Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) (b) Last week Hasan Patel bought 5 Mildmay Close, Lymm, Cheshire (5 Mildmay Close) from Mike Platt, the sole registered proprietor. To save

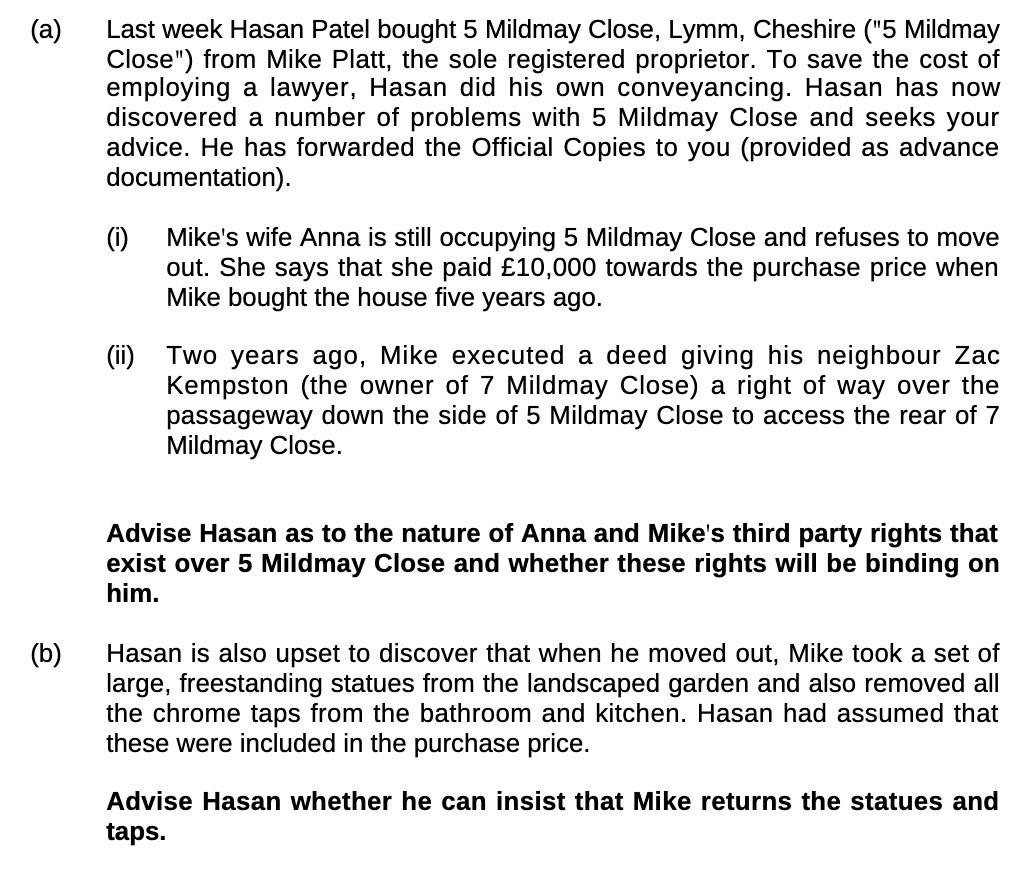

(a) (b) Last week Hasan Patel bought 5 Mildmay Close, Lymm, Cheshire ("5 Mildmay Close") from Mike Platt, the sole registered proprietor. To save the cost of employing a lawyer, Hasan did his own conveyancing. Hasan has now discovered a number of problems with 5 Mildmay Close and seeks your advice. He has forwarded the Official Copies to you (provided as advance documentation). (1) Mike's wife Anna is still occupying 5 Mildmay Close and refuses to move out. She says that she paid 10,000 towards the purchase price when Mike bought the house five years ago. (ii) Two years ago, Mike executed a deed giving his neighbour Zac Kempston (the owner of 7 Mildmay Close) a right of way over the passageway down the side of 5 Mildmay Close to access the rear of 7 Mildmay Close. Advise Hasan as to the nature of Anna and Mike's third party rights that exist over 5 Mildmay Close and whether these rights will be binding on him. Hasan is also upset to discover that when he moved out, Mike took a set of large, freestanding statues from the landscaped garden and also removed all the chrome taps from the bathroom and kitchen. Hasan had assumed that these were included in the purchase price. Advise Hasan whether he can insist that Mike returns the statues and taps.

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i Annas Occupation and Payment Annas claim that she paid 10000 towards the purchase price five years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started