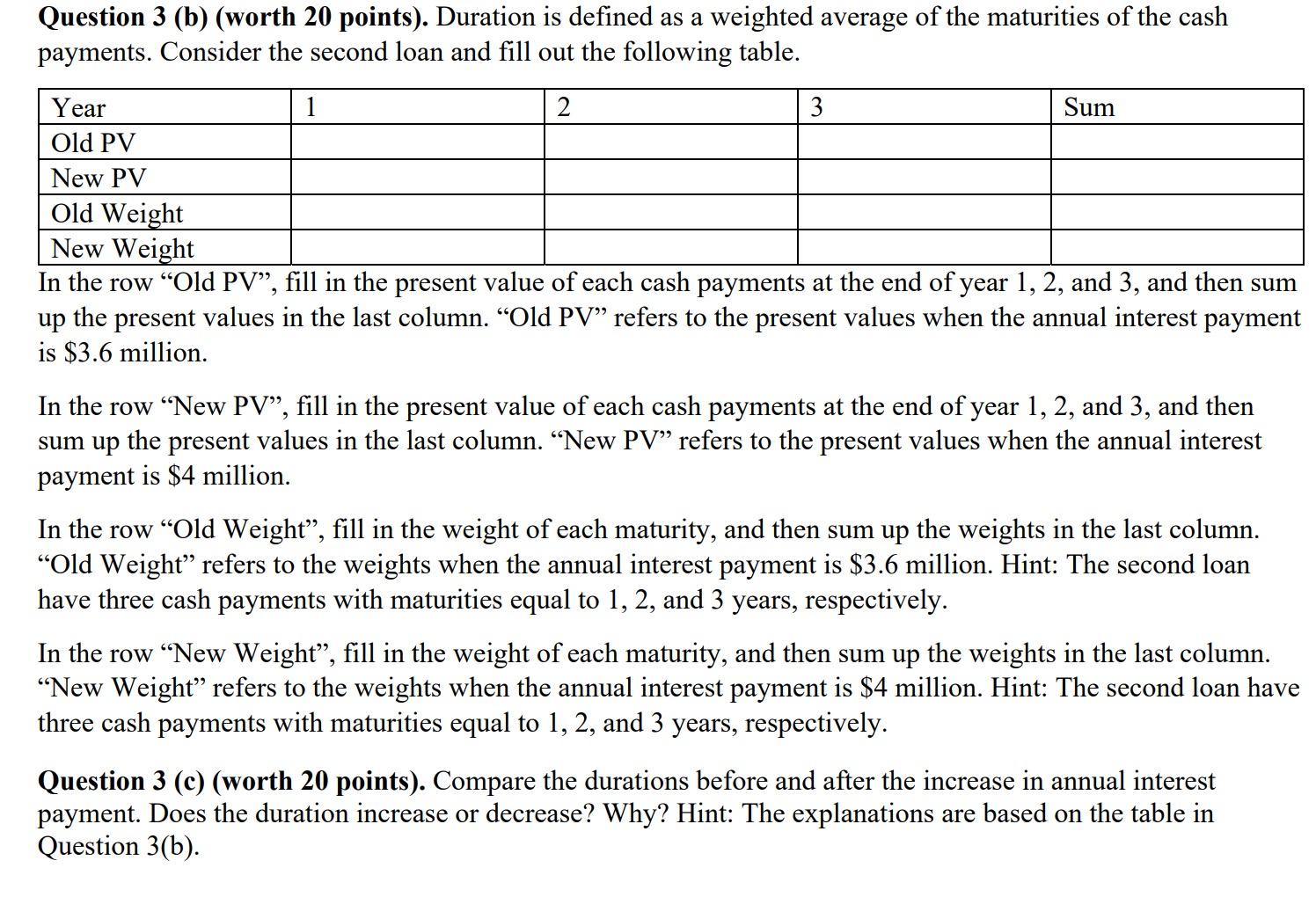

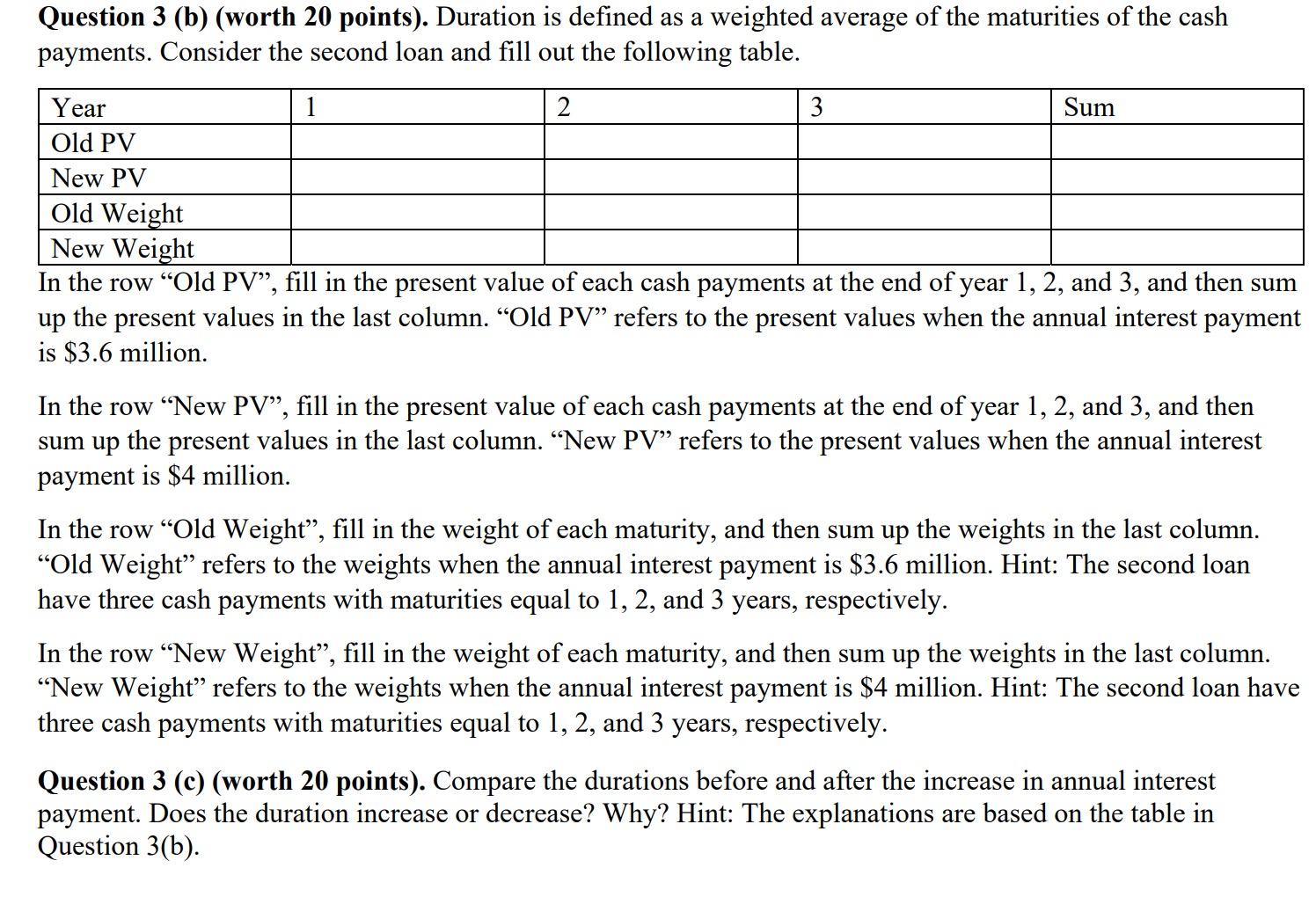

A bank has two, 3-year commercial loans. The first is a loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second loan requires an annual interest payment of $3.6 million. The principal of the second loan of $40 million is due in 3 years. The interest rate is 8%. Round your intermediate steps and your final answers to 0.0000. (e.g., round 0.45674 to 0.4567) Question 3 (b) (worth 20 points). Duration is defined as a weighted average of the maturities of the cash payments. Consider the second loan and fill out the following table. Year 1 2 3 Sum Old PV New PV Old Weight New Weight In the row Old PV, fill in the present value of each cash payments at the end of year 1, 2, and 3, and then sum up the present values in the last column. Old PV refers to the present values when the annual interest payment is $3.6 million. In the row New PV, fill in the present value of each cash payments at the end of year 1, 2, and 3, and then sum up the present values in the last column. New PV refers to the present values when the annual interest payment is $4 million. In the row Old Weight, fill in the weight of each maturity, and then sum up the weights in the last column. Old Weight refers to the weights when the annual interest payment is $3.6 million. Hint: The second loan have three cash payments with maturities equal to 1, 2, and 3 years, respectively. In the row New Weight, fill in the weight of each maturity, and then sum up the weights in the last column. New Weight refers to the weights when the annual interest payment is $4 million. Hint: The second loan have three cash payments with maturities equal to 1, 2, and 3 years, respectively. Question 3 (c) (worth 20 points). Compare the durations before and after the increase in annual interest payment. Does the duration increase or decrease? Why? Hint: The explanations are based on the table in Question 3(b). A bank has two, 3-year commercial loans. The first is a loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second loan requires an annual interest payment of $3.6 million. The principal of the second loan of $40 million is due in 3 years. The interest rate is 8%. Round your intermediate steps and your final answers to 0.0000. (e.g., round 0.45674 to 0.4567) Question 3 (b) (worth 20 points). Duration is defined as a weighted average of the maturities of the cash payments. Consider the second loan and fill out the following table. Year 1 2 3 Sum Old PV New PV Old Weight New Weight In the row Old PV, fill in the present value of each cash payments at the end of year 1, 2, and 3, and then sum up the present values in the last column. Old PV refers to the present values when the annual interest payment is $3.6 million. In the row New PV, fill in the present value of each cash payments at the end of year 1, 2, and 3, and then sum up the present values in the last column. New PV refers to the present values when the annual interest payment is $4 million. In the row Old Weight, fill in the weight of each maturity, and then sum up the weights in the last column. Old Weight refers to the weights when the annual interest payment is $3.6 million. Hint: The second loan have three cash payments with maturities equal to 1, 2, and 3 years, respectively. In the row New Weight, fill in the weight of each maturity, and then sum up the weights in the last column. New Weight refers to the weights when the annual interest payment is $4 million. Hint: The second loan have three cash payments with maturities equal to 1, 2, and 3 years, respectively. Question 3 (c) (worth 20 points). Compare the durations before and after the increase in annual interest payment. Does the duration increase or decrease? Why? Hint: The explanations are based on the table in Question 3(b)