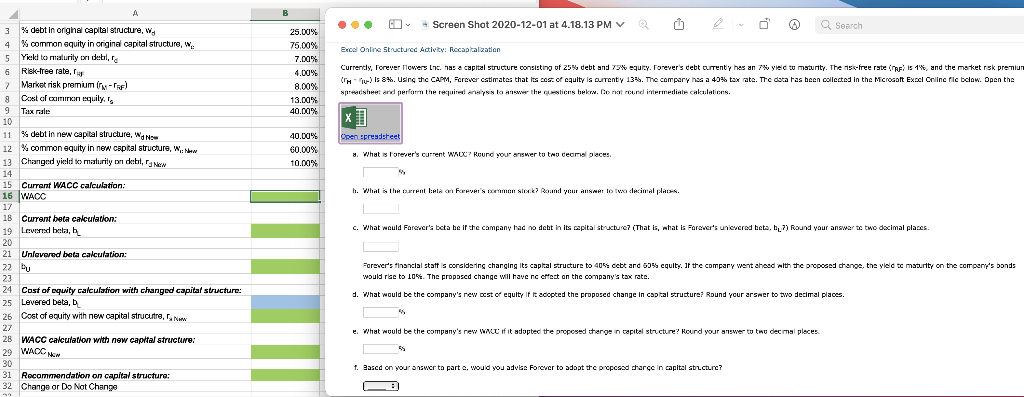

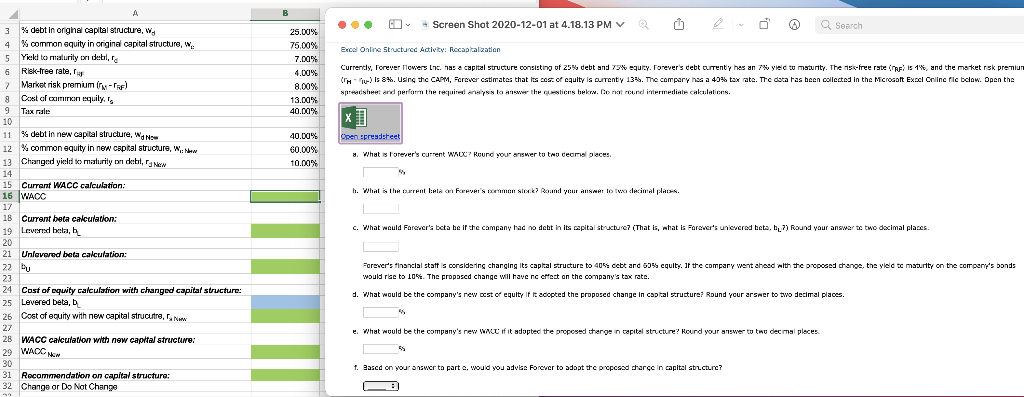

A B Screen Shot 2020-12-01 at 4.18.13 PM V Q Search Excel Online Structured Activity: Rocapitalization 25.00% 75.00% 7.00% 4.00% 8.00% 13.00% 40.00% Currently, Forever Flowers Lic. has a capital structure consisting of 25% debt and 75% equity. Forever's debt cutenty hes an 7 yiec tu maturity. The ns-free rate of is 1%, and the market risk premium CTM -> I: 8%. Using the CAPM, Forever estimates that its cost of cquity is cuitenty 13%. The company has a 40% tax rate. The data has been collected in the Microsoft Excel Online filc below. Open the spreadshester perform the required analysis to answer the Creations beken. De rat reund intermediate cakulations. 40.00% Open spreadsheet 60.00% 10.00% What is Forever's current WAC? Round your answer to two teams places h. What is the rent biela a Forever's mon slock? Round your AnnA lo la decimal ples. 3 % debt in orghal capital structure, w 4 % common equity in original capital structure, w. 5 Yiekl to maturity on debil, o 6 Risk-free rabe, 7 Market risk premium irn-PRF) 8 8 Cast af min equily.is 9 Tax role 10 11 % debt in new capital structure, WHO 12 % common equity in new captal structure, W: ww 13 Changed yield to malurily on debit, New 14 15 Current WACC calculation: 16 WACC 17 18 Current beta calculation: 19 Leverd beta, 20 21 Unlevered beta calculation: 22 Du 23 24 Cost of equity calculation with changed capital structure: 25 Levered beta, 26 Cost of equity with new capital strucutre, Now 27 2B WACC calculation with new capital structure: 29 WAOC NOW 30 31 Recommendation on capital structure: 32 Change or Do Not Change c. What would Farewer's bata be if the company had no debt in its capital structure (That is, what is Forever's univcred bets, 6L 7) Round your answer to two decimal places Farewer's financial staff is considering changing its capital structure to 4055 cebt and 50% cquity. If the company went ahead with the proposed change, the yield to masutty on the company's bonds would rise to 10%. The proposed change will have nc effect on the company's tax rate. d. What would be the company's new ost of equity if it adopted the proposed change in capital structure? Round your arswer to two decimal places. . What would be the company's new w if it adaptec the proposed there in capital structure? Kourd your answer to the decimal places f. Based on your answer ta parte, would you adobe Forever to adopt the proposed starce in capital socture