Question

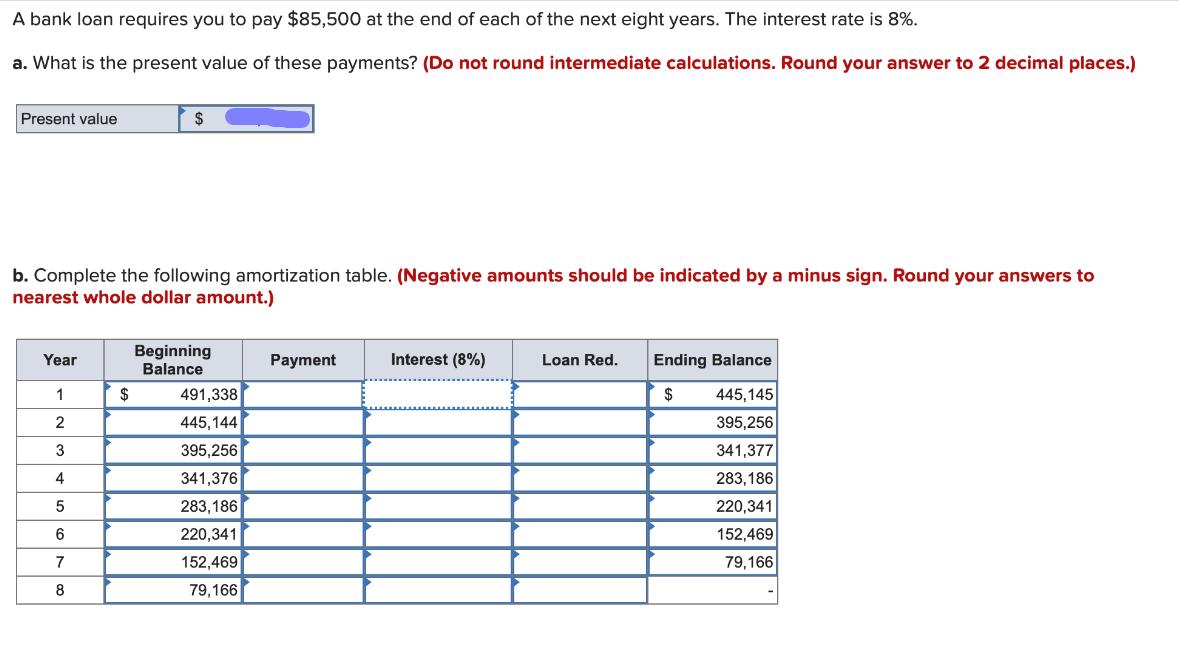

A bank loan requires you to pay $85,500 at the end of each of the next eight years. The interest rate is 8%. a.

A bank loan requires you to pay $85,500 at the end of each of the next eight years. The interest rate is 8%. a. What is the present value of these payments? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value b. Complete the following amortization table. (Negative amounts should be indicated by a minus sign. Round your answers to nearest whole dollar amount.) Year 1 2 3 4 5 6 7 8 $ $ Beginning Balance 491,338 445,144 395,256 341,376 283,186 220,341 152,469 79,166 Payment Interest (8%) Loan Red. Ending Balance $ 445,145 395,256 341,377 283,186 220,341 152,469 79,166

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the present value of the loan payments we can use the formula for the presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Alan Marcus

8th edition

77861620, 978-0077861629

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App