a.

b.

b.

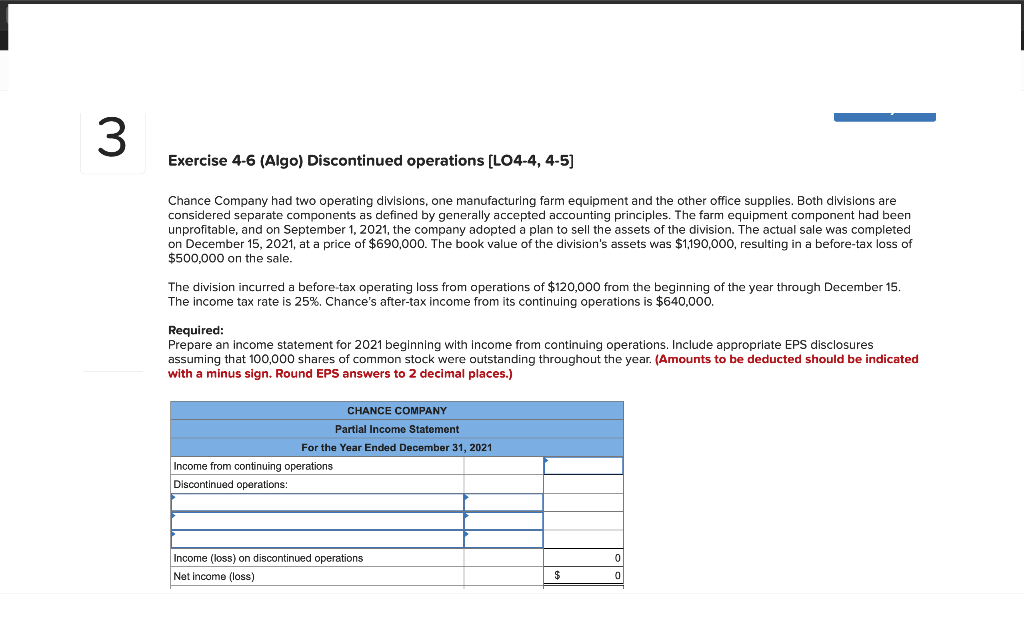

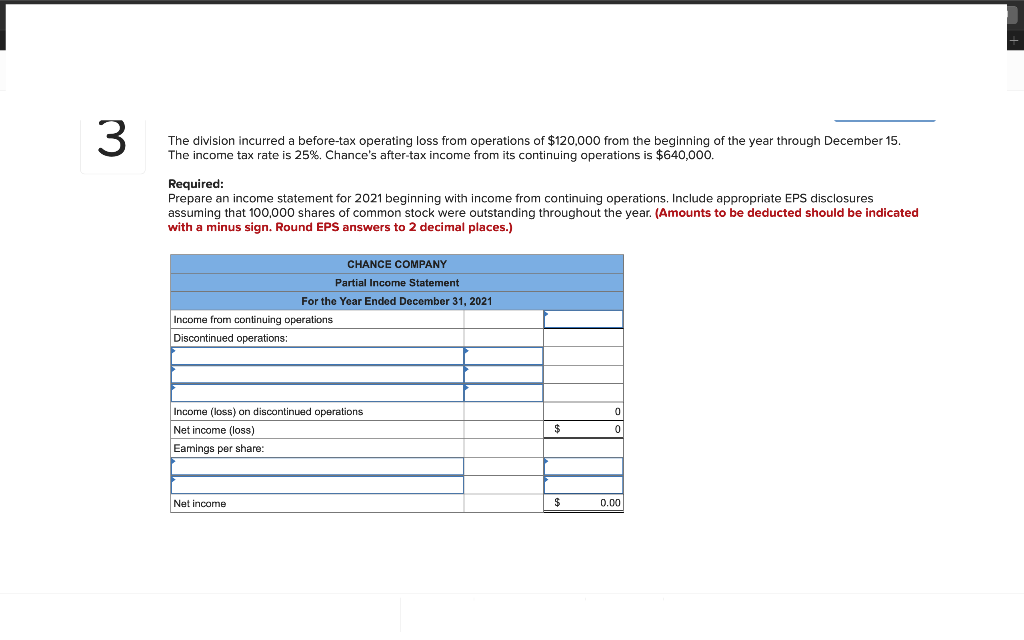

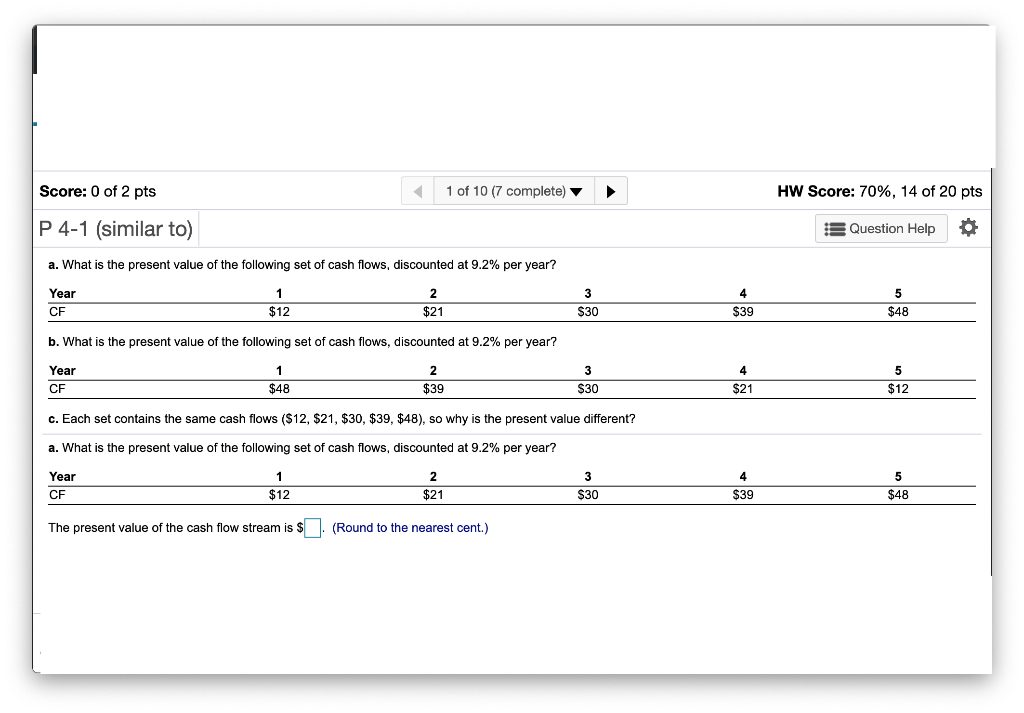

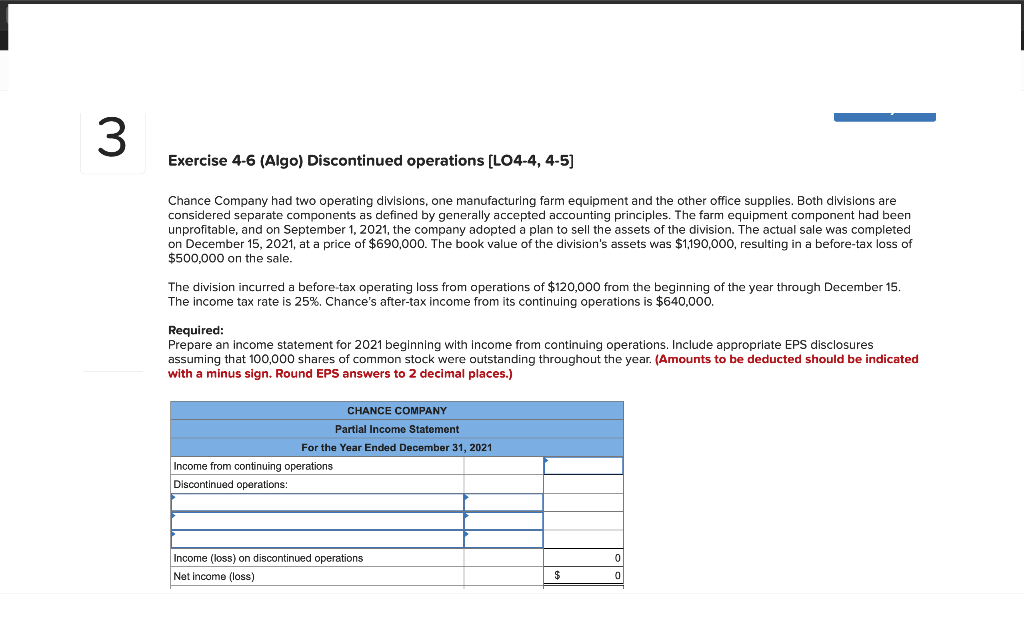

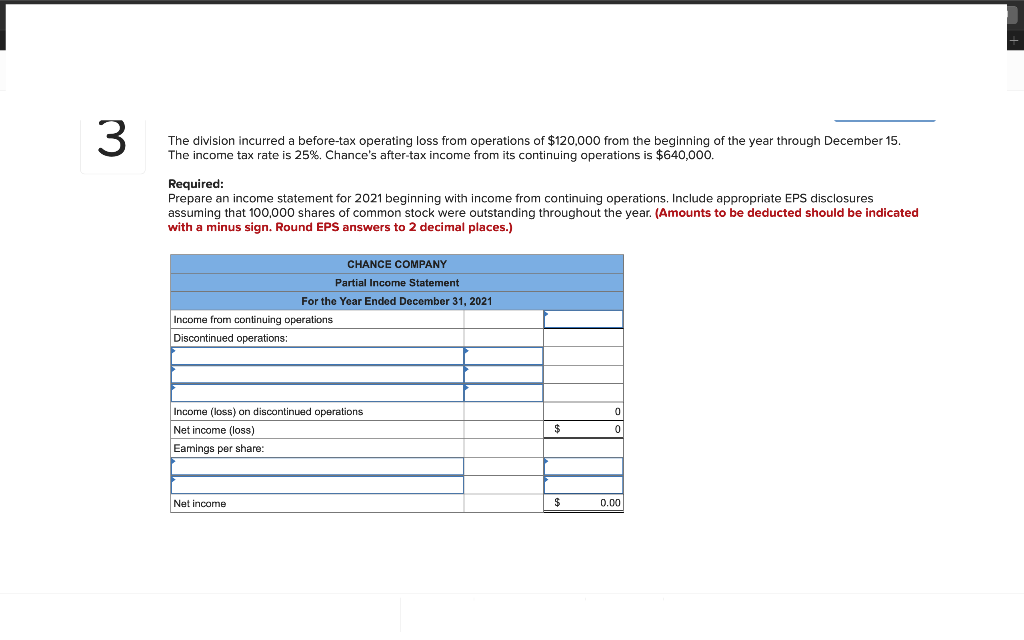

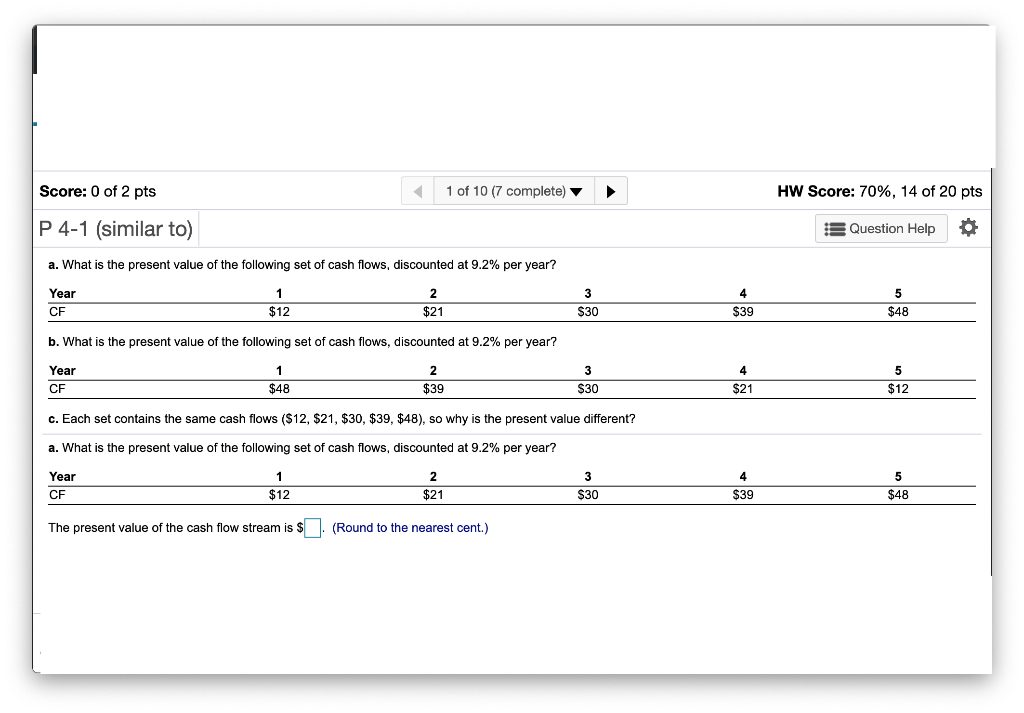

Score: 0 of 2 pts 1 of 10 (7 complete) HW Score: 70%, 14 of 20 pts P 4-1 (similar to) Question Help a. What is the present value of the following set of cash flows, discounted at 9.2% per year? Year CF 1 $12 2 $21 3 $30 4 $39 5 $48 b. What is the present value of the following set of cash flows, discounted at 9.2% per year? Year CF 1 $48 2 $39 3 $30 4 $21 5 $12 c. Each set contains the same cash flows ($12, $21, $30, $39, $48), so why is the present value different? a. What is the present value of the following set of cash flows, discounted at 9.2% per year? Year 4 1 $12 2 $21 3 $30 5 $48 CF $39 The present value of the cash flow stream is $ (Round to the nearest cent.) 3 Exercise 4-6 (Algo) Discontinued operations (L04-4, 4-5) Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2021, the company adopted a plan to sell the assets of the division. The actual sale was completed on December 15, 2021, at a price of $690,000. The book value of the division's assets was $1,190,000, resulting in a before-tax loss of $500,000 on the sale. The division incurred a before-tax operating loss from operations of $120,000 from the beginning of the year through December 15. The income tax rate is 25%. Chance's after-tax income from its continuing operations is $640,000. Required: Prepare an income statement for 2021 beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places.) CHANCE COMPANY Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations Discontinued operations: Income (loss) on discontinued operations Net Income (loss) 0 3 The division incurred a before-tax operating loss from operations of $120,000 from the beginning of the year through December 15. The income tax rate is 25%. Chance's after-tax income from its continuing operations is $640,000. Required: Prepare an income statement for 2021 beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places.) CHANCE COMPANY Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations Discontinued operations: 0 Income (loss) on discontinued operations Net income (loss) Earings per share: Net income $ 0.00

b.

b.