Answered step by step

Verified Expert Solution

Question

1 Approved Answer

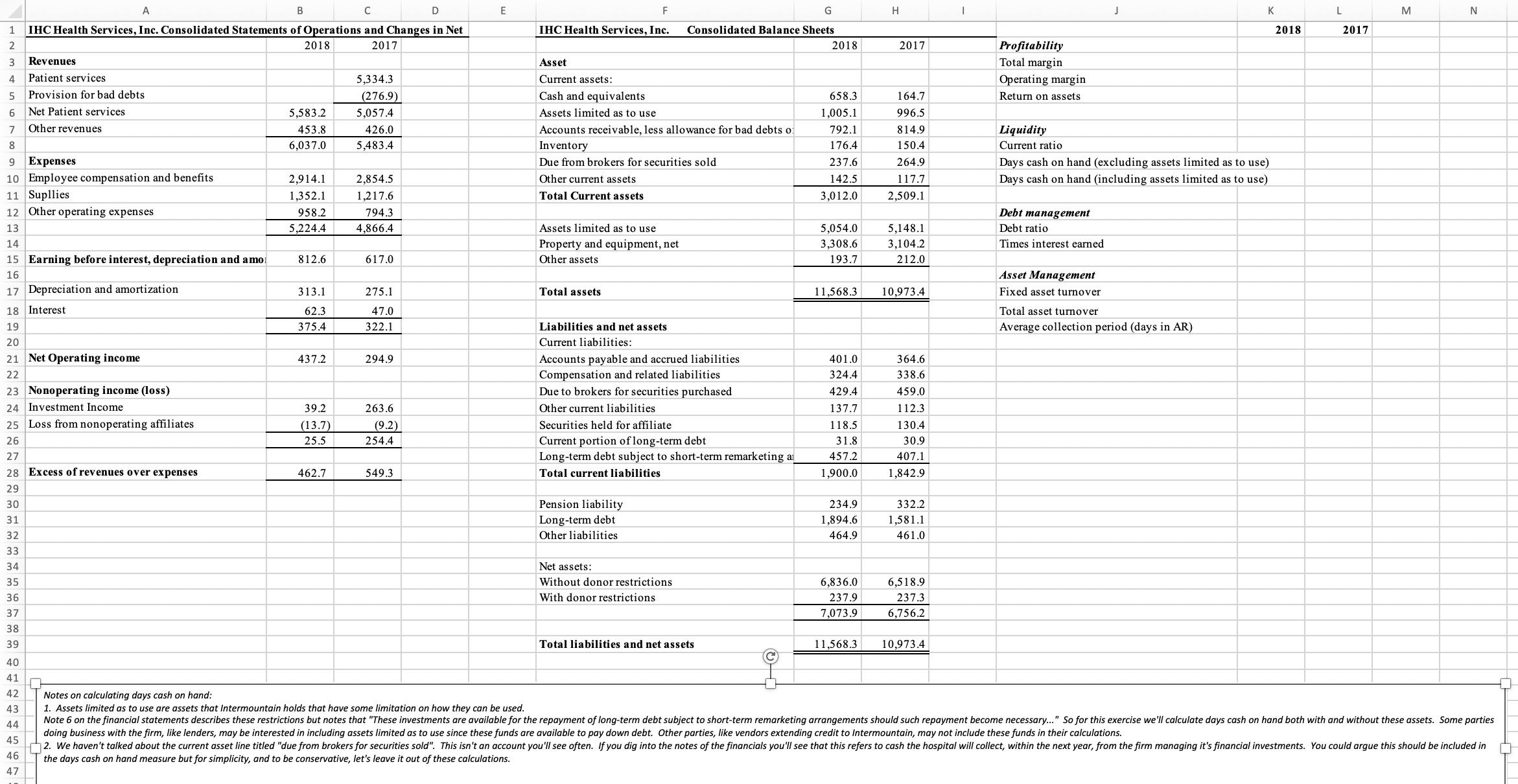

A B D E F G H 1 IHC Health Services, Inc. Consolidated Statements of Operations and Changes in Net IHC Health Services, Inc.

A B D E F G H 1 IHC Health Services, Inc. Consolidated Statements of Operations and Changes in Net IHC Health Services, Inc. Consolidated Balance Sheets J K L M N 2018 2017 2 2018 2017 2018 2017 Profitability 3 Revenues Asset Total margin 4 Patient services 5,334.3 Current assets: Operating margin 5 Provision for bad debts. (276.9) Cash and equivalents 658.3 164.7 Return on assets 6 Net Patient services 5,583.2 5,057.4 Assets limited as to use 1,005.1 996.5 7 Other revenues 8 453.8 6,037.0 426.0 5,483.4 Accounts receivable, less allowance for bad debts of 792.1 814.9 Inventory 176.4 150.4 9 Expenses Due from brokers for securities sold 237.6 264.9 10 Employee compensation and benefits 2,914.1 2,854.5 Other current assets 142.5 117.7 Liquidity Current ratio Days cash on hand (excluding assets limited as to use) Days cash on hand (including assets limited as to use) 11 Supllies 1,352.1 1,217.6 Total Current assets 3,012.0 2,509.1 12 Other operating expenses 958.2 13 5,224.4 794.3 4,866.4 Debt management Assets limited as to use 5,054.0 5,148.1 Debt ratio 14 Property and equipment, net 3,308.6 3,104.2 Times interest earned 15 Earning before interest, depreciation and amo 812.6 617.0 Other assets 193.7 212.0 16 Asset Management 17 Depreciation and amortization 313.1 275.1 Total assets 11,568.3 10,973.4 18 Interest 62.3 47.0 Fixed asset turnover. Total asset turnover 19 20 375.4 322.1 Liabilities and net assets Average collection period (days in AR) Current liabilities: 21 Net Operating income 437.2 294.9 22 Accounts payable and accrued liabilities Compensation and related liabilities 401.0 364.6 324.4 338.6 23 Nonoperating income (loss) Due to brokers for securities purchased 429.4 459.0 24 Investment Income 39.2 263.6 Other current liabilities 137.7 112.3 25 Loss from nonoperating affiliates (13.7) (9.2) Securities held for affiliate 118.5 130.4 26 25.5 254.4 Current portion of long-term debt 31.8 30.9 27 Long-term debt subject to short-term remarketing a 457.2 407.1 28 Excess of revenues over expenses 462.7 549.3 Total current liabilities 1,900.0 1,842.9 29 30 Pension liability 31 32 33 34 35 36 Long-term debt Other liabilities Net assets: Without donor restrictions With donor restrictions 234.9 332.2 1,894.6 464.9 1,581.1 461.0 37 38 39 6,836.0 237.9 6,518.9 237.3 7,073.9 6,756.2 Total liabilities and net assets 11,568.3 10,973.4 40 41 42 Notes on calculating days cash on hand: 43 1. Assets limited as to use are assets that Intermountain holds that have some limitation on how they can be used. 44 45 46 Note 6 on the financial statements describes these restrictions but notes that "These investments are available for the repayment of long-term debt subject to short-term remarketing arrangements should such repayment become necessary..." So for this exercise we'll calculate days cash on hand both with and without these assets. Some parties doing business with the firm, like lenders, may be interested in including assets limited as to use since these funds are available to pay down debt. Other parties, like vendors extending credit to Intermountain, may not include these funds in their calculations. 2. We haven't talked about the current asset line titled "due from brokers for securities sold". This isn't an account you'll see often. If you dig into the notes of the financials you'll see that this refers to cash the hospital will collect, within the next year, from the firm managing it's financial investments. You could argue this should be included in the days cash on hand measure but for simplicity, and to be conservative, let's leave it out of these calculations. 47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started