Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bank offers the following saving scheme: Invest a fixed amount on the first of the month of each month for a set number of

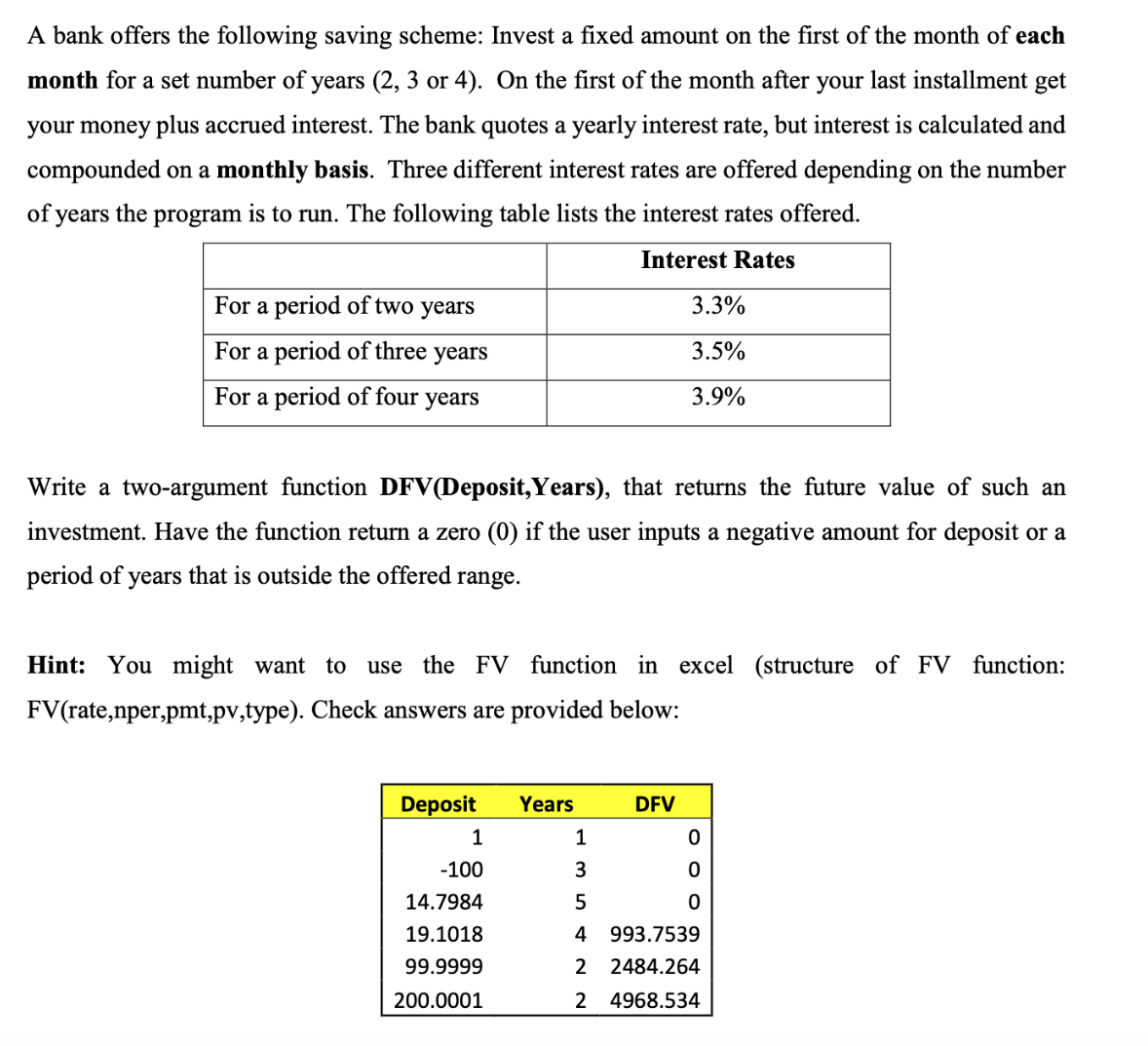

A bank offers the following saving scheme: Invest a fixed amount on the first of the month of each month for a set number of years ( 2,3 or 4). On the first of the month after your last installment get your money plus accrued interest. The bank quotes a yearly interest rate, but interest is calculated and compounded on a monthly basis. Three different interest rates are offered depending on the number of years the program is to run. The following table lists the interest rates offered. Write a two-argument function DFV(Deposit,Years), that returns the future value of such an investment. Have the function return a zero (0) if the user inputs a negative amount for deposit or a period of years that is outside the offered range. Hint: You might want to use the FV function in excel (structure of FV function: FV(rate,nper,pmt,pv,type). Check answers are provided below: A bank offers the following saving scheme: Invest a fixed amount on the first of the month of each month for a set number of years ( 2,3 or 4). On the first of the month after your last installment get your money plus accrued interest. The bank quotes a yearly interest rate, but interest is calculated and compounded on a monthly basis. Three different interest rates are offered depending on the number of years the program is to run. The following table lists the interest rates offered. Write a two-argument function DFV(Deposit,Years), that returns the future value of such an investment. Have the function return a zero (0) if the user inputs a negative amount for deposit or a period of years that is outside the offered range. Hint: You might want to use the FV function in excel (structure of FV function: FV(rate,nper,pmt,pv,type). Check answers are provided below

A bank offers the following saving scheme: Invest a fixed amount on the first of the month of each month for a set number of years ( 2,3 or 4). On the first of the month after your last installment get your money plus accrued interest. The bank quotes a yearly interest rate, but interest is calculated and compounded on a monthly basis. Three different interest rates are offered depending on the number of years the program is to run. The following table lists the interest rates offered. Write a two-argument function DFV(Deposit,Years), that returns the future value of such an investment. Have the function return a zero (0) if the user inputs a negative amount for deposit or a period of years that is outside the offered range. Hint: You might want to use the FV function in excel (structure of FV function: FV(rate,nper,pmt,pv,type). Check answers are provided below: A bank offers the following saving scheme: Invest a fixed amount on the first of the month of each month for a set number of years ( 2,3 or 4). On the first of the month after your last installment get your money plus accrued interest. The bank quotes a yearly interest rate, but interest is calculated and compounded on a monthly basis. Three different interest rates are offered depending on the number of years the program is to run. The following table lists the interest rates offered. Write a two-argument function DFV(Deposit,Years), that returns the future value of such an investment. Have the function return a zero (0) if the user inputs a negative amount for deposit or a period of years that is outside the offered range. Hint: You might want to use the FV function in excel (structure of FV function: FV(rate,nper,pmt,pv,type). Check answers are provided below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started