Question

A bank entered into a two-year currency swap with semi-annual payments 200 days ago by agreeing to swap $1,000,000 for 800,000. The bank agreed to

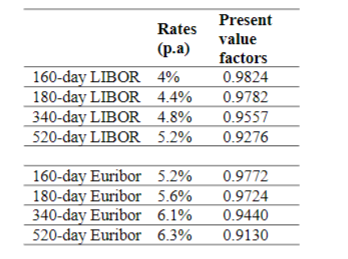

A bank entered into a two-year currency swap with semi-annual payments 200 days ago by agreeing to swap $1,000,000 for 800,000. The bank agreed to pay an annual fixed rate of 5%(with semi-annual compounding) on the 800,000 and receive a floating rate tied to LIBOR on the $1,000,000. Current LIBOR and Euribor rates and present value factors are shown in the following table (LIBOR and Euribor quoted in the table are continuously compounding rates).

The current spot exchange rate is 1USD = 0.91. 180-day LIBOR at the last payment date was 4.2% p.a. (with semi-annual compounding). Assume that the implied forward rates and the theoretical forward exchange rates can be realized. Also assume there are 360 days in a year.

Required:

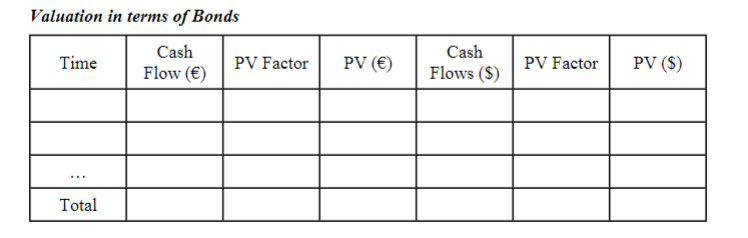

Whats the value of the swap to the bank today? Please calculate the value of the swap to the bank in terms of bonds and in terms of forward contracts.

Note: these two methods may yield slightly different results if you use the 4d.p. discount factors given or if you round any number in the calculation. The discrepancy due to rounding errors can be ignored and will be accepted.

Hint: You may use the following tables to guide your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started