Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bank has assets $10 million, liabilities $8 million, and stockholder's equity $2 million. DA=10.5 and DL=5.5. The bank wishes to hedge the balance sheet

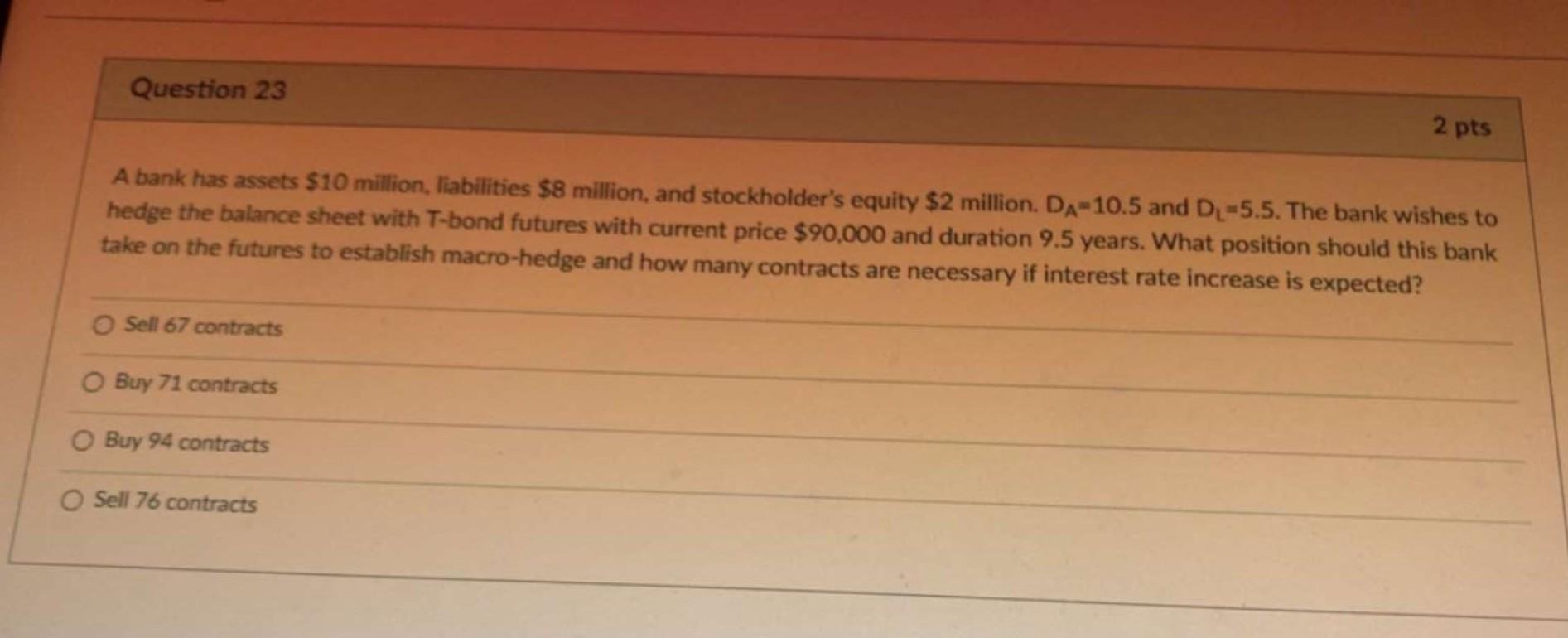

A bank has assets $10 million, liabilities $8 million, and stockholder's equity $2 million. DA=10.5 and DL=5.5. The bank wishes to hedge the balance sheet with T-bond futures with current price $90,000 and duration 9.5 years. What position should this bank take on the futures to establish macro-hedge and how many contracts are necessary if interest rate increase is expected? Sell 67 contracts Buy 71 contracts Buy 94 contracts Sell 76 contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started