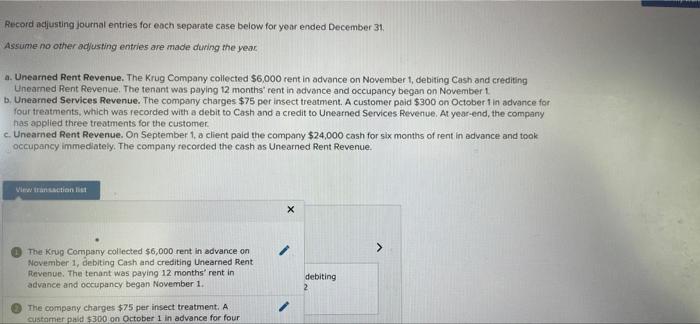

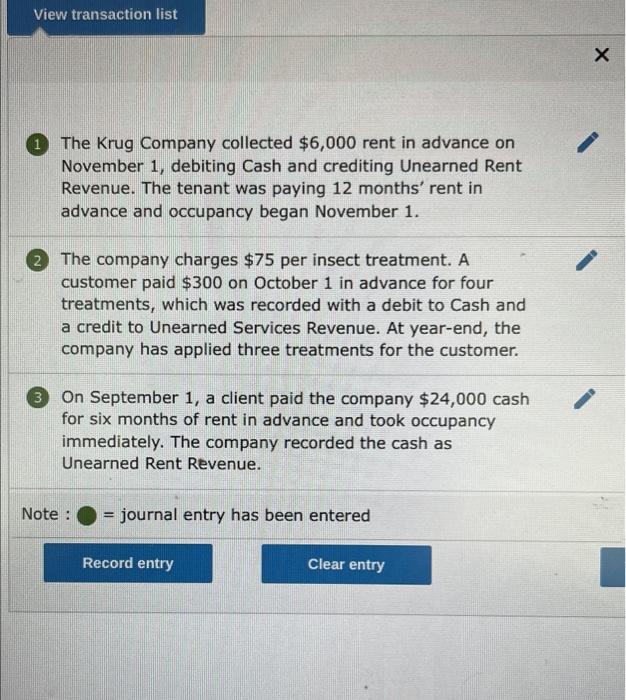

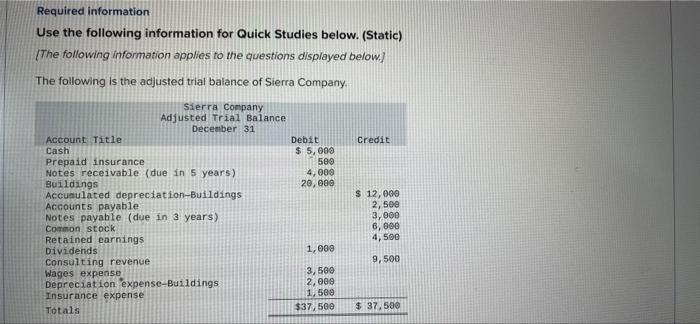

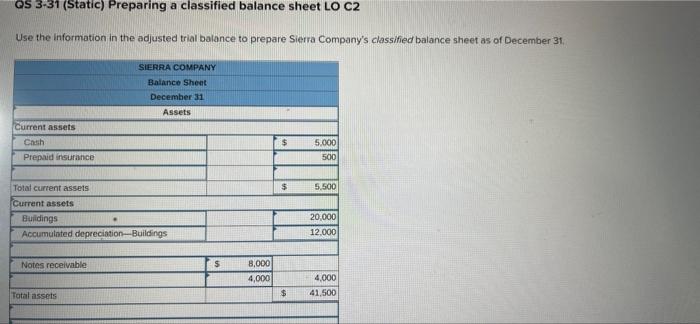

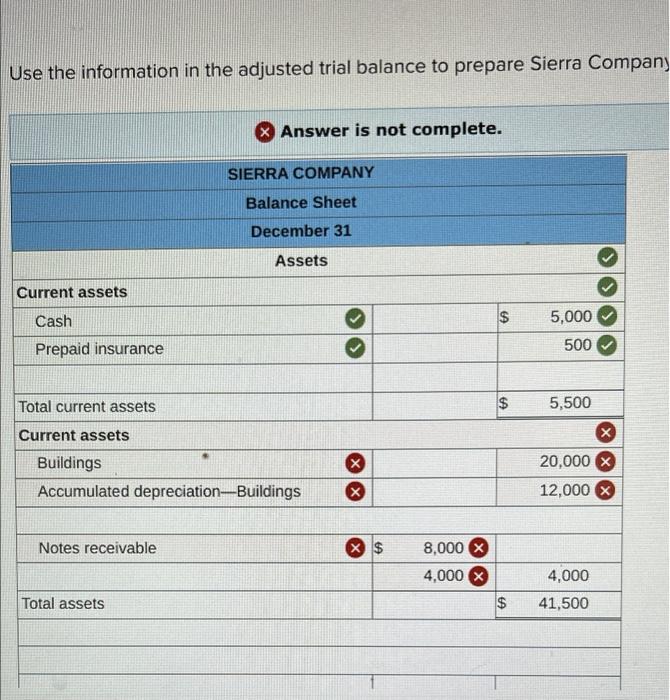

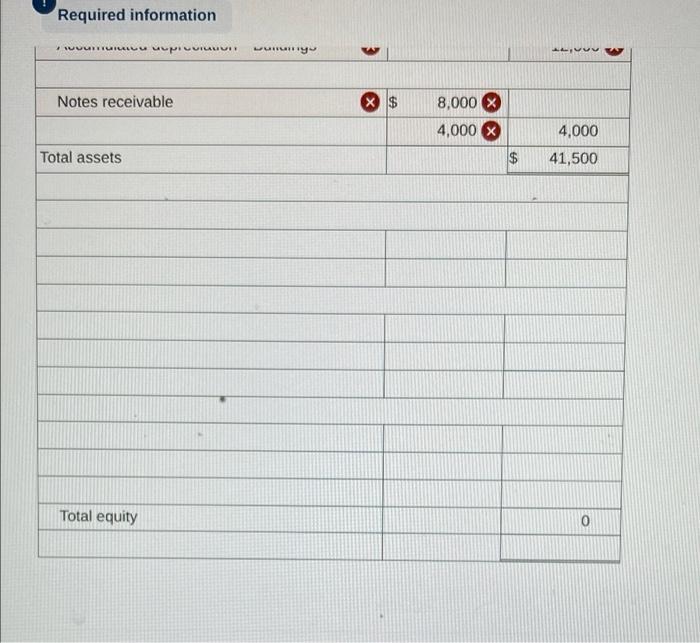

Record adjusting journal entries for each separate case below for year ended December 31, Assume no other adjusting entries are made during the year a. Unearned Rent Revenue. The Krug Company collected $6,000 rent in advance on November 1, debiting Cash and crediting Uneamed Rent Revenue. The tenant was paying 12 months' rent in advance and occupancy began on November 1 b. Unearned Services Revenue. The company charges $75 per insect treatment. A customer paid $300 on October 1 in advance for four treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue At year-end, the company has applied three treatments for the customer c. Uneared Rent Revenue. On September 1, a client paid the company $24,000 cash for six months of rent in advance and took occupancy immediately. The company recorded the cash as Unearned Rent Revenue. View transaction lit > The Krug Company collected $6,000 rent in advance on November 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months' rent in advance and occupancy began November 1. debiting 2 The company charges $75 per insect treatment. A customer paid $300 on October 1 in advance for four View transaction list 1 The Krug Company collected $6,000 rent in advance on November 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months' rent in advance and occupancy began November 1. 2 The company charges $75 per insect treatment. A customer paid $300 on October 1 in advance for four treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied three treatments for the customer. 3 On September 1, a client paid the company $24,000 cash for six months of rent in advance and took occupancy immediately. The company recorded the cash as Unearned Rent Revenue. Note : - journal entry has been entered Record entry Clear entry Required information Use the following information for Quick Studies below. (Static) The following information applies to the questions displayed below.) The following is the adjusted trial balance of Sierra Company Credit 4,009 Sierra Company Adjusted Trial Balance December 31 Account Title Debit Cash $ 5,000 Prepaid insurance 509 Notes receivable (due in 5 years) Buildings 20,000 Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) Common stock Retained earnings Dividends 1,000 Consulting revenue Wages expense 3,500 Depreciation expense-Buildings 2.000 Insurance expense 1,569 Totals $37,500 S 12,000 2,500 3,000 6,000 4,500 9,500 $ 37,500 OS 3-31 (Static) Preparing a classified balance sheet LO C2 Use the information in the adjusted trial balance to prepare Sierra Company's classified balance sheet as of December 31 SIERRA COMPANY Balance Sheet December 31 Assets Current assets Cash Prepaid insurance $ 5.000 500 $ 5,500 Total current assets Current assets Buildings Accumulated depreciation--Buildings 20,000 12.000 Notes receivable 5 8,000 4,000 4.000 41,500 Total assets $ Use the information in the adjusted trial balance to prepare Sierra Company Answer is not complete. SIERRA COMPANY Balance Sheet December 31 Assets Current assets Cash $ 5,000 500 Prepaid insurance Total current assets $ 5,500 Current assets x 20,000 X Buildings Accumulated depreciation-Buildings x 12,000 x Notes receivable x $ 8,000 X 4,000 X $ 4,000 41,500 Total assets Required information UURILLU PILUILALUI LULLY ALVUV Notes receivable x $ 8,000 4,000 X 4,000 Total assets $ 41,500 Total equity