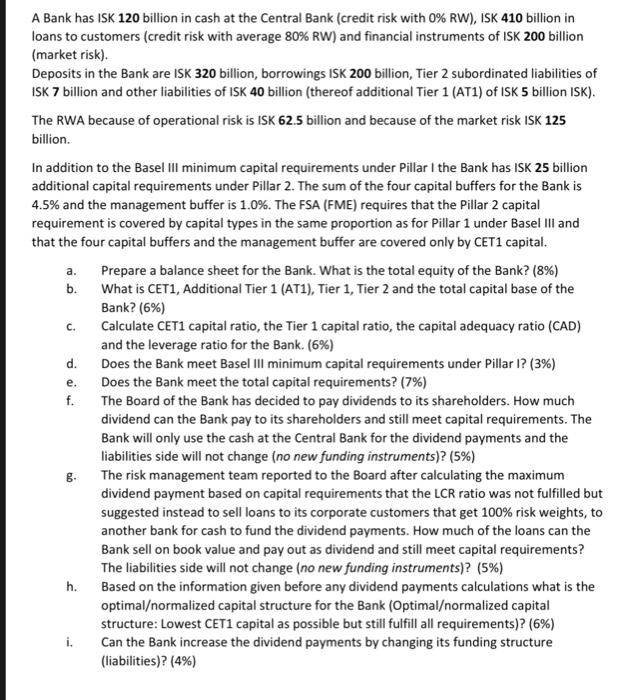

A Bank has ISK 120 billion in cash at the Central Bank (credit risk with 0% RW), ISK 410 billion in loans to customers (credit risk with average 80% RW) and financial instruments of ISK 200 billion (market risk) Deposits in the Bank are ISK 320 billion, borrowings ISK 200 billion, Tier 2 subordinated liabilities of ISK 7 billion and other liabilities of ISK 40 billion (thereof additional Tier 1 (AT1) of ISK 5 billion ISK). The RWA because of operational risk is ISK 62.5 billion and because of the market risk ISK 125 billion. In addition to the Basel IIl minimum capital requirements under Pillar I the Bank has ISK 25 billion additional capital requirements under Pillar 2. The sum of the four capital buffers for the Bank is 4.5% and the management buffer is 1.096. The FSA (FME) requires that the Pillar 2 capital requirement is covered by capital types in the same proportion as for Pillar 1 under Basel II and that the four capital buffers and the management buffer are covered only by CET1 capital a. Prepare a balance sheet for the Bank, what is the total equity of the Bank? (896) b What is CET1, Additional Tier 1 (AT1), Tier 1, Tier 2 and the total capital base of the Bank? (696) Calculate CET1 capital ratio, the Tier 1 capital ratio, the capital adequacy ratio (CAD) and the leverage ratio for the Bank. (6%) Does the Bank meet Basel II minimum capital requirements under Pillar I? (396) Does the Bank meet the total capital requirements? (796) The Board of the Bank has decided to pay dividends to its shareholders. How much dividend can the Bank pay to its shareholders and still meet capital requirements. The Bank will only use the cash at the Central Bank for the dividend payments and the liabilities side will not change (no new funding instruments)? (5%) The risk management team reported to the Board after calculating the maximum dividend paym suggested instead to sell loans to its corporate customers that get 100% risk weights, to another bank for cash to fund the dividend payments. How much of the loans can the Bank sell on book value and pay out as dividend and still meet capital requirements? The liabilities side will not change (no new funding instruments)? (5%) Based on the information given before any dividend payments calculations what is the optimalormalized capital structure for the Bank (Optimalormalized capital structure: Lowest CETI capital as possible but still fulfill all requirements)? (6%) Can the Bank increase the dividend payments by changing its funding structure (liabilities)? (496) c. d. e. f. g. ent based on capital requirements that the LCR ratio was not fulfilled but h. i. A Bank has ISK 120 billion in cash at the Central Bank (credit risk with 0% RW), ISK 410 billion in loans to customers (credit risk with average 80% RW) and financial instruments of ISK 200 billion (market risk) Deposits in the Bank are ISK 320 billion, borrowings ISK 200 billion, Tier 2 subordinated liabilities of ISK 7 billion and other liabilities of ISK 40 billion (thereof additional Tier 1 (AT1) of ISK 5 billion ISK). The RWA because of operational risk is ISK 62.5 billion and because of the market risk ISK 125 billion. In addition to the Basel IIl minimum capital requirements under Pillar I the Bank has ISK 25 billion additional capital requirements under Pillar 2. The sum of the four capital buffers for the Bank is 4.5% and the management buffer is 1.096. The FSA (FME) requires that the Pillar 2 capital requirement is covered by capital types in the same proportion as for Pillar 1 under Basel II and that the four capital buffers and the management buffer are covered only by CET1 capital a. Prepare a balance sheet for the Bank, what is the total equity of the Bank? (896) b What is CET1, Additional Tier 1 (AT1), Tier 1, Tier 2 and the total capital base of the Bank? (696) Calculate CET1 capital ratio, the Tier 1 capital ratio, the capital adequacy ratio (CAD) and the leverage ratio for the Bank. (6%) Does the Bank meet Basel II minimum capital requirements under Pillar I? (396) Does the Bank meet the total capital requirements? (796) The Board of the Bank has decided to pay dividends to its shareholders. How much dividend can the Bank pay to its shareholders and still meet capital requirements. The Bank will only use the cash at the Central Bank for the dividend payments and the liabilities side will not change (no new funding instruments)? (5%) The risk management team reported to the Board after calculating the maximum dividend paym suggested instead to sell loans to its corporate customers that get 100% risk weights, to another bank for cash to fund the dividend payments. How much of the loans can the Bank sell on book value and pay out as dividend and still meet capital requirements? The liabilities side will not change (no new funding instruments)? (5%) Based on the information given before any dividend payments calculations what is the optimalormalized capital structure for the Bank (Optimalormalized capital structure: Lowest CETI capital as possible but still fulfill all requirements)? (6%) Can the Bank increase the dividend payments by changing its funding structure (liabilities)? (496) c. d. e. f. g. ent based on capital requirements that the LCR ratio was not fulfilled but h