Answered step by step

Verified Expert Solution

Question

1 Approved Answer

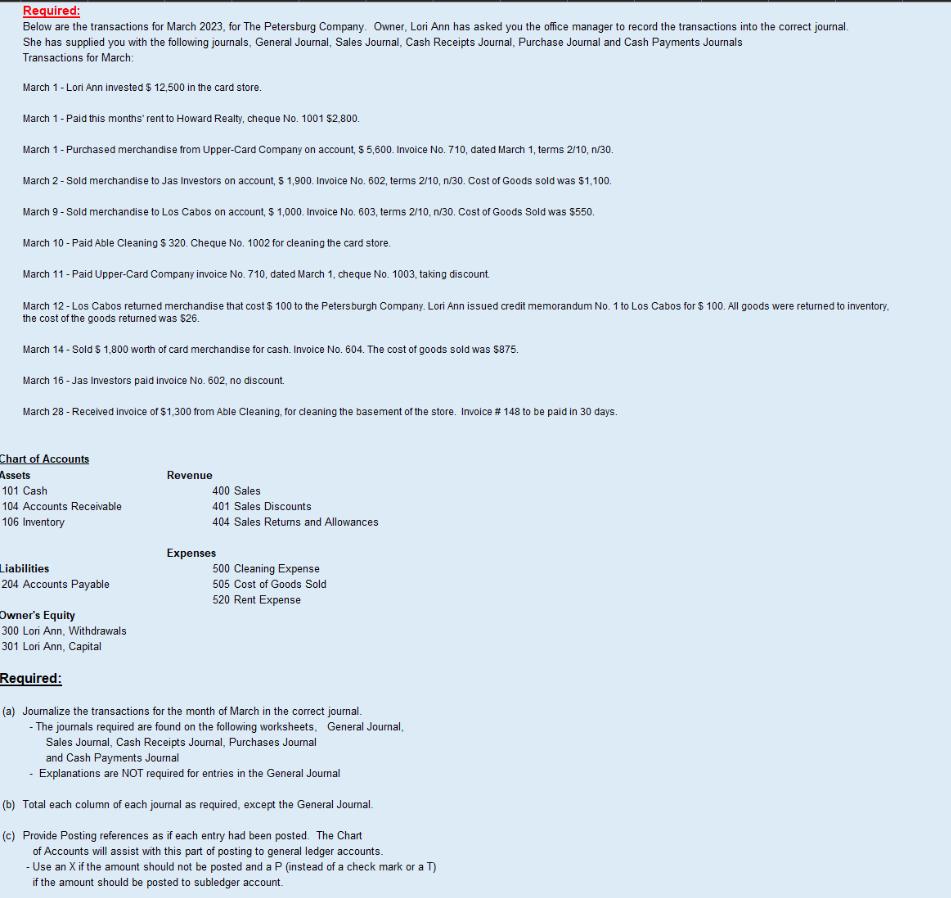

Required: Below are the transactions for March 2023, for The Petersburg Company. Owner, Lori Ann has asked you the office manager to record the

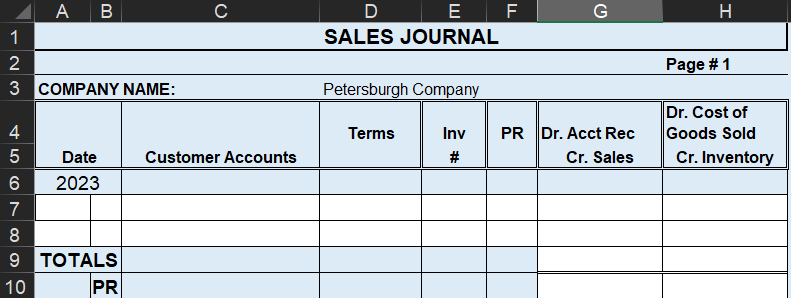

Required: Below are the transactions for March 2023, for The Petersburg Company. Owner, Lori Ann has asked you the office manager to record the transactions into the correct journal. She has supplied you with the following journals, General Journal, Sales Journal, Cash Receipts Journal, Purchase Journal and Cash Payments Journals Transactions for March: March 1 - Lori Ann invested $12,500 in the card store. March 1 - Paid this months' rent to Howard Realty, cheque No. 1001 $2.800. March 1 - Purchased merchandise from Upper-Card Company on account, $5,600. Invoice No. 710, dated March 1, terms 2/10, n/30. March 2 - Sold merchandise to Jas Investors on account, $ 1,900. Invoice No. 602, terms 2/10, n/30. Cost of Goods sold was $1,100. March 9 - Sold merchandise to Los Cabos on account, $ 1,000. Invoice No. 603, terms 2/10, n/30. Cost of Goods Sold was $550. March 10-Paid Able Cleaning $ 320. Cheque No. 1002 for cleaning the card store. March 11 - Paid Upper-Card Company invoice No. 710, dated March 1, cheque No. 1003, taking discount March 12-Los Cabos returned merchandise that cost $ 100 to the Petersburgh Company. Lori Ann issued credit memorandum No. 1 to Los Cabos for $ 100. All goods were returned to inventory. the cost of the goods returned was $26. March 14 - Sold $ 1,800 worth of card merchandise for cash. Invoice No. 604. The cost of goods sold was $875. March 16 - Jas Investors paid invoice No. 602, no discount. March 28 - Received invoice of $1,300 from Able Cleaning, for cleaning the basement of the store. Invoice # 148 to be paid in 30 days. Chart of Accounts Assets Revenue 101 Cash 104 Accounts Receivable 106 Inventory 400 Sales. 401 Sales Discounts 404 Sales Returns and Allowances. Expenses Liabilities 500 Cleaning Expense 204 Accounts Payable Owner's Equity 300 Lori Ann, Withdrawals 301 Lori Ann, Capital Required: 505 Cost of Goods Sold 520 Rent Expense (a) Journalize the transactions for the month of March in the correct journal. -The journals required are found on the following worksheets. General Journal, Sales Journal, Cash Receipts Journal, Purchases Journal and Cash Payments Journal - Explanations are NOT required for entries in the General Journal (b) Total each column of each journal as required, except the General Journal. (c) Provide Posting references as if each entry had been posted. The Chart of Accounts will assist with this part of posting to general ledger accounts. -Use an X if the amount should not be posted and a P (instead of a check mark or a T) if the amount should be posted to subledger account. 1 2 A B 3 COMPANY NAME: D E SALES JOURNAL Petersburgh Company LL F G I Page #1 4 Terms Inv 5 Date Customer Accounts # PR Dr. Acct Rec Cr. Sales Dr. Cost of Goods Sold Cr. Inventory 6 2023 7 8 9 TOTALS 10 PR

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

General Journal March 1 Debit Cash 12500 Credit Lon Ann Capital 12500 Investment March 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started