Answered step by step

Verified Expert Solution

Question

1 Approved Answer

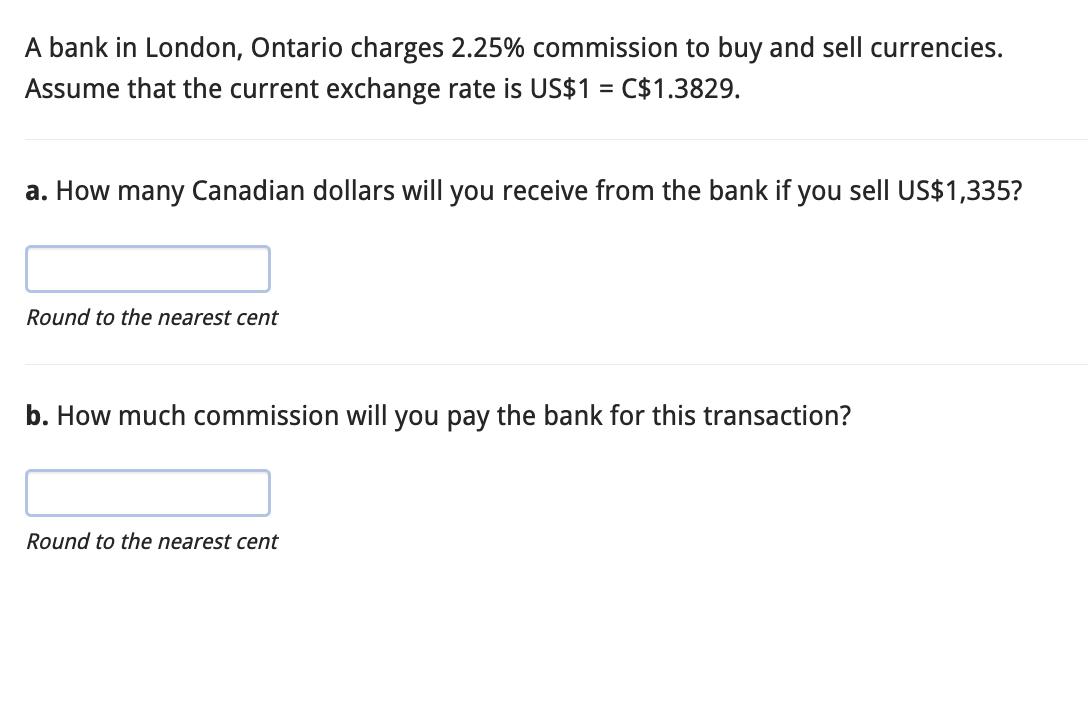

A bank in London, Ontario charges 2.25% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3829. a.

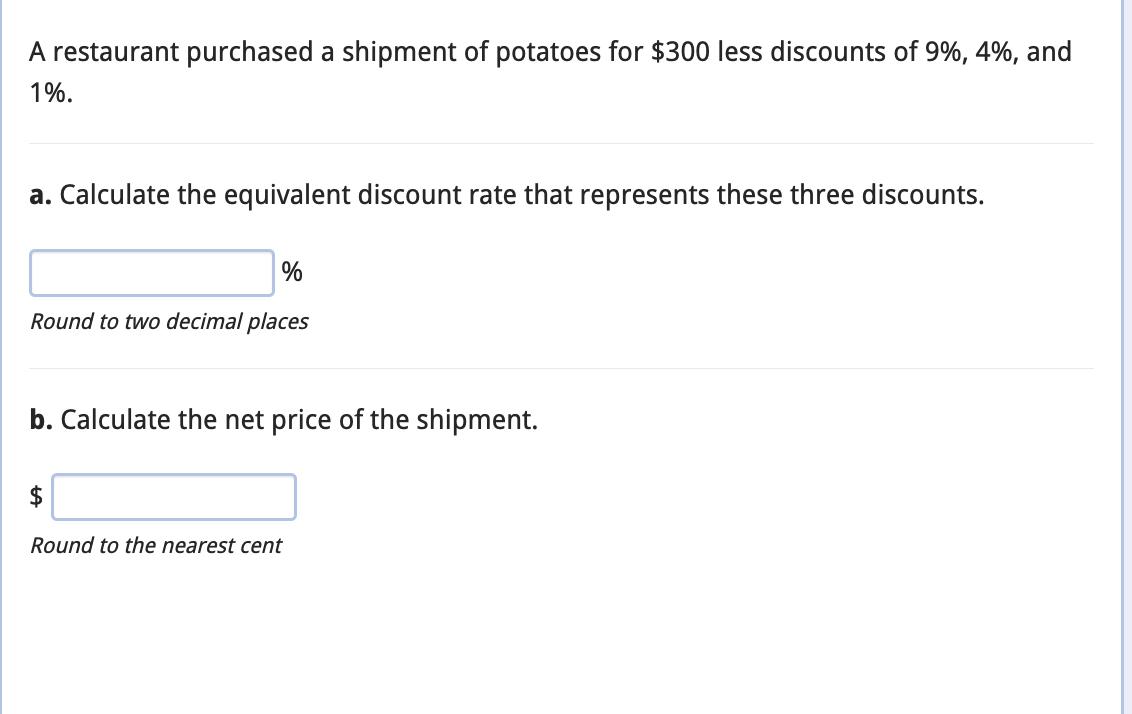

A bank in London, Ontario charges 2.25% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3829. a. How many Canadian dollars will you receive from the bank if you sell US$1,335? Round to the nearest cent b. How much commission will you pay the bank for this transaction? Round to the nearest cent A restaurant purchased a shipment of potatoes for $300 less discounts of 9%, 4%, and 1%. a. Calculate the equivalent discount rate that represents these three discounts. % Round to two decimal places b. Calculate the net price of the shipment. $ Round to the nearest cent Maroon Company received an invoice for $164,000 dated November 4, 2011 with payment terms 6/3, 4/20, n/45 for a truck-load of goods. Calculate the amount required to settle the invoice on the following dates. a. November 6, 2011 Round to the nearest cent b. November 24, 2011 Round to the nearest cent c. December 19, 2011 Round to the nearest cent

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q a Amount in Canadian dollars 1335US dollars 13829184851 184851 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started