A)

B)

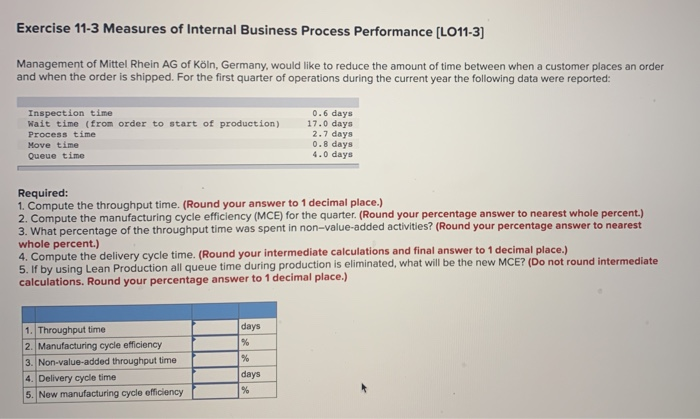

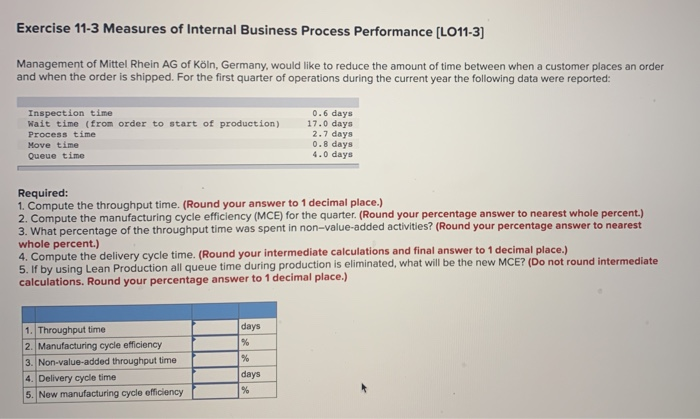

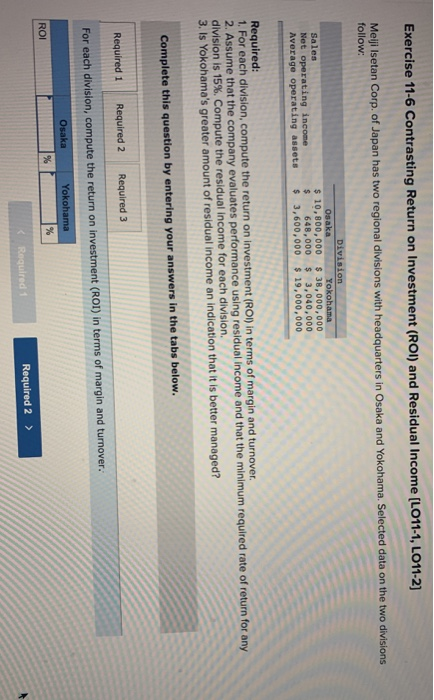

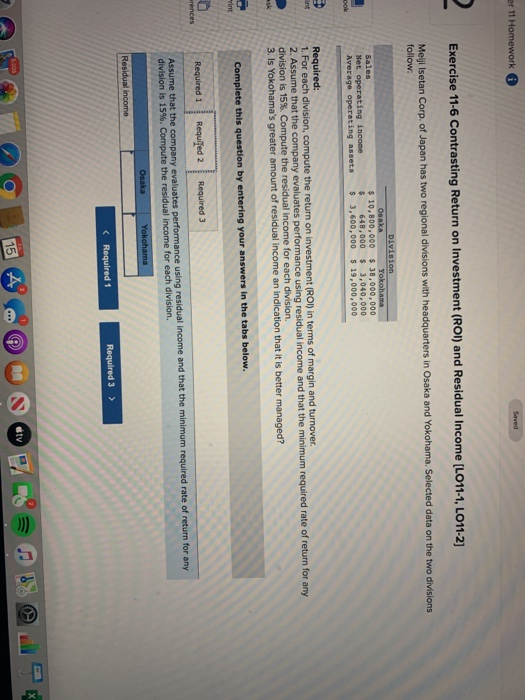

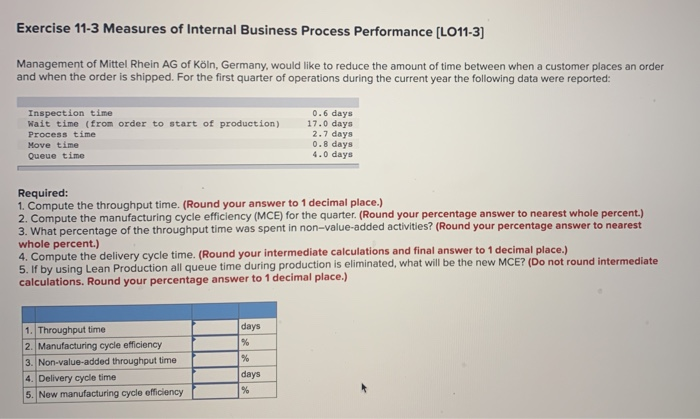

Exercise 11-3 Measures of Internal Business Process Performance (LO11-3) Management of Mittel Rhein AG of Kln, Germany, would like to reduce the amount of time between when a customer places an order and when the order is shipped. For the first quarter of operations during the current year the following data were reported: Inspection time wait time (from order to start of production) Move time Queue time Process time 0.6 days 17.0 days 2.7 days 0.8 days 4.0 days Required: 1. Compute the throughput time. (Round your answer to 1 decimal place.) 2. Compute the manufacturing cycle efficiency (MCE) for the quarter. (Round your percentage answer to nearest whole percent.) 3. What percentage of the throughput time was spent in non-value-added activities? (Round your percentage answer to nearest whole percent.) 4. Compute the delivery cycle time. (Round your intermediate calculations and final answer to 1 decimal place.) 5. If by using Lean Production all queue time during production is eliminated, what will be the new MCE? (Do not round intermediate calculations. Round your percentage answer to 1 decimal place.) 1. Throughput time 2. Manufacturing cycle efficiency 3. Non-value-added throughput time 4. Delivery cycle time 5. New manufacturing cycle officiency days % % days % Exercise 11-6 Contrasting Return on Investment (ROI) and Residual Income (LO11-1, LO11-2] Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Division Osaka Yokohama $ 10,800,000 $ 38,000,000 $ 648,000 $ 3,040,000 $ 3,600,000 $ 19,000,000 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 15%. Compute the residual income for each division 3. Is Yokohama's greater amount of residual income an indication that it is better managed? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 For each division, compute the return on investment (ROI) in terms of margin and turnover. Osaka Yokohama ROI % % Required 1 Required 2 > er 11 Homework Saved Exercise 11-6 Contrasting Return on Investment (ROI) and Residual Income (LO11-1, LO11-2] Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow Sales Net operating income Average operating assets Division Osaka Yokohama $ 10,800,000 $ 38,000,000 $ 648,000 $3,040,000 $ 3,600,000 $ 19,000,000 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 15%. Compute the residual income for each division 3. Is Yokohama's greater amount of residual income an indication that it is better managed? ask Complete this question by entering your answers in the tabs below. Print Required 1 Requied 2 Required 3 erences Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 15%. Compute the residual income for each division. Osaka Yokohama Residual income 9 . atv 15 A