Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bank buys 1,000 European call options on a non-dividend paying stock at a strike of $19. The bank wishes to hedge this exposure.

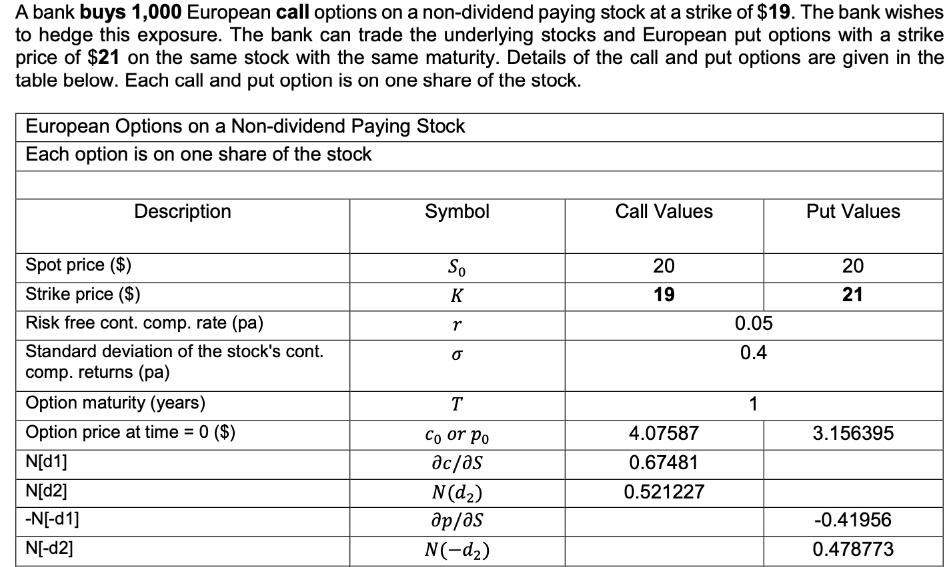

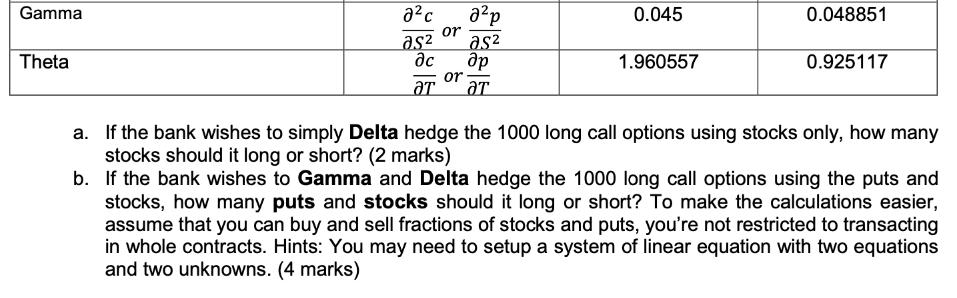

A bank buys 1,000 European call options on a non-dividend paying stock at a strike of $19. The bank wishes to hedge this exposure. The bank can trade the underlying stocks and European put options with a strike price of $21 on the same stock with the same maturity. Details of the call and put options are given in the table below. Each call and put option is on one share of the stock. European Options on a Non-dividend Paying Stock Each option is on one share of the stock Description Spot price ($) Strike price ($) Risk free cont. comp. rate (pa) Standard deviation of the stock's cont. comp. returns (pa) Option maturity (years) Option price at time = 0 ($) N[d1] N[d2] -N[-d1] N[-d2] Symbol Call Values Put Values So 20 20 K 19 21 r 0.05 0.4 T 1 Co or Po 4.07587 3.156395 ac/as 0.67481 N(d2) 0.521227 / -0.41956 N(-d) 0.478773 Gamma Theta ac 0.045 0.048851 or as as 1.960557 0.925117 or a. If the bank wishes to simply Delta hedge the 1000 long call options using stocks only, how many stocks should it long or short? (2 marks) b. If the bank wishes to Gamma and Delta hedge the 1000 long call options using the puts and stocks, how many puts and stocks should it long or short? To make the calculations easier, assume that you can buy and sell fractions of stocks and puts, you're not restricted to transacting in whole contracts. Hints: You may need to setup a system of linear equation with two equations and two unknowns. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To hedge the exposure from the purchase of 1000 European call options the bank can use a combination ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started