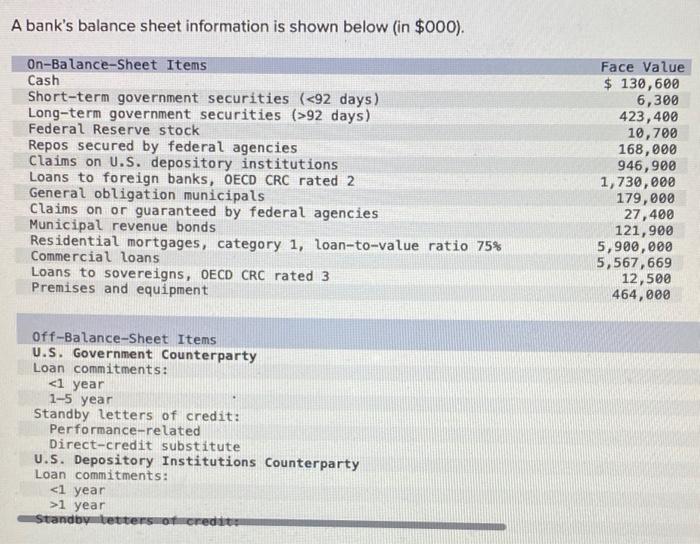

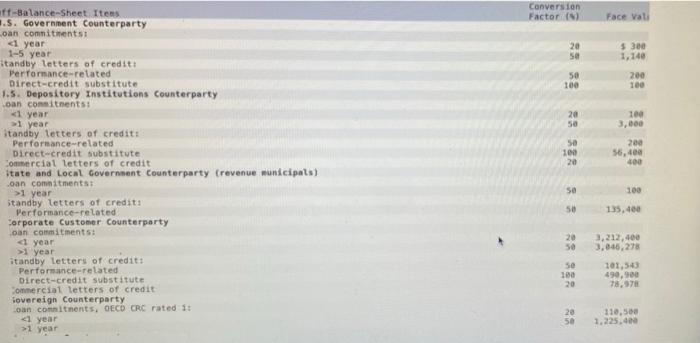

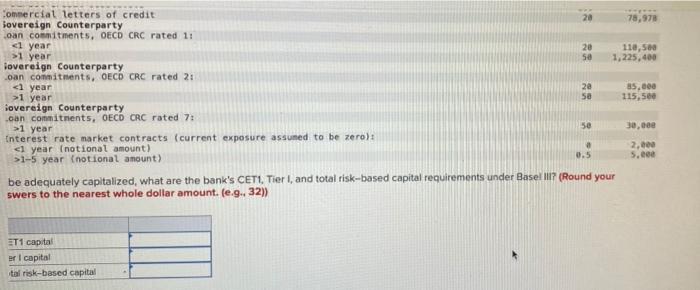

A bank's balance sheet information is shown below (in $000). On-Balance-Sheet Items Cash Short-term government securities (92 days) Federal Reserve stock Repos secured by federal agencies Claims on U.S. depository institutions Loans to foreign banks, OECD CRC rated 2 General obligation municipals Claims on or guaranteed by federal agencies Municipal revenue bonds Residential mortgages, category 1, loan-to-value ratio 75% Commercial loans Loans to sovereigns, OECD CRC rated 3 Premises and equipment Face Value $ 130,600 6,300 423,400 10,700 168,000 946,900 1,730,000 179,000 27,400 121,900 5,900,000 5,567,669 12,500 464,000 Off-Balance-Sheet Items U.S. Government Counterparty Loan commitments: 1 year Standby letters of credit Conversion Factor) Face vati 20 Sa $300 1,140 50 100 200 100 20 100 3,600 200 56,400 400 20 -Balance-Sheet Items 1.5. Government Counterparty oan commitments year 1-5 year itandby letters of credit: Performance-related Direct-credit substitute 1.5. Depository Institutions Counterparty can commitments: 1 year 1 year tandby letters of credit: Performance-related Direct-credit substitute Commercial letters of credit itate and Local Government Counterparty (revenue municipals) oan commitments > year Standby letters of credits Performance-related Corporate Customer counterparty can commitments dyear >> year Standby letters of credit: Performance related Direct-credit substitute Commercial letters of credit lovereign counterparty can commitments, OECD CRC rated 1: 1 year >>1 year Se 100 50 135,400 20 50 3,212,400 3.046,278 50 100 20 101,543 499,900 78.978 20 50 110.500 1.225.4 commercial letters of credit 20 78,978 Sovereign counterparty oan commitments, OECD CRC rated 11 a year 20 118,500 >1 year sa 1,225,400 lovereign counterparty oan commitments. OECO CRC rated 2: year 20 85.000 >1 year Sa 115,500 Sovereign counterparty can commitments, OECD ORC rated 7 30, ce >1 year Interest rate market contracts (current exposure assumed to be zero): 1 year (notional amount) 0.5 5.000 >1-5 year notional amount) be adequately capitalized, what are the bank's CET1, Tier, and total risk-based capital requirements under Basel ? (Round your swers to the nearest whole dollar amount. (e.9., 32)) 50 T1 capital er i capital tai risk-based capital A bank's balance sheet information is shown below (in $000). On-Balance-Sheet Items Cash Short-term government securities (92 days) Federal Reserve stock Repos secured by federal agencies Claims on U.S. depository institutions Loans to foreign banks, OECD CRC rated 2 General obligation municipals Claims on or guaranteed by federal agencies Municipal revenue bonds Residential mortgages, category 1, loan-to-value ratio 75% Commercial loans Loans to sovereigns, OECD CRC rated 3 Premises and equipment Face Value $ 130,600 6,300 423,400 10,700 168,000 946,900 1,730,000 179,000 27,400 121,900 5,900,000 5,567,669 12,500 464,000 Off-Balance-Sheet Items U.S. Government Counterparty Loan commitments: 1 year Standby letters of credit Conversion Factor) Face vati 20 Sa $300 1,140 50 100 200 100 20 100 3,600 200 56,400 400 20 -Balance-Sheet Items 1.5. Government Counterparty oan commitments year 1-5 year itandby letters of credit: Performance-related Direct-credit substitute 1.5. Depository Institutions Counterparty can commitments: 1 year 1 year tandby letters of credit: Performance-related Direct-credit substitute Commercial letters of credit itate and Local Government Counterparty (revenue municipals) oan commitments > year Standby letters of credits Performance-related Corporate Customer counterparty can commitments dyear >> year Standby letters of credit: Performance related Direct-credit substitute Commercial letters of credit lovereign counterparty can commitments, OECD CRC rated 1: 1 year >>1 year Se 100 50 135,400 20 50 3,212,400 3.046,278 50 100 20 101,543 499,900 78.978 20 50 110.500 1.225.4 commercial letters of credit 20 78,978 Sovereign counterparty oan commitments, OECD CRC rated 11 a year 20 118,500 >1 year sa 1,225,400 lovereign counterparty oan commitments. OECO CRC rated 2: year 20 85.000 >1 year Sa 115,500 Sovereign counterparty can commitments, OECD ORC rated 7 30, ce >1 year Interest rate market contracts (current exposure assumed to be zero): 1 year (notional amount) 0.5 5.000 >1-5 year notional amount) be adequately capitalized, what are the bank's CET1, Tier, and total risk-based capital requirements under Basel ? (Round your swers to the nearest whole dollar amount. (e.9., 32)) 50 T1 capital er i capital tai risk-based capital