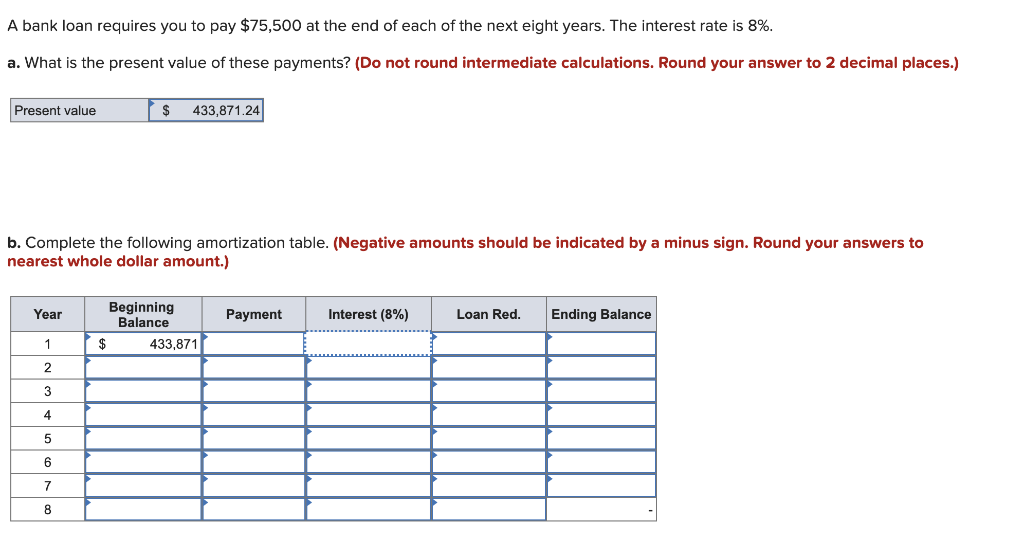

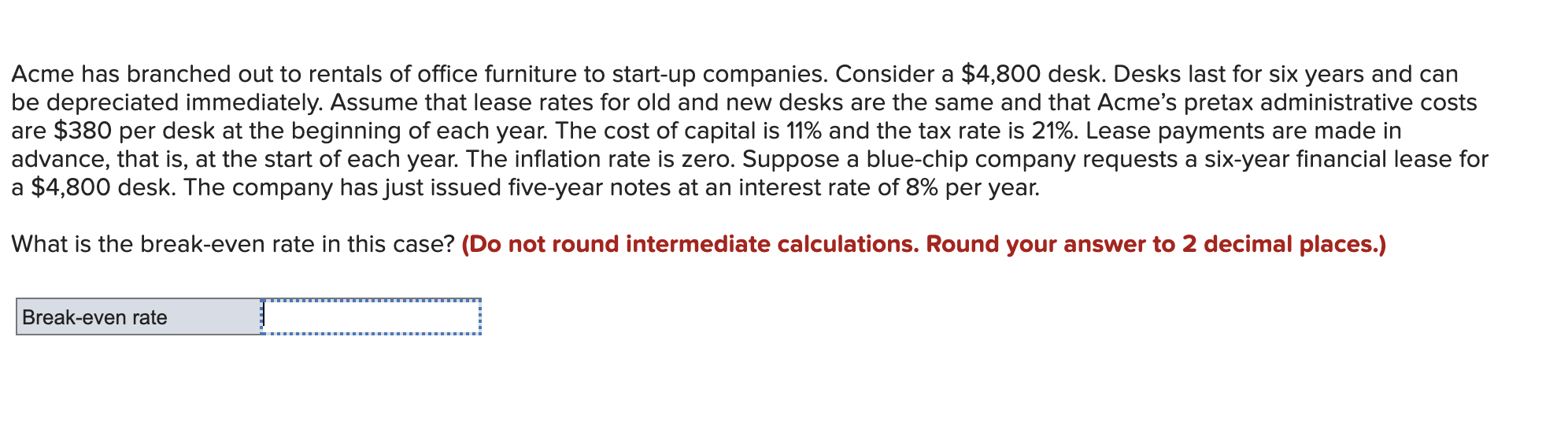

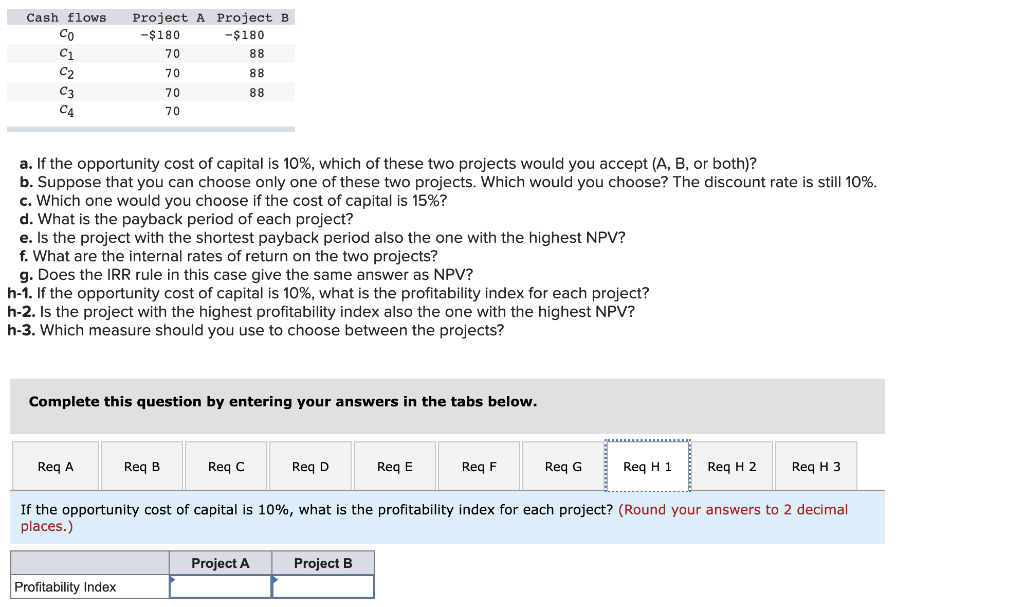

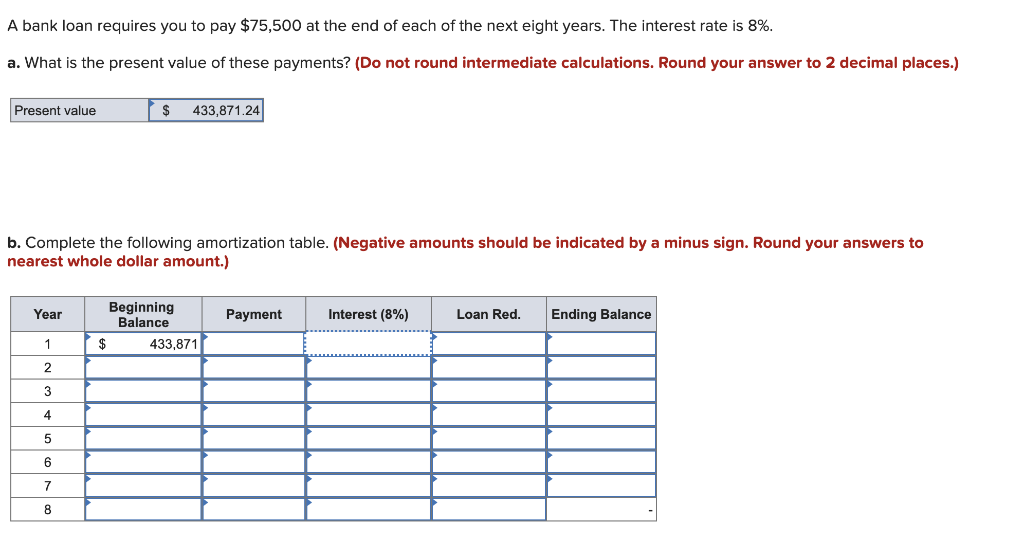

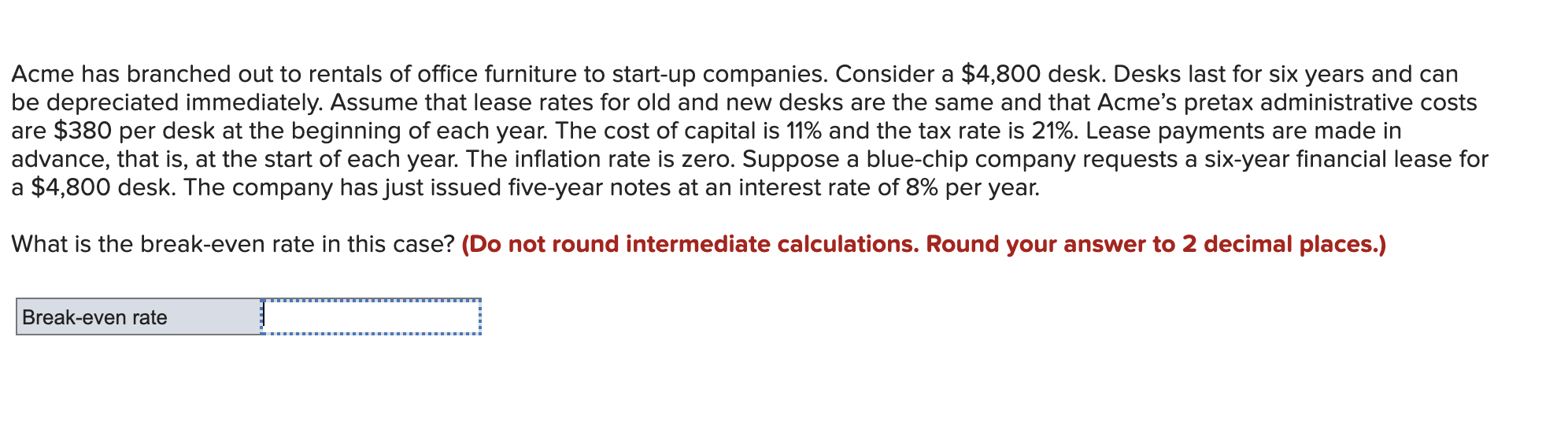

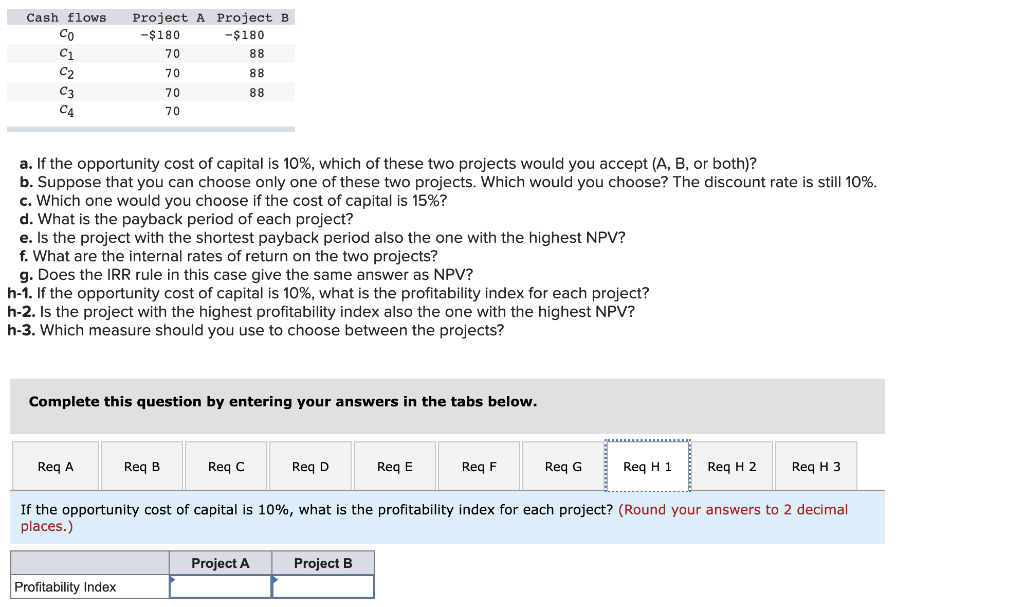

A bank loan requires you to pay $75,500 at the end of each of the next eight years. The interest rate is 8%. a. What is the present value of these payments? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value $ 433,871.24 b. Complete the following amortization table. (Negative amounts should be indicated by a minus sign. Round your answers to nearest whole dollar amount.) Year Payment Interest (8%) Loan Red. Ending Balance Beginning Balance $ 433,871 1 2 3 4 5 7 8 Acme has branched out to rentals of office furniture to start-up companies. Consider a $4,800 desk. Desks last for six years and can be depreciated immediately. Assume that lease rates for old and new desks are the same and that Acme's pretax administrative costs are $380 per desk at the beginning of each year. The cost of capital is 11% and the tax rate is 21%. Lease payments are made in advance, that is, at the start of each year. The inflation rate is zero. Suppose a blue-chip company requests a six-year financial lease for a $4,800 desk. The company has just issued five-year notes at an interest rate of 8% per year. What is the break-even rate in this case? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Break-even rate Cash flows C1 C2 C3 C4 Project A Project B -$180 -$180 70 88 70 88 70 88 70 a. If the opportunity cost of capital is 10%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 10%. c. Which one would you choose if the cost of capital is 15%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h-1. If the opportunity cost of capital is 10%, what is the profitability index for each project? h-2. Is the project with the highest profitability index also the one with the highest NPV? h-3. Which measure should you use to choose between the projects? Complete this question by entering your answers in the tabs below. Req A Req B Reg C Reg D Req E Req F Req G Req H1 ReqH2 Reg H 3 If the opportunity cost of capital is 10%, what is the profitability index for each project? (Round your answers to 2 decimal places.) Project A Project B Profitability Index