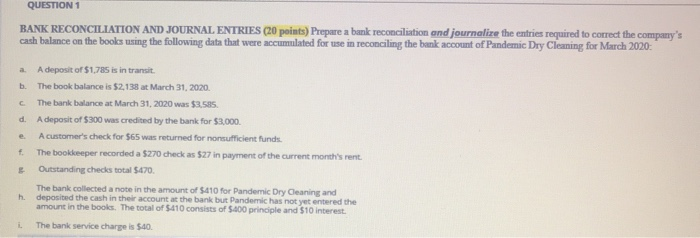

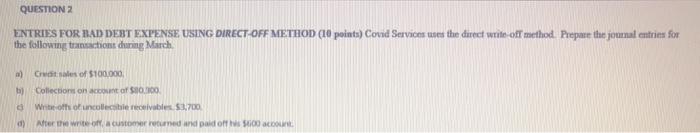

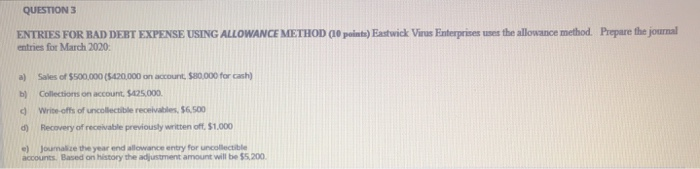

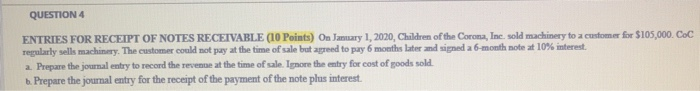

a b d. QUESTION 1 BANK RECONCILIATION AND JOURNAL ENTRIES (20 points) Prepare a bank reconciliation and journalize the entries required to correct the company's cash balance on the books using the following data that were accumulated for use in reconciling the bank account of Pandemic Dry Cleaning for March 2020- A deposit of $1,785 is in transit. The book balance is $2,138 at March 31, 2020. The bank balance at March 31, 2020 was $2,585. A deposit of $200 was credited by the bank for $3,000. A customer's check for $65 was returned for nonsufficient funds. f. The bookkeeper recorded a $270 check as $27 in payment of the current month's rent Outstanding checks total $470 The bank collected a note in the amount of $410 for Pandemic Dry Cleaning and deposited the cash in their account at the bank but Pandemic has not yet entered the amount in the books. The total of $410 consists of $400 principle and $10 interest. The bank service charge is $40 e h. QUESTION 2 ENTRIES FOR BAD DEBT EXPENSE USING DIRECT-OFF METHOD (10 points) Covid Services uses the direct write-off method. Prepare the journal entries for the following transactions during March a) Credit sales of $100.000, b) Collections on account of $80.300 Write-offs of uncollectible receivables. 53,700 d) After the write-off a customer returned and paid of his $600 account QUESTIONS ENTRIES FOR BAD DEBT EXPENSE USING ALLOWANCE METHOD (10 points) Eastwick Virus Enterprises uses the allowance method. Prepare the journal entries for March 2020: a) b) Sales of $500,000 ($420,000 on account, $80,000 for cash) Collections on account. $425,000 Write-offs of uncollectible receivables, $6.500 Recovery of receivable previously written oft $1,000 d d) Journalize the year and allowance entry for uncollectible accounts. Based on history the adjustment amount will be $5.200 QUESTION 4 ENTRIES FOR RECEIPT OF NOTES RECEIVABLE (10 Points) On January 1, 2020, Children of the Corona, Inc. sold machinery to a customer for $105,000. COC regularly sells machinery. The customer could not pay at the time of sale but agreed to pay 6 months later and signed a 6-month note at 10% interest a. Prepare the journal entry to record the revenue at the time of sale. Ignore the entry for cost of goods sold b. Prepare the journal entry for the receipt of the payment of the note plus interest