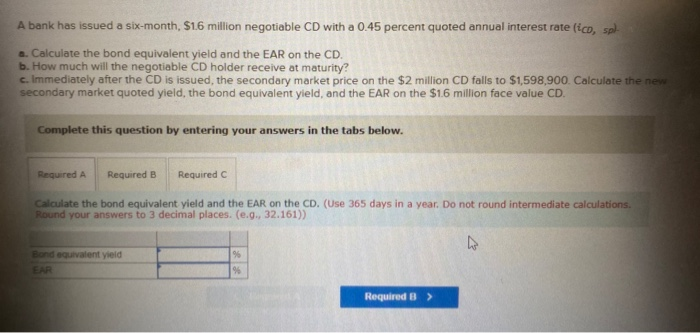

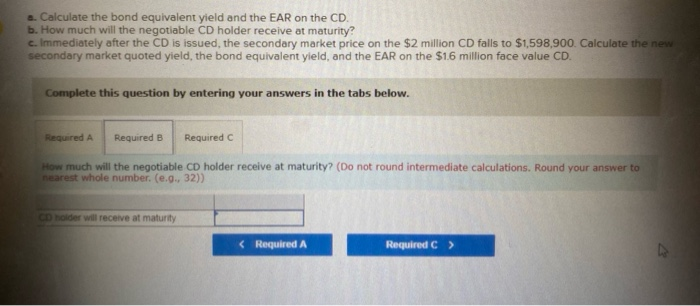

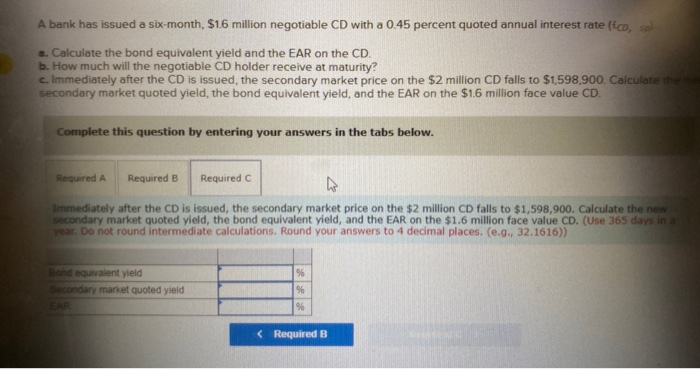

A bank has issued a six-month, $1.6 million negotiable CD with a 0.45 percent quoted annual interest rate (ico, spl a. Calculate the bond equivalent yield and the EAR on the CD. b. How much will the negotiable CD holder receive at maturity? c. Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1,598,900. Calculate the new secondary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the bond equivalent yield and the EAR on the CD. (Use 365 days in a year. Do not round intermediate calculations Round your answers to 3 decimal places. (e.g., 32.161)) d equivalent yield EAR Required B > a. Calculate the bond equivalent yield and the EAR on the CD. b. How much will the negotiable CD holder receive at maturity? Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1,598,900. Calculate the new secondary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. Complete this question by entering your answers in the tabs below. Required A Required B Required How much will the negotiable CD holder receive at maturity? (Do not round intermediate calculations. Round your answer to nearest whole number. (e.g., 32)) Dholder will receive at maturity A bank has issued a six-month, $1.6 million negotiable CD with a 0.45 percent quoted annual interest rate ico, spl a. Calculate the bond equivalent yield and the EAR on the CD b. How much will the negotiable CD holder receive at maturity? c. Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1.598.900. Calculate secondary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. Complete this question by entering your answers in the tabs below. Required A Required B Required Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1,598,900. Calculate the new econdary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. (Use 365 days in ear. Do not round intermediate calculations. Round your answers to 4 decimal places. (e.g., 32.1616)) Bond equivalent yield condary market quoted yield a. Calculate the bond equivalent yield and the EAR on the CD. b. How much will the negotiable CD holder receive at maturity? Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1,598,900. Calculate the new secondary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. Complete this question by entering your answers in the tabs below. Required A Required B Required How much will the negotiable CD holder receive at maturity? (Do not round intermediate calculations. Round your answer to nearest whole number. (e.g., 32)) Dholder will receive at maturity A bank has issued a six-month, $1.6 million negotiable CD with a 0.45 percent quoted annual interest rate ico, spl a. Calculate the bond equivalent yield and the EAR on the CD b. How much will the negotiable CD holder receive at maturity? c. Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1.598.900. Calculate secondary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. Complete this question by entering your answers in the tabs below. Required A Required B Required Immediately after the CD is issued, the secondary market price on the $2 million CD falls to $1,598,900. Calculate the new econdary market quoted yield, the bond equivalent yield, and the EAR on the $1.6 million face value CD. (Use 365 days in ear. Do not round intermediate calculations. Round your answers to 4 decimal places. (e.g., 32.1616)) Bond equivalent yield condary market quoted yield