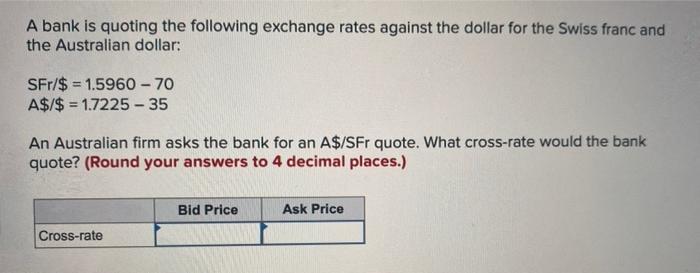

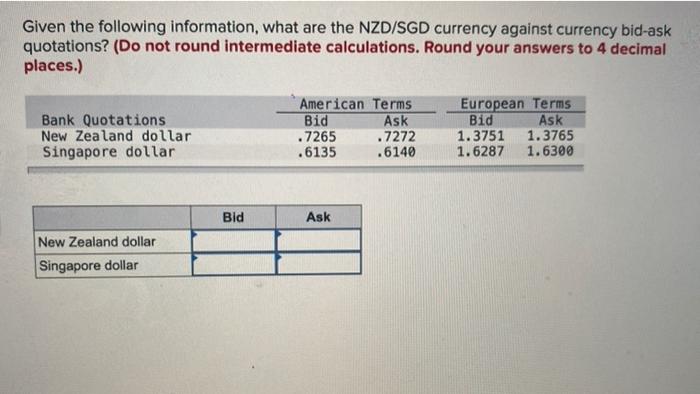

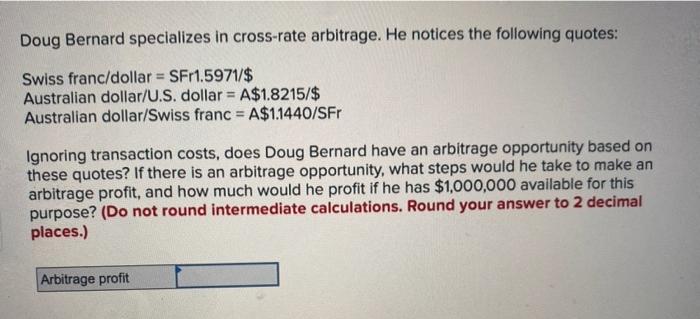

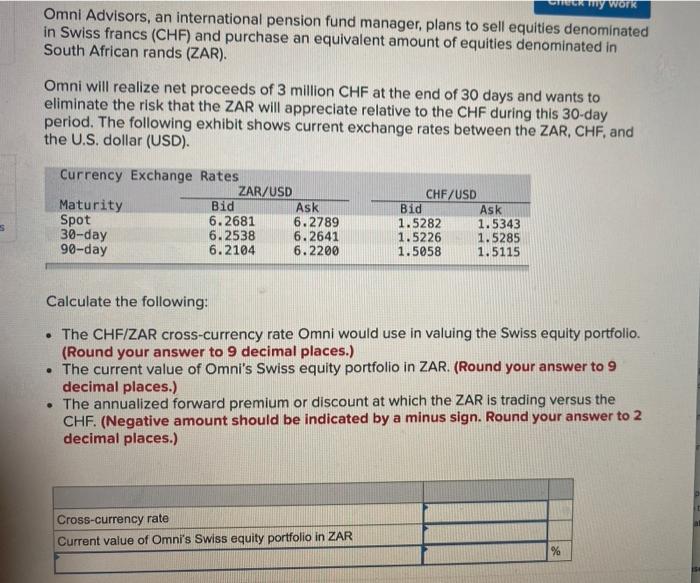

A bank is quoting the following exchange rates against the dollar for the Swiss franc and the Australian dollar: SFr/$ = 1.5960 - 70 A$1$ = 1.7225 - 35 An Australian firm asks the bank for an A$/SFr quote. What cross-rate would the bank quote? (Round your answers to 4 decimal places.) Bid Price Ask Price Cross-rate Given the following information, what are the NZD/SGD currency against currency bid-ask quotations? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Bank Quotations New Zealand dollar Singapore dollar American Terms Bid Ask .7265 .7272 .6135 .6140 European Terms Bid Ask 1.3751 1.3765 1.6287 1.6300 Bid Ask New Zealand dollar Singapore dollar Doug Bernard specializes in cross-rate arbitrage. He notices the following quotes: Swiss franc/dollar =SFr1.5971/$ Australian dollar/U.S. dollar = A$1.8215/$ Australian dollar/Swiss franc = A$1.1440/SFr Ignoring transaction costs, does Doug Bernard have an arbitrage opportunity based on these quotes? If there is an arbitrage opportunity, what steps would he take to make an arbitrage profit, and how much would he profit if he has $1,000,000 available for this purpose? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Arbitrage profit my wor Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss francs (CHF) and purchase an equivalent amount of equities denominated in South African rands (ZAR). Omni will realize net proceeds of 3 million CHF at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. The following exhibit shows current exchange rates between the ZAR, CHF, and the U.S. dollar (USD). Currency Exchange Rates ZAR/USD Maturity Bid Ask Spot 6.2681 6.2789 30-day 6.2538 6.2641 90-day 6.2104 6.2200 S CHF/USD Bid Ask 1.5282 1.5343 1.5226 1.5285 1.5058 1.5115 Calculate the following: . The CHF/ZAR cross-currency rate Omni would use in valuing the Swiss equity portfolio. (Round your answer to 9 decimal places.) The current value of Omni's Swiss equity portfolio in ZAR. (Round your answer to 9 decimal places.) The annualized forward premium or discount at which the ZAR is trading versus the CHF. (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Cross-currency rate Current value of Omni's Swiss equity portfolio in ZAR %