Answered step by step

Verified Expert Solution

Question

1 Approved Answer

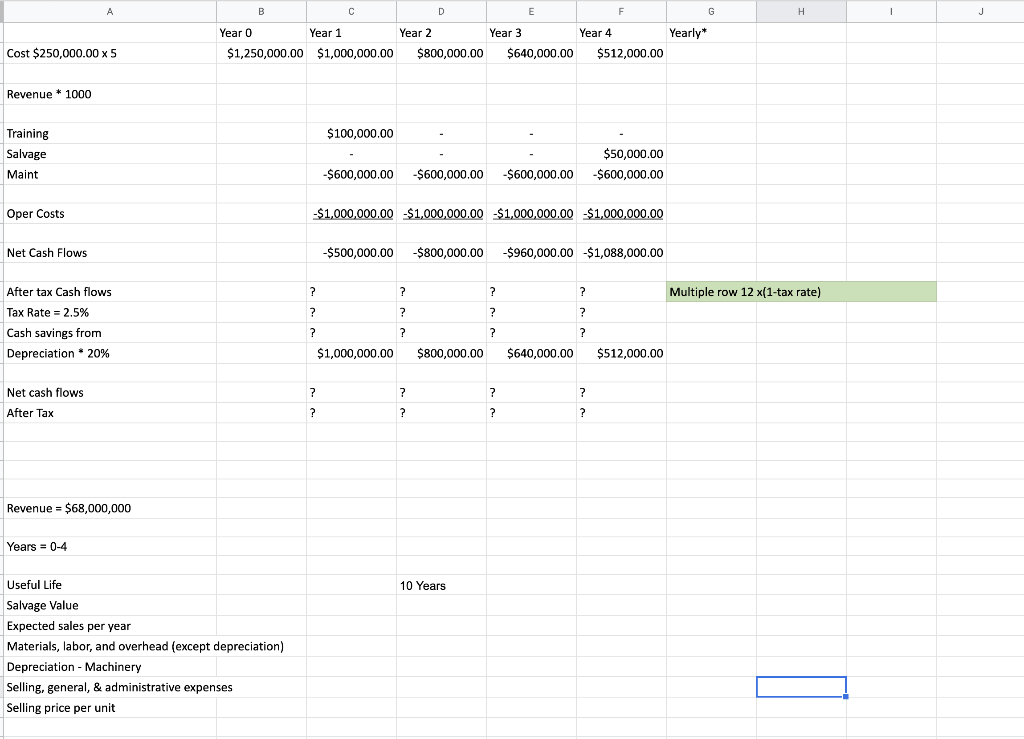

A B D E F G H | J Year 0 Year 1 Year 2 Year 3 Year 4 Yearly* Cost $250,000.00 x 5

A B D E F G H | J Year 0 Year 1 Year 2 Year 3 Year 4 Yearly* Cost $250,000.00 x 5 $1,250,000.00 $1,000,000.00 $800,000.00 $640,000.00 $512,000.00 Revenue 1000 Training Salvage Maint Oper Costs Net Cash Flows $100,000.00 - $50,000.00 -$600,000.00 -$600,000.00 -$600,000.00 -$600,000.00 -$1,000,000.00 $1,000,000.00 $1,000,000.00 $1,000,000.00 -$500,000.00 -$800,000.00 -$960,000.00 -$1,088,000.00 Multiple row 12 x(1-tax rate) After tax Cash flows ? ? ? ? Tax Rate = 2.5% ? ? ? ? Cash savings from ? ? ? Depreciation 20% Net cash flows After Tax Revenue = $68,000,000 Years = 0-4 Useful Life Salvage Value Expected sales per year Materials, labor, and overhead (except depreciation) Depreciation - Machinery Selling, general, & administrative expenses Selling price per unit $1,000,000.00 $800,000.00 $640,000.00 ? ? ? ? ? ? ? ? 10 Years $512,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started