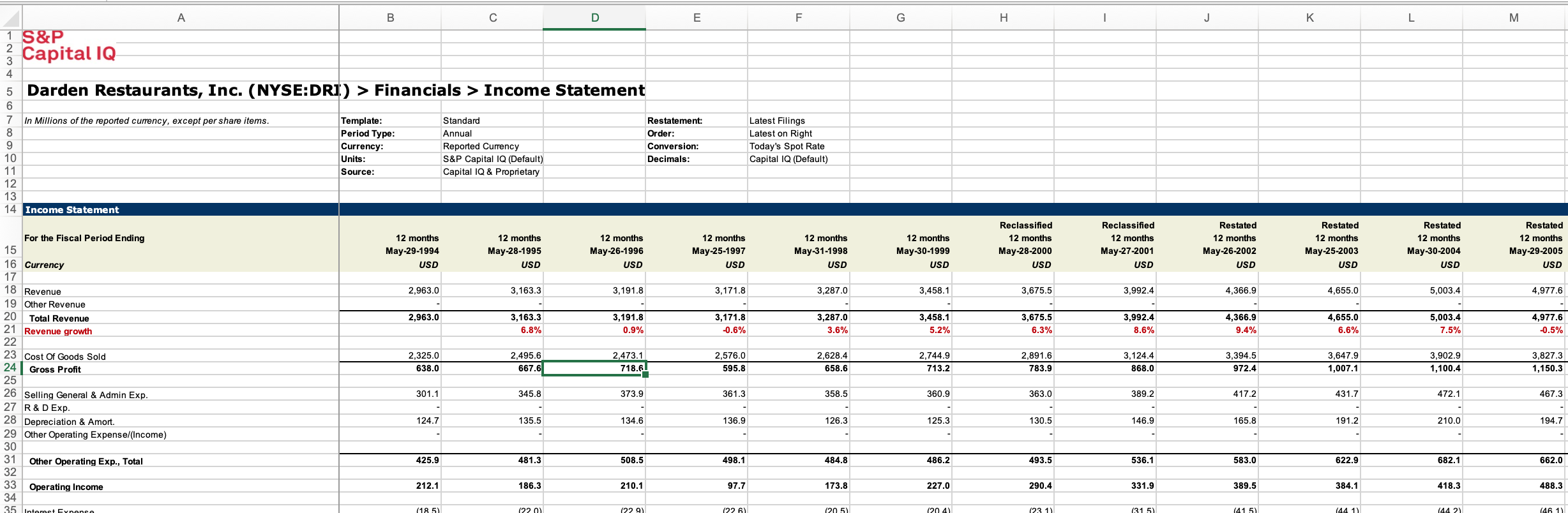

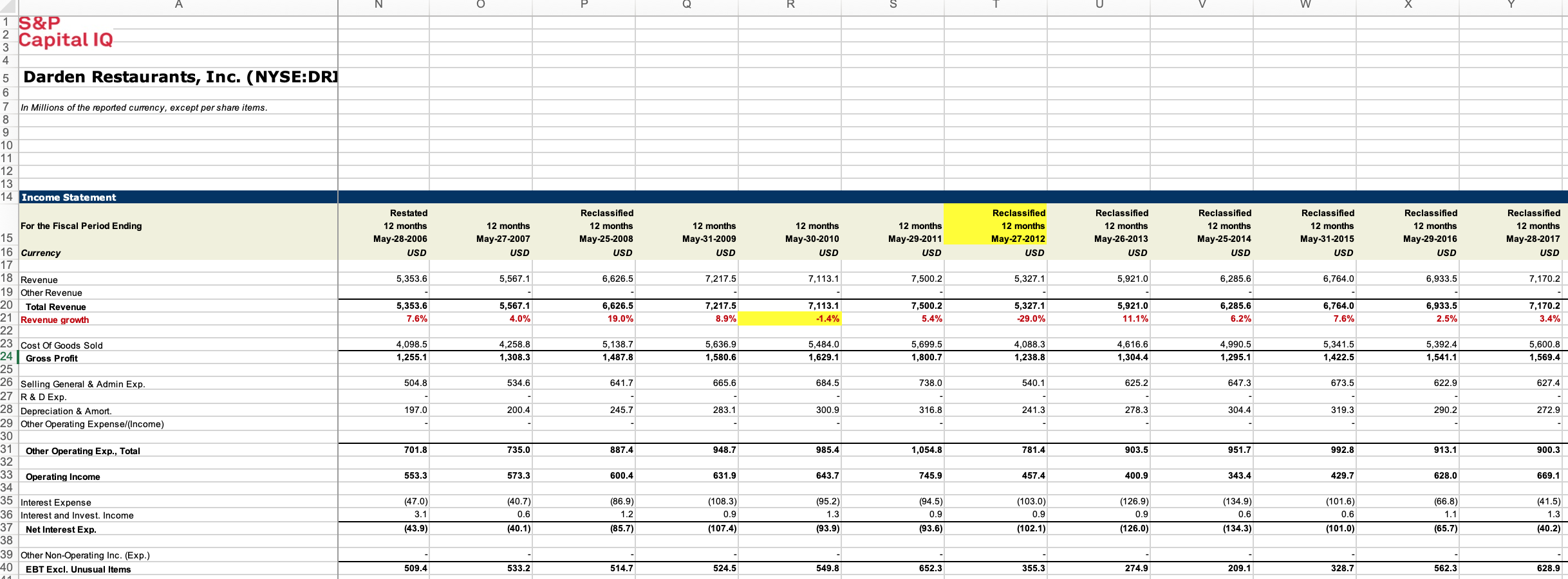

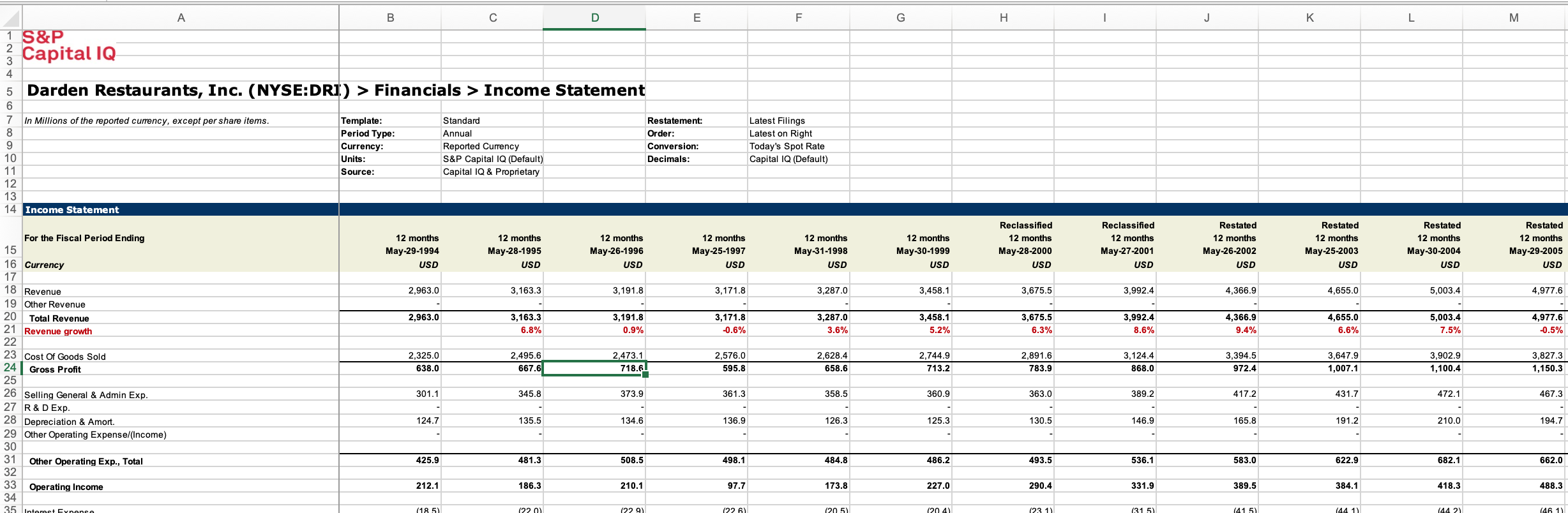

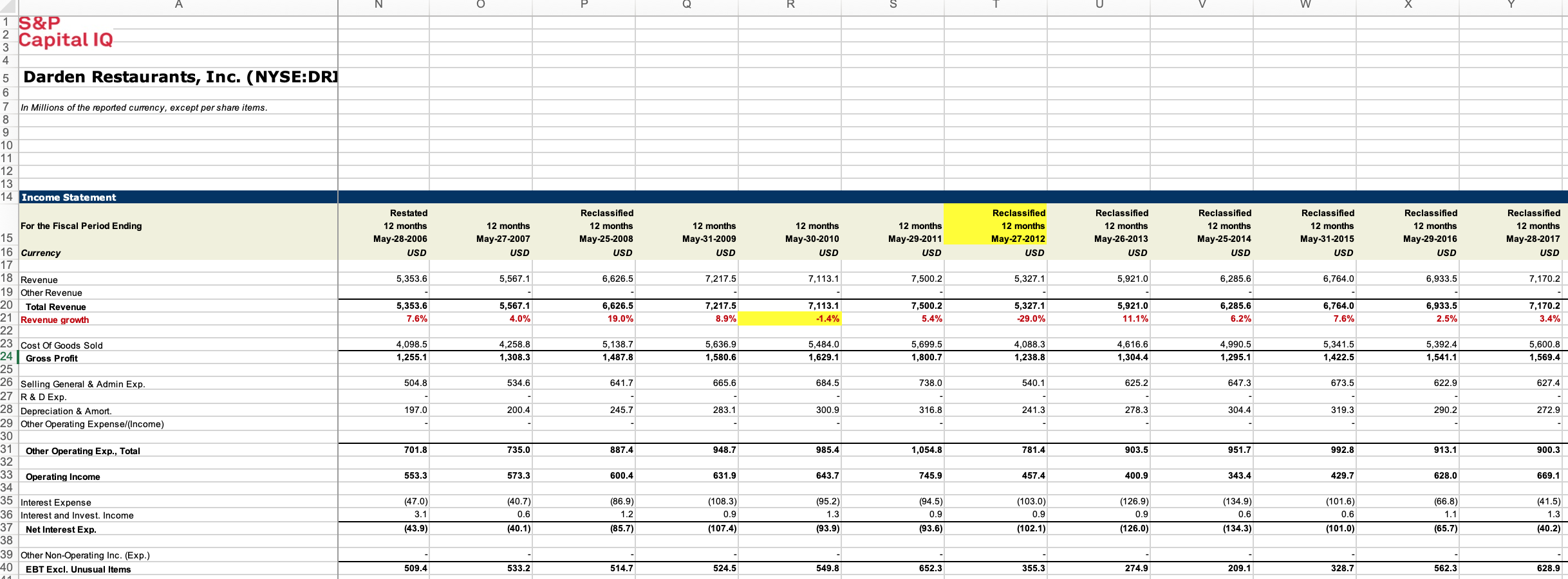

A B S&P C D E F G H I J Capital IQ K L M Darden Restaurants, Inc. (NYSE:DR]) > Financials > Income Statement In Millions of the reported currency, except per share items. Template: Standard Period Type: Annual Restatement: Latest Filings Currency: Order: Latest on Right Conversion: 11 Units: Reported Currency s&P Capital IQ (Default) Decimals: Today's Spot Rate 12 Source : Capital IQ & Proprietary Capital IQ (Default) 13 14 Income Statement For the Fiscal Period Ending 15 12 months May-29-1994 12 months May-28-1995 12 months 12 months 12 months Reclassified 12 months Reclassified Restated 16 Currency May-26-1996 May-25-1997 May-31-1998 12 months May-30-1999 12 months Restated 12 months Restated 12 months Restated 17 USD 12 months USD 12 months USD USD May-28-2000 USD USD May-27-2001 May-26-2002 USD 8 Revenue USD May-25-2003 USD May-30-2004 May-29-2005 USD USD 19 Other Revenue 2,963.0 3,163.3 3, 191.8 USD 3,171.8 3,287.0 20 3,458.1 3,675.5 Total Revenue 3,992.4 4,366.9 2,963.0 4,655.0 5,003.4 Revenue growth 3,163.3 3, 191.8 4,977.6 6.8% 3,171.8 3,287.0 0.9% 3,458.1 -0.6% 3.6% 3,675.5 3,992.4 5.2% 4,366.9 23 Cost Of Goods Sold 6.3% 8.6% 4,655.0 9.4% 5,003.4 6.6% 4,977.6 24 Gross Profit 2,325.0 7.5% 2,495.6 667.6 2,576.0 2,628.4 0.5% 638 .0 2,473.1 25 718.61 595.8 2,744. 658 .6 2,891.6 713.2 3,124.4 783.9 3,394. 868 .0 972.4 3,647.9 3,902.9 26 Selling General & Admin Exp. 1,007.1 3,827.3 27 R & D Exp 301.1 1,100.4 345.8 373.9 1,150.3 361.3 358.5 360.9 363.0 389.2 28 Depreciation & Amort 417.2 124.7 431.7 472.1 135.5 467.3 136.9 126.3 30 29 Other Operating Expense/(Income) 134.6 125.3 130.5 146.9 165.8 191.2 210.0 194.7 31 32 Other Operating Exp., Total 425.9 481.3 508.5 498. 33 484.8 486.2 493.5 536. 583.0 622.9 682.1 34 Operating Income 212.1 186.3 662.0 210.1 97.7 173.8 227.0 290.4 331.9 389.5 384.1 418.3 488.3S&P Capital IQ Darden Restaurants, Inc. (NYSE:DR] In Millions of the reported currency, except per share items Income Statement For the Fiscal Period Ending Restated 12 months Reclassified 12 months 12 months 12 months 12 months Reclassified Reclassified Reclassified 15 12 months 12 months Reclassified 12 months Reclassified 12 months 12 months Reclassified 17 6 Currency May-28-200 May-27-2007 May-25-2008 May-31-2009 USD May-30-2010 USD USD May-29-2011 May-27-2012 May-26-2013 12 months USD May-25-2014 12 months USD USD May-31-2015 USD May-29-2016 USD May-28-2017 18 USD USD Revenue USD USD 19 Other Revenue 5,353. 5,567.1 6,626.5 7,217.5 7,113.1 7,500.2 5,327. 20 5,921.0 5,285.6 6,764.0 Total Revenue 6,933.5 7,170.2 Revenue growth 5,353.6 5,567.1 7.6% 6,626. 4.0% 7,217.5 7,113. 19.0% 7,500. 8.9% 5,327.1 -1.4% 5.4% 5,921.0 -29.0% 6,285.6 6,764.0 11.1% 6.2% 6,933.5 .6% ,170.2 Cost Of Goods Sold 2.5% 3.4% Gross Profit 4,098.5 4,258.8 1,255.1 1,308.3 5,138.7 5,636.9 5,484.0 5,699.5 1,487. 1,580.6 4,088.3 4,616. 25 1,629.1 1,800.7 1,238. 4,990.5 1,304.4 5,341.5 1,295.1 5,392.4 5,600.8 1,422. Selling General & Admin Exp. 1,541.1 1,569.4 R & D Exp 504.8 534.6 641.7 665.6 684.5 738.0 540.1 625.2 $47.3 28 673.5 622.9 Depreciation & Amor 627.4 197.0 29 Other Operating Expense/(Income) 200.4 245.7 283.1 300 .9 316.8 241.3 278.3 304.4 319.3 290.2 272.9 Other Operating Exp., Total 701.8 735.0 887.4 948.7 985.4 1,054.8 781.4 903.5 951.7 992.8 913.1 Operating Income 900.3 553.3 573.3 600.4 631.9 643.7 745.9 457.4 400.9 35 Interest Expense 343.4 429.7 628.0 669.1 Interest and Invest. Income (47.0) 3.1 (40.7) (86.9) 0.6 (108.3) 1.2 (95.2) 0.9 (94.5) (103.0 1.3 0.9 (126.9) 0.9 (134.9) (101.6 (66.8) 38 Net Interest Exp. (43.9 (40.1) (85.7) 0.9 (41.5) (107.4 93.9 (93.6) 0.6 (102.1) 0. 1.1 (126.0 1.3 (134.3 Other Non-Operating Inc. (Exp.) (101.0) (65.7 (40.2) 0 EBT Excl Unusual Items 509.4 533.2 514.7 524.5 549.8 652.3 355.3 274.9 209.1 328.7 562.3 628.9