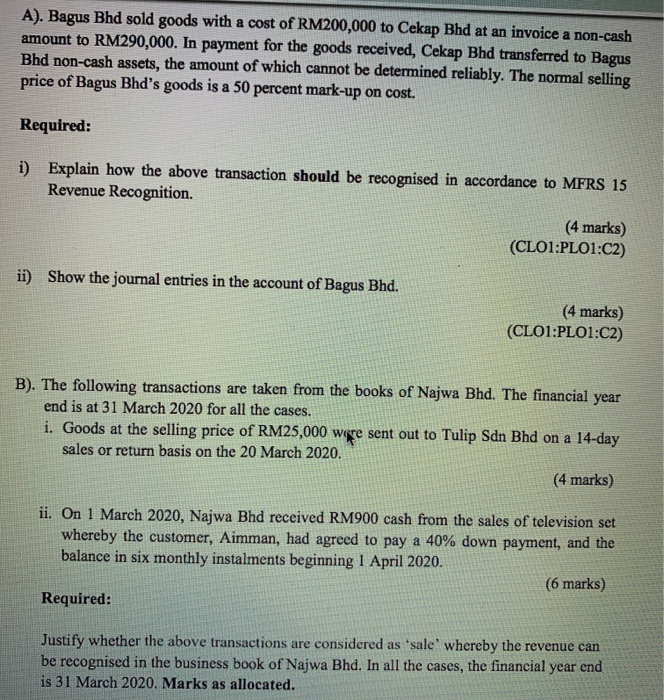

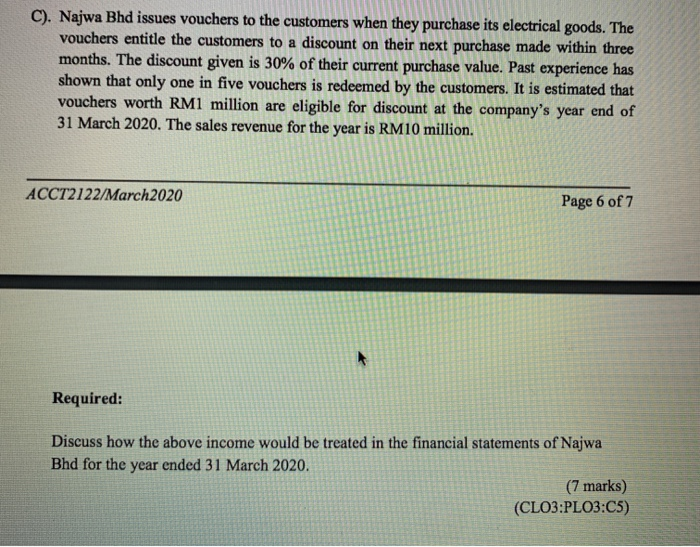

A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice a non-cash amount to RM290,000. In payment for the goods received, Cekap Bhd transferred to Bagus Bhd non-cash assets, the amount of which cannot be determined reliably. The normal selling price of Bagus Bhd's goods is a 50 percent mark-up on cost. Required: i) Explain how the above transaction should be recognised in accordance to MFRS 15 Revenue Recognition. (4 marks) (CLO1:PLO1:C2) ii) Show the journal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii. On 1 March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning 1 April 2020. (6 marks) Required: Justify whether the above transactions are considered as 'sale' whereby the revenue can be recognised in the business book of Najwa Bhd. In all the cases, the financial year end is 31 March 2020. Marks as allocated. C). Najwa Bhd issues vouchers to the customers when they purchase its electrical goods. The vouchers entitle the customers to a discount on their next purchase made within three months. The discount given is 30% of their current purchase value. Past experience has shown that only one in five vouchers is redeemed by the customers. It is estimated that vouchers worth RM1 million are eligible for discount at the company's year end of 31 March 2020. The sales revenue for the year is RM10 million. ACCT2122/March 2020 Page 6 of 7 Required: Discuss how the above income would be treated in the financial statements of Najwa Bhd for the year ended 31 March 2020. (7 marks) (CLO3:PLO3:C5) A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice a non-cash amount to RM290,000. In payment for the goods received, Cekap Bhd transferred to Bagus Bhd non-cash assets, the amount of which cannot be determined reliably. The normal selling price of Bagus Bhd's goods is a 50 percent mark-up on cost. Required: i) Explain how the above transaction should be recognised in accordance to MFRS 15 Revenue Recognition. (4 marks) (CLO1:PLO1:C2) ii) Show the journal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii. On 1 March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning 1 April 2020. (6 marks) Required: Justify whether the above transactions are considered as 'sale' whereby the revenue can be recognised in the business book of Najwa Bhd. In all the cases, the financial year end is 31 March 2020. Marks as allocated. C). Najwa Bhd issues vouchers to the customers when they purchase its electrical goods. The vouchers entitle the customers to a discount on their next purchase made within three months. The discount given is 30% of their current purchase value. Past experience has shown that only one in five vouchers is redeemed by the customers. It is estimated that vouchers worth RM1 million are eligible for discount at the company's year end of 31 March 2020. The sales revenue for the year is RM10 million. ACCT2122/March 2020 Page 6 of 7 Required: Discuss how the above income would be treated in the financial statements of Najwa Bhd for the year ended 31 March 2020. (7 marks) (CLO3:PLO3:C5)