedi 0 0 0 0 Taxable income 0 0 0 Income tax 0 0 0 0 0 0 0 0 U 0 0 0 0 0 0 0 0 0 1.459.080 0 1,459,080 1,472,972 1,487,558 0 0 0 1,472,972 1,487,558 57 58 Year 59 Bank 60 Law firm 61 Broker 62 63 Potential Gross Income 64 Vacancy 65 Effective Gross Incom 66 67 Year 68 Bank 69 Law firm 70 Broker 71 Total Expenses 72 13 Net Operating Income 74 - Caplial Improvemen - 75 =Before-tax Cash Flow 76 -Debt Service (Debt pa $ 77 Equity BTCF 78 - Income tax 79 =Equity ATCE 80 Office + 1,365,000 1,433,250 1,445,850 0 0 0 1,365,000 1,433,250 1,445,850 Expenses 1 2 3 $361,266 $0 $0 $51,609 0 0 0 0 $82,575 0 0 495,150 0 4 $0 0 0 0 5 $0 0 0 0 0 6 $0 0 0 0 0 1 ##### 0 Cash Flow from Sal year 5 Gross Sale Proceed 3 Year Equity ATCE Selling Expenses 1,029,000 0 25,000 Net Sale Price -1,028,997 - Loan Payoll $ 25,000 2 ######## -tax due on sale (360,149) After-tax reversion ######## 4 ######## 5 -693,848 Tax Due on sale NPV= ##### Net Sale Price -1,028,997 IRR #NUMI -Adjusted Bias (0) orignal price+cap imprv Taxable gain on sal -1,028,997 - Depreciation Tax due on sale (360,149) 1,459,080 0 1,459,080 869,550 1,433,250 1,445,850 0 0 869,550 1,433,250 1,445,850 $ $ 869,550 1,433,250 1,445,850 0 0 0 1,029,000 869,550 1,433,250 416,850 $ $ 1,472,972 1,487,558 10,000 1,462,972 1,487,558 $ 1,462,972 1,487,558 25,000 0 1,437,972 1,487,558 1,459,080 0 1,459,080