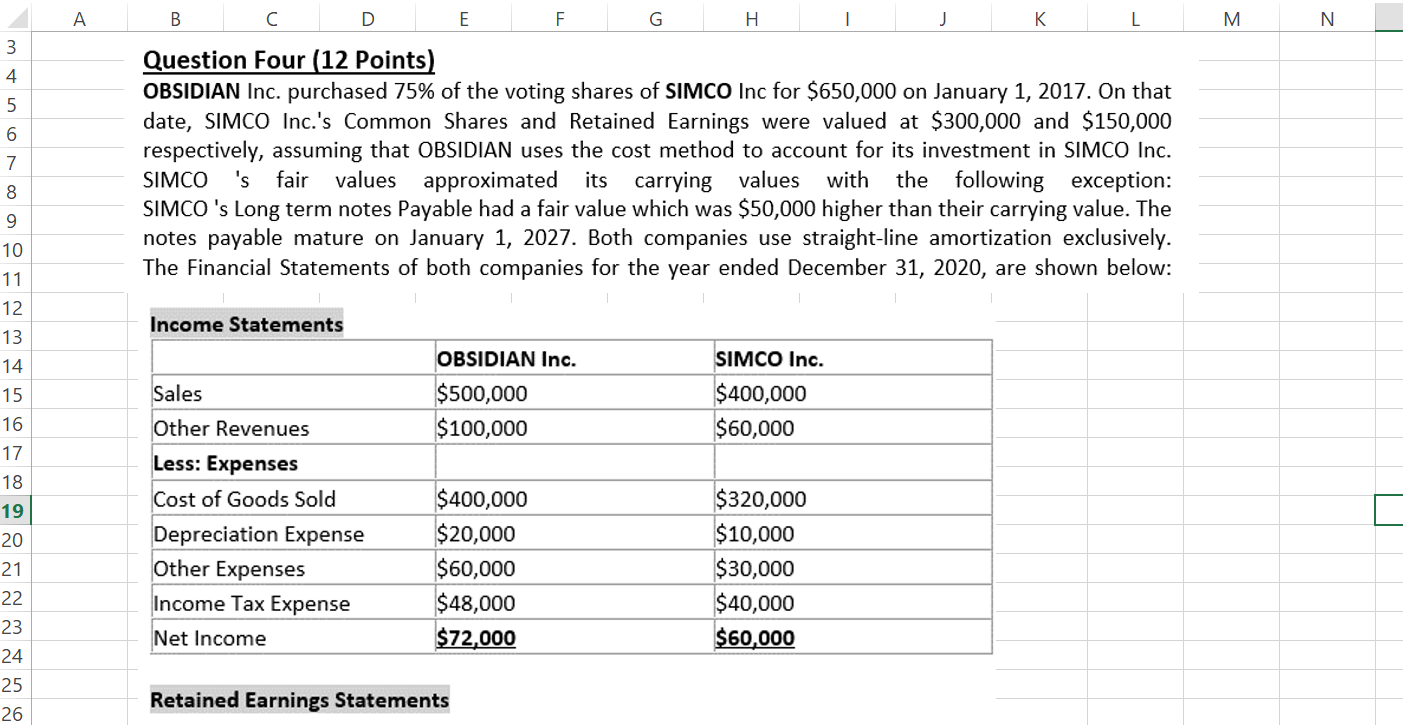

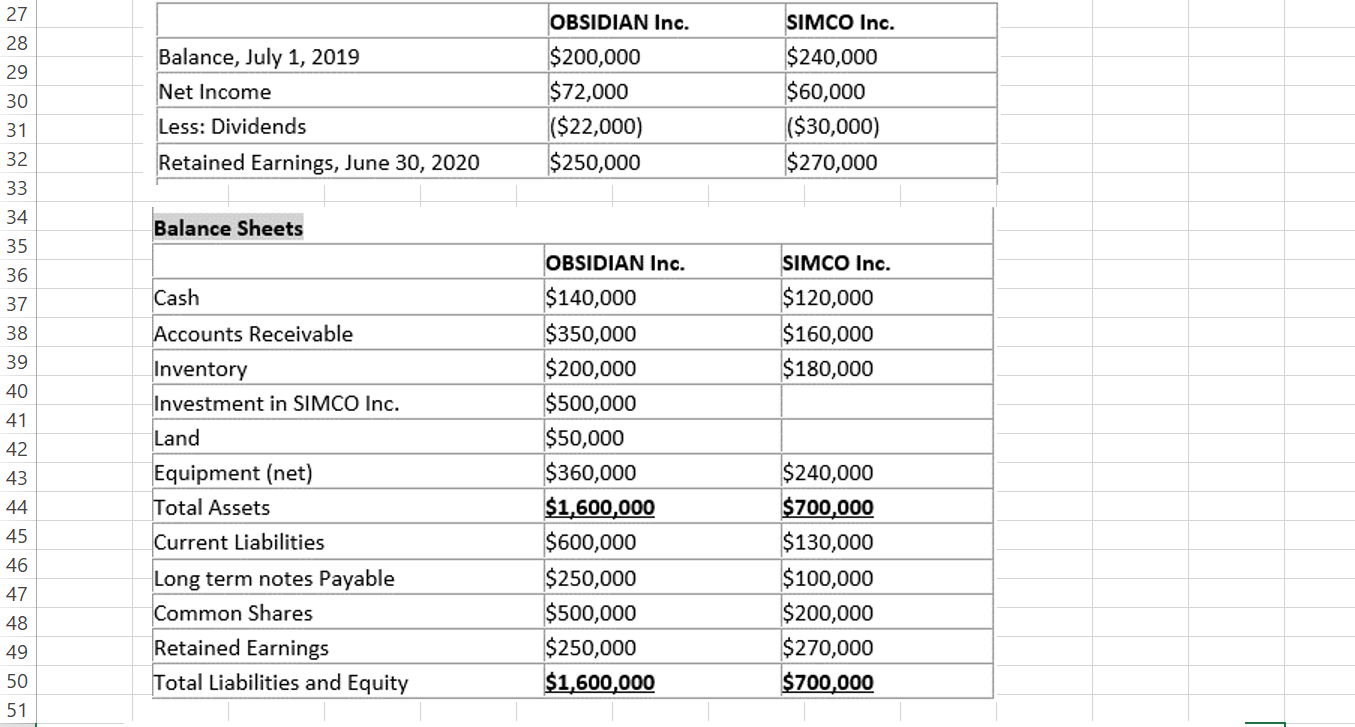

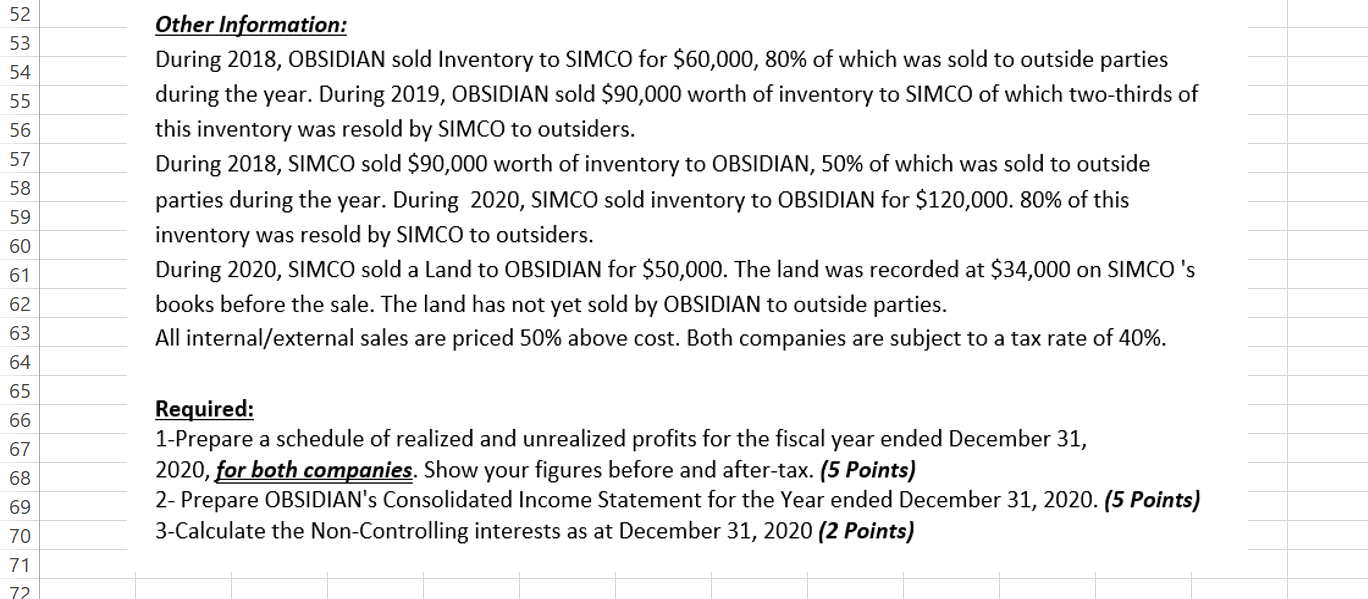

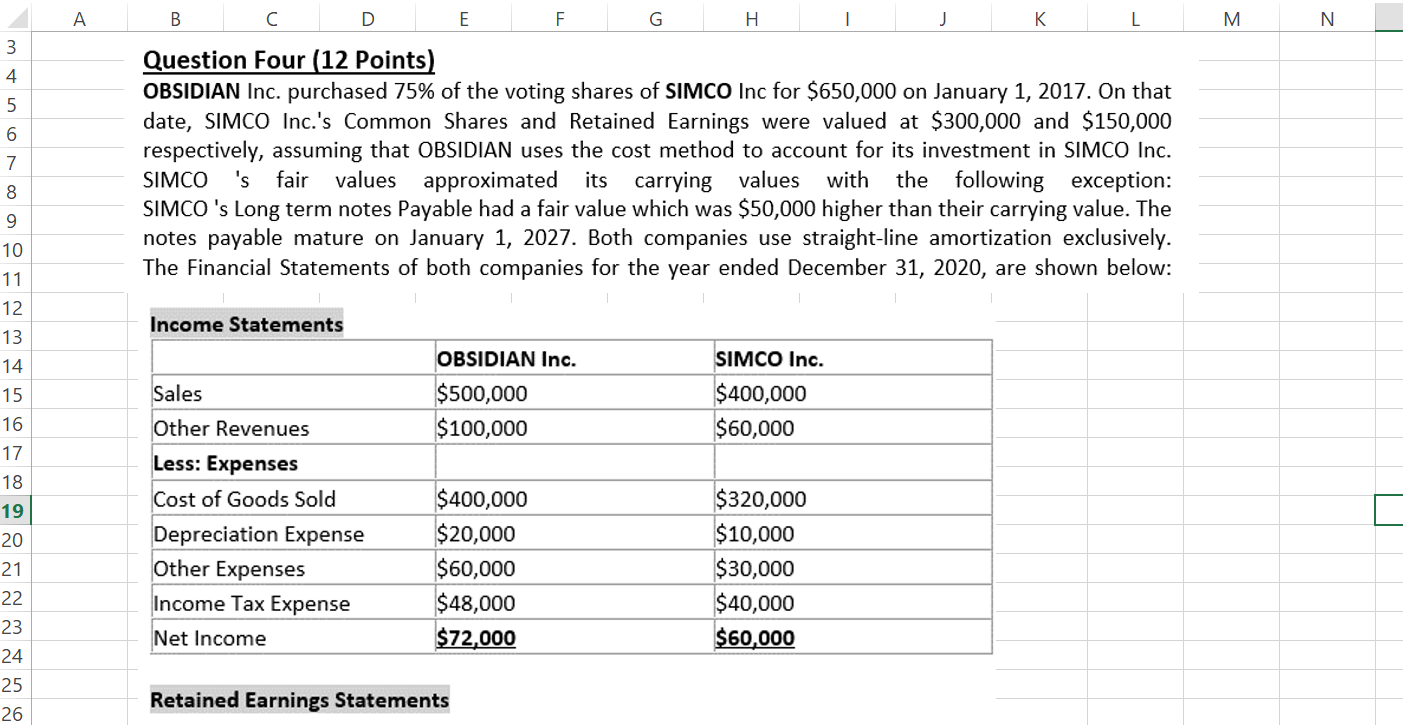

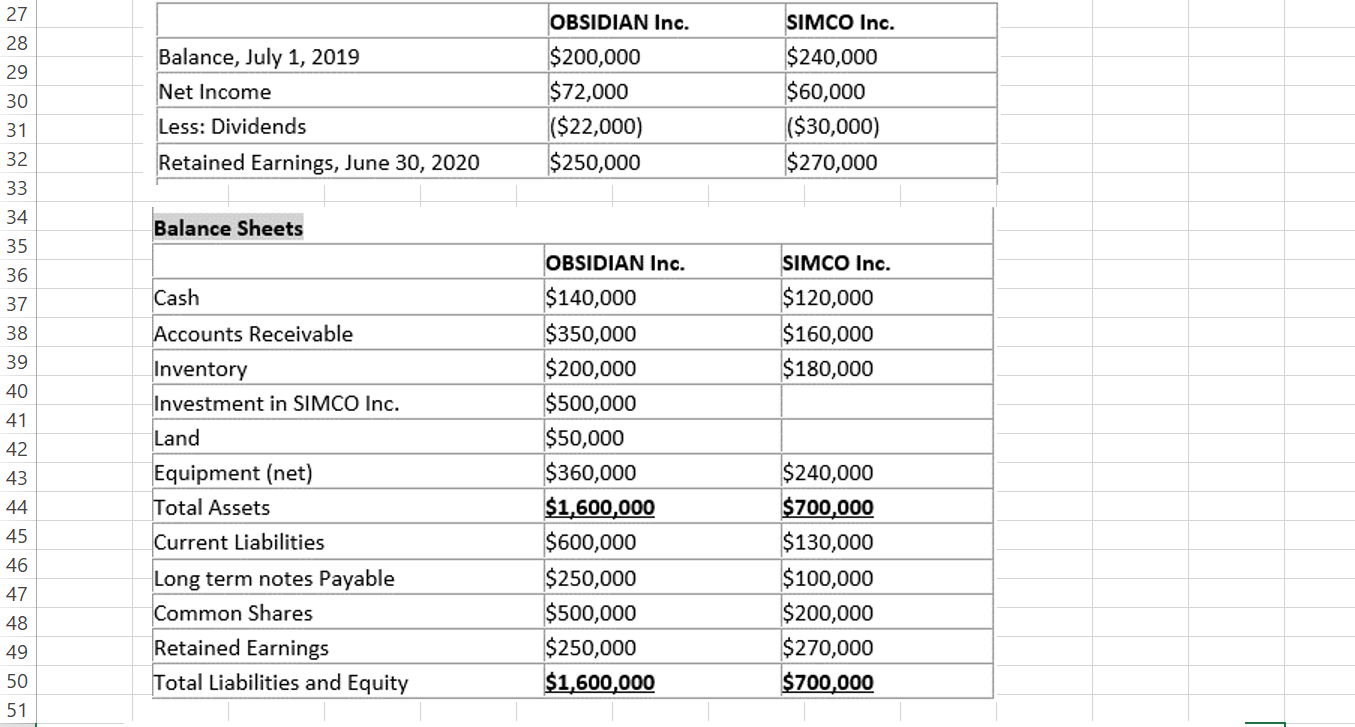

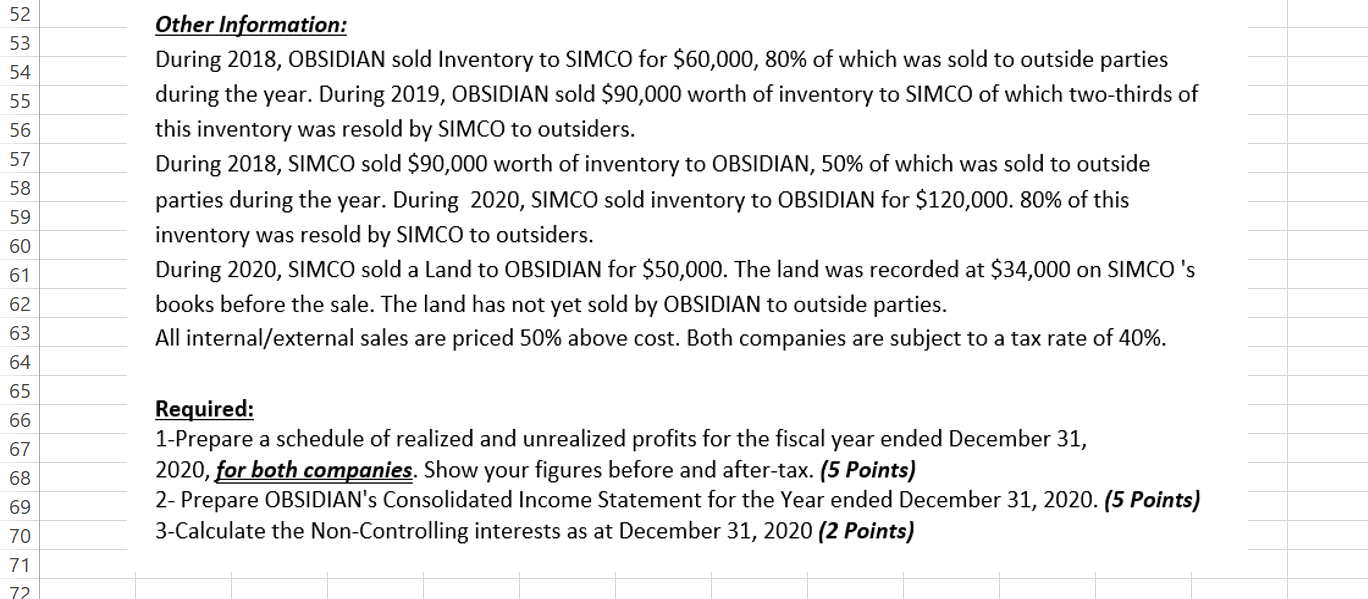

A B D E F G H - J K M N 3 4 5 6 7 Question Four (12 Points) OBSIDIAN Inc. purchased 75% of the voting shares of SIMCO Inc for $650,000 on January 1, 2017. On that date, SIMCO Inc.'s Common Shares and Retained Earnings were valued at $300,000 and $150,000 respectively, assuming that OBSIDIAN uses the cost method to account for its investment in SIMCO Inc. SIMCO 's fair values approximated its carrying values with the following exception: SIMCO 's Long term notes Payable had a fair value which was $50,000 higher than their carrying value. The notes payable mature on January 1, 2027. Both companies use straight-line amortization exclusively. The Financial Statements of both companies for the year ended December 31, 2020, are shown below: 8 9 10 11 12 13 14 Income Statements 15 Sales OBSIDIAN Inc. $500,000 $100,000 SIMCO Inc. $400,000 $60,000 16 Other Revenues 17 18 19 20 21 Less: Expenses Cost of Goods Sold Depreciation Expense Other Expenses Income Tax Expense Net Income $400,000 $20,000 $60,000 $48,000 $72,000 $320,000 $10,000 $30,000 $40,000 $60,000 22 23 24 25 26 Retained Earnings Statements OBSIDIAN Inc. Balance, July 1, 2019 Net Income 27 28 29 30 31 32 33 34 35 36 37 $200,000 $72,000 ($22,000) $250,000 SIMCO Inc. $240,000 $60,000 ($30,000) $270,000 Less: Dividends Retained Earnings, June 30, 2020 Balance Sheets OBSIDIAN Inc. Cash SIMCO Inc. $120,000 $160,000 $180,000 Accounts Receivable 38 39 40 41 42 43 44 $140,000 $350,000 $200,000 $500,000 $50,000 $360,000 $1,600,000 $600,000 $250,000 $500,000 $250,000 $1,600,000 Inventory Investment in SIMCO Inc. Land Equipment (net) Total Assets Current Liabilities Long term notes Payable Common Shares Retained Earnings Total Liabilities and Equity 45 46 47 48 49 50 51 $240,000 $700,000 $130,000 $100,000 $200,000 $270,000 $700,000 52 53 54 55 56 57 58 59 Other Information: During 2018, OBSIDIAN sold Inventory to SIMCO for $60,000, 80% of which was sold to outside parties during the year. During 2019, OBSIDIAN sold $90,000 worth of inventory to SIMCO of which two-thirds of this inventory was resold by SIMCO to outsiders. During 2018, SIMCO sold $90,000 worth of inventory to OBSIDIAN, 50% of which was sold to outside parties during the year. During 2020, SIMCO sold inventory to OBSIDIAN for $120,000. 80% of this inventory was resold by SIMCO to outsiders. During 2020, SIMCO sold a Land to OBSIDIAN for $50,000. The land was recorded at $34,000 on SIMCO's books before the sale. The land has not yet sold by OBSIDIAN to outside parties. All internal/external sales are priced 50% above cost. Both companies are subject to a tax rate of 40%. 60 61 62 63 64 65 66 67 68 Required: 1-Prepare a schedule of realized and unrealized profits for the fiscal year ended December 31, 2020, for both companies. Show your figures before and after-tax. (5 Points) 2- Prepare OBSIDIAN's Consolidated Income Statement for the Year ended December 31, 2020. (5 Points) 3-Calculate the Non-Controlling interests as at December 31, 2020 (2 points) 69 70 71 72 A B D E F G H - J K M N 3 4 5 6 7 Question Four (12 Points) OBSIDIAN Inc. purchased 75% of the voting shares of SIMCO Inc for $650,000 on January 1, 2017. On that date, SIMCO Inc.'s Common Shares and Retained Earnings were valued at $300,000 and $150,000 respectively, assuming that OBSIDIAN uses the cost method to account for its investment in SIMCO Inc. SIMCO 's fair values approximated its carrying values with the following exception: SIMCO 's Long term notes Payable had a fair value which was $50,000 higher than their carrying value. The notes payable mature on January 1, 2027. Both companies use straight-line amortization exclusively. The Financial Statements of both companies for the year ended December 31, 2020, are shown below: 8 9 10 11 12 13 14 Income Statements 15 Sales OBSIDIAN Inc. $500,000 $100,000 SIMCO Inc. $400,000 $60,000 16 Other Revenues 17 18 19 20 21 Less: Expenses Cost of Goods Sold Depreciation Expense Other Expenses Income Tax Expense Net Income $400,000 $20,000 $60,000 $48,000 $72,000 $320,000 $10,000 $30,000 $40,000 $60,000 22 23 24 25 26 Retained Earnings Statements OBSIDIAN Inc. Balance, July 1, 2019 Net Income 27 28 29 30 31 32 33 34 35 36 37 $200,000 $72,000 ($22,000) $250,000 SIMCO Inc. $240,000 $60,000 ($30,000) $270,000 Less: Dividends Retained Earnings, June 30, 2020 Balance Sheets OBSIDIAN Inc. Cash SIMCO Inc. $120,000 $160,000 $180,000 Accounts Receivable 38 39 40 41 42 43 44 $140,000 $350,000 $200,000 $500,000 $50,000 $360,000 $1,600,000 $600,000 $250,000 $500,000 $250,000 $1,600,000 Inventory Investment in SIMCO Inc. Land Equipment (net) Total Assets Current Liabilities Long term notes Payable Common Shares Retained Earnings Total Liabilities and Equity 45 46 47 48 49 50 51 $240,000 $700,000 $130,000 $100,000 $200,000 $270,000 $700,000 52 53 54 55 56 57 58 59 Other Information: During 2018, OBSIDIAN sold Inventory to SIMCO for $60,000, 80% of which was sold to outside parties during the year. During 2019, OBSIDIAN sold $90,000 worth of inventory to SIMCO of which two-thirds of this inventory was resold by SIMCO to outsiders. During 2018, SIMCO sold $90,000 worth of inventory to OBSIDIAN, 50% of which was sold to outside parties during the year. During 2020, SIMCO sold inventory to OBSIDIAN for $120,000. 80% of this inventory was resold by SIMCO to outsiders. During 2020, SIMCO sold a Land to OBSIDIAN for $50,000. The land was recorded at $34,000 on SIMCO's books before the sale. The land has not yet sold by OBSIDIAN to outside parties. All internal/external sales are priced 50% above cost. Both companies are subject to a tax rate of 40%. 60 61 62 63 64 65 66 67 68 Required: 1-Prepare a schedule of realized and unrealized profits for the fiscal year ended December 31, 2020, for both companies. Show your figures before and after-tax. (5 Points) 2- Prepare OBSIDIAN's Consolidated Income Statement for the Year ended December 31, 2020. (5 Points) 3-Calculate the Non-Controlling interests as at December 31, 2020 (2 points) 69 70 71 72