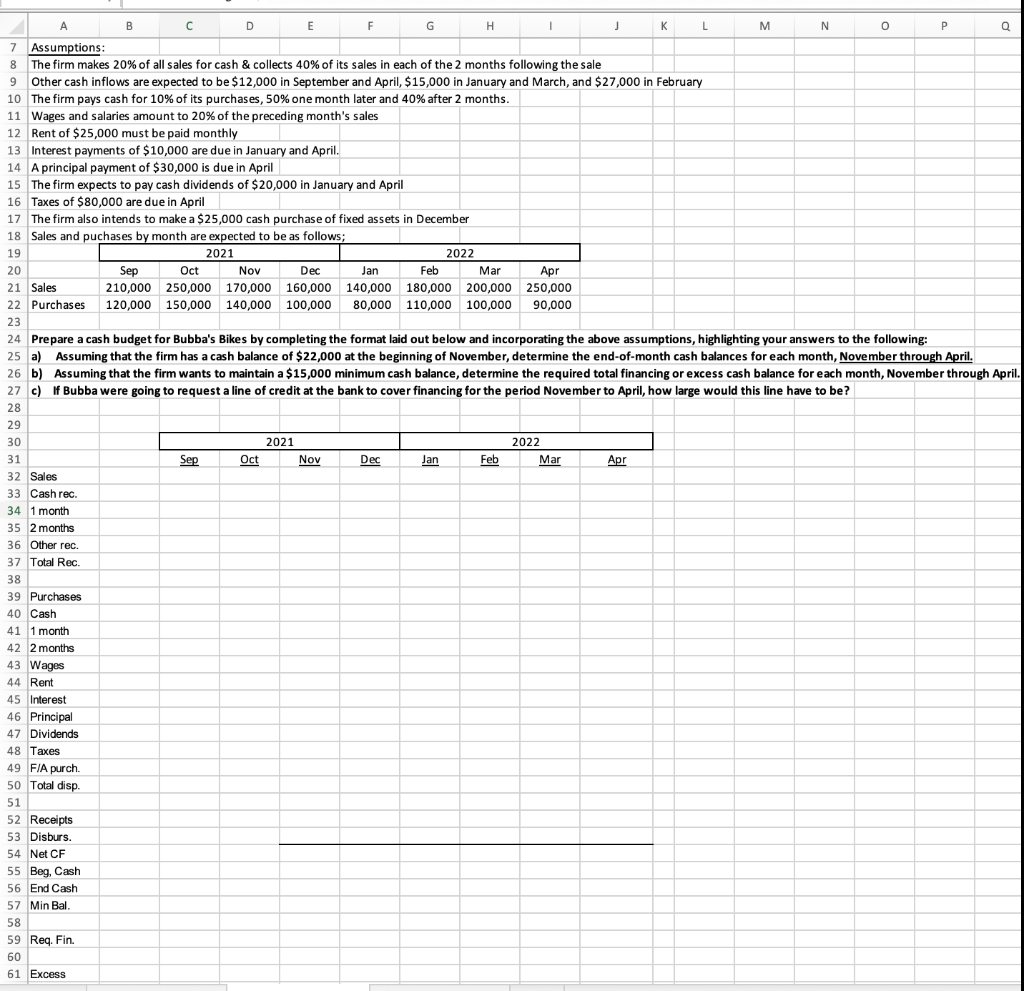

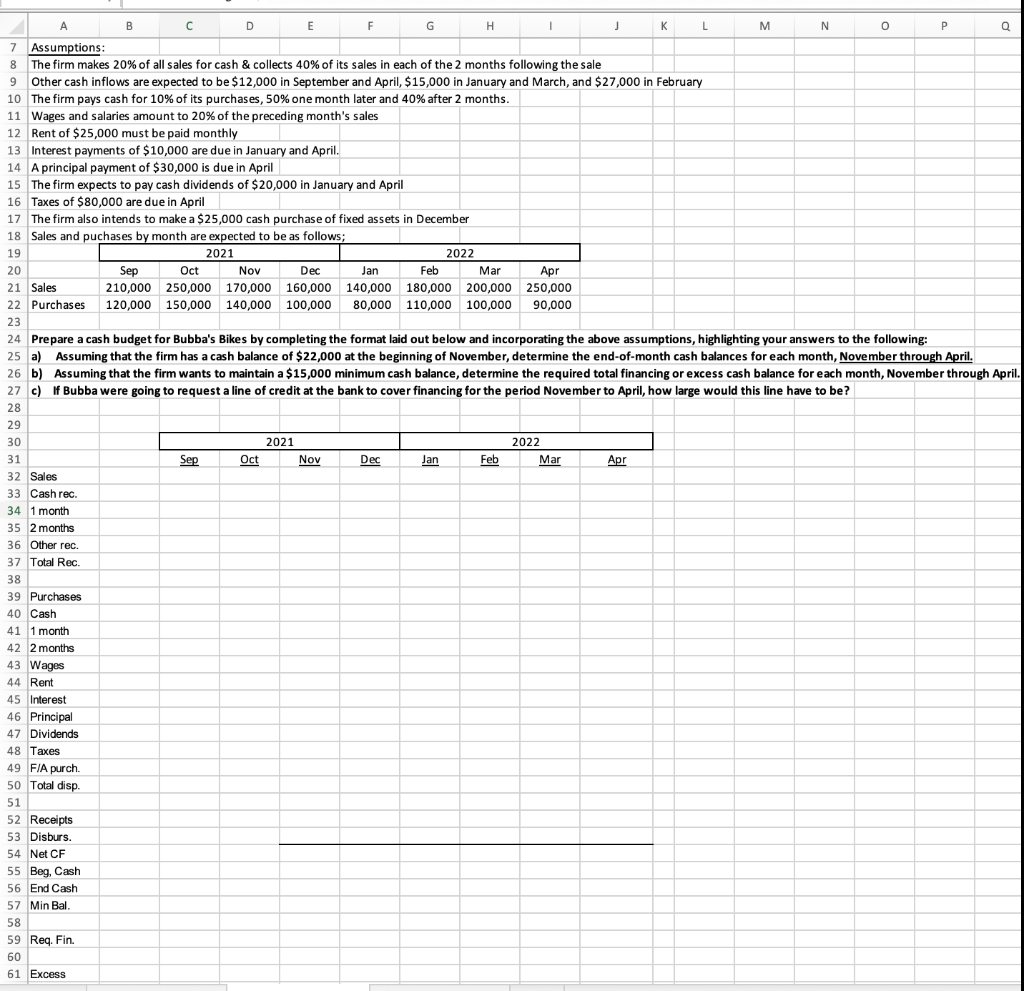

A B D E F G H J L M M N N o P Q 7 Assumptions: 8 The firm makes 20% of all sales for cash & collects 40% of its sales in each of the 2 months following the sale 9 Other cash inflows are expected to be $12,000 in September and April, $15,000 in January and March, and $27,000 in February 10 The firm pays cash for 10% of its purchases, 50% one month later and 40% after 2 months. 11 Wages and salaries amount to 20% of the preceding month's sales 12 Rent of $25,000 must be paid monthly 13 Interest payments of $10,000 are due in January and April. 14 A principal payment of $30,000 is due in April 15 The firm expects to pay cash dividends of $20,000 in January and April 16 Taxes of $80,000 are due in April 17 The firm also intends to make a $25,000 cash purchase of fixed assets in December 18 Sales and puchas es by month are expected to be as follows; 19 2021 2022 20 Sep Oct Nov Dec Jan Feb Mar Apr 21 Sales 210,000 250,000 170,000 160,000 140,000 180,000 200,000 250,000 22 Purchases 120,000 150,000 140,000 100,000 80,000 110,000 100,000 90,000 23 24 Prepare a cash budget for Bubba's Bikes by completing the format laid out below and incorporating the above assumptions, highlighting your answers to the following: 25 a) Assuming that the firm has a cash balance of $22,000 at the beginning of November, determine the end-of-month cash balances for each month, November through April. 26 b) Assuming that the firm wants to maintain a $15,000 minimum cash balance, determine the required total financing or excess cash balance for each month, November through April 27 c) If Bubba were going to request a line of credit at the bank to cover financing for the period November to April, how large would this line have to be? 28 29 30 2021 2022 31 Sep Oct Nov Dec Jan Feb Mar Apr 32 Sales 33 Cash rec. 34 1 month 35 2 months 36 Other rec. 37 Total Rec. 38 39 Purchases 40 Cash 41 1 month 42 2 months 43 Wages 44 Rent 45 Interest 46 Principal 47 Dividends 48 Taxes 49 FIA purch 50 Total disp. 51 52 Receipts 53 Disburs. 54 Net CF 55 Beg, Cash 56 End Cash 57 Min Bal. 58 59 Req. Fin. 60 61 Excess A B D E F G H J L M M N N o P Q 7 Assumptions: 8 The firm makes 20% of all sales for cash & collects 40% of its sales in each of the 2 months following the sale 9 Other cash inflows are expected to be $12,000 in September and April, $15,000 in January and March, and $27,000 in February 10 The firm pays cash for 10% of its purchases, 50% one month later and 40% after 2 months. 11 Wages and salaries amount to 20% of the preceding month's sales 12 Rent of $25,000 must be paid monthly 13 Interest payments of $10,000 are due in January and April. 14 A principal payment of $30,000 is due in April 15 The firm expects to pay cash dividends of $20,000 in January and April 16 Taxes of $80,000 are due in April 17 The firm also intends to make a $25,000 cash purchase of fixed assets in December 18 Sales and puchas es by month are expected to be as follows; 19 2021 2022 20 Sep Oct Nov Dec Jan Feb Mar Apr 21 Sales 210,000 250,000 170,000 160,000 140,000 180,000 200,000 250,000 22 Purchases 120,000 150,000 140,000 100,000 80,000 110,000 100,000 90,000 23 24 Prepare a cash budget for Bubba's Bikes by completing the format laid out below and incorporating the above assumptions, highlighting your answers to the following: 25 a) Assuming that the firm has a cash balance of $22,000 at the beginning of November, determine the end-of-month cash balances for each month, November through April. 26 b) Assuming that the firm wants to maintain a $15,000 minimum cash balance, determine the required total financing or excess cash balance for each month, November through April 27 c) If Bubba were going to request a line of credit at the bank to cover financing for the period November to April, how large would this line have to be? 28 29 30 2021 2022 31 Sep Oct Nov Dec Jan Feb Mar Apr 32 Sales 33 Cash rec. 34 1 month 35 2 months 36 Other rec. 37 Total Rec. 38 39 Purchases 40 Cash 41 1 month 42 2 months 43 Wages 44 Rent 45 Interest 46 Principal 47 Dividends 48 Taxes 49 FIA purch 50 Total disp. 51 52 Receipts 53 Disburs. 54 Net CF 55 Beg, Cash 56 End Cash 57 Min Bal. 58 59 Req. Fin. 60 61 Excess