Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bi-weekly. How much does

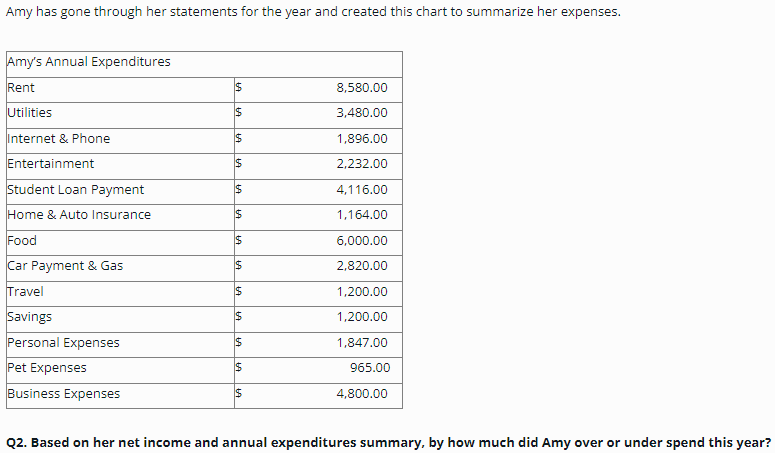

Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bi-weekly. How much does Amy net in a year from her day job? Amy has gone through her statements for the year and created this chart to summarize her expenses. Amy's Annual Expenditures Rent Utilities Internet & Phone Entertainment Student Loan Payment Home & Auto Insurance Food Car Payment & Gas Travel Savings Personal Expenses Pet Expenses Business Expenses $ $ $ $ $ $ $ $ $ $ $ $ $ 64 649 8,580.00 3,480.00 1,896.00 2,232.00 4,116.00 1,164.00 6,000.00 2,820.00 1,200.00 1,200.00 1,847.00 965.00 4,800.00 Q2. Based on her net income and annual expenditures summary, by how much did Amy over or under spend this year? Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bi-weekly. How much does Amy net in a year from her day job? Amy has gone through her statements for the year and created this chart to summarize her expenses. Amy's Annual Expenditures Rent Utilities Internet & Phone Entertainment Student Loan Payment Home & Auto Insurance Food Car Payment & Gas Travel Savings Personal Expenses Pet Expenses Business Expenses $ $ $ $ $ $ $ $ $ $ $ $ $ 64 649 8,580.00 3,480.00 1,896.00 2,232.00 4,116.00 1,164.00 6,000.00 2,820.00 1,200.00 1,200.00 1,847.00 965.00 4,800.00 Q2. Based on her net income and annual expenditures summary, by how much did Amy over or under spend this year? Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bi-weekly. How much does Amy net in a year from her day job? Amy has gone through her statements for the year and created this chart to summarize her expenses. Amy's Annual Expenditures Rent Utilities Internet & Phone Entertainment Student Loan Payment Home & Auto Insurance Food Car Payment & Gas Travel Savings Personal Expenses Pet Expenses Business Expenses $ $ $ $ $ $ $ $ $ $ $ $ $ 64 649 8,580.00 3,480.00 1,896.00 2,232.00 4,116.00 1,164.00 6,000.00 2,820.00 1,200.00 1,200.00 1,847.00 965.00 4,800.00 Q2. Based on her net income and annual expenditures summary, by how much did Amy over or under spend this year? Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bi-weekly. How much does Amy net in a year from her day job? Amy has gone through her statements for the year and created this chart to summarize her expenses. Amy's Annual Expenditures Rent Utilities Internet & Phone Entertainment Student Loan Payment Home & Auto Insurance Food Car Payment & Gas Travel Savings Personal Expenses Pet Expenses Business Expenses $ $ $ $ $ $ $ $ $ $ $ $ $ 64 649 8,580.00 3,480.00 1,896.00 2,232.00 4,116.00 1,164.00 6,000.00 2,820.00 1,200.00 1,200.00 1,847.00 965.00 4,800.00 Q2. Based on her net income and annual expenditures summary, by how much did Amy over or under spend this year? Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bi-weekly. How much does Amy net in a year from her day job? Amy has gone through her statements for the year and created this chart to summarize her expenses. Amy's Annual Expenditures Rent Utilities Internet & Phone Entertainment Student Loan Payment Home & Auto Insurance Food Car Payment & Gas Travel Savings Personal Expenses Pet Expenses Business Expenses $ $ $ $ $ $ $ $ $ $ $ $ $ 64 649 8,580.00 3,480.00 1,896.00 2,232.00 4,116.00 1,164.00 6,000.00 2,820.00 1,200.00 1,200.00 1,847.00 965.00 4,800.00 Q2. Based on her net income and annual expenditures summary, by how much did Amy over or under spend this year?

Step by Step Solution

★★★★★

3.27 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Lets start by calculating Amys annual net income from her day job Amys biwe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started