Answered step by step

Verified Expert Solution

Question

1 Approved Answer

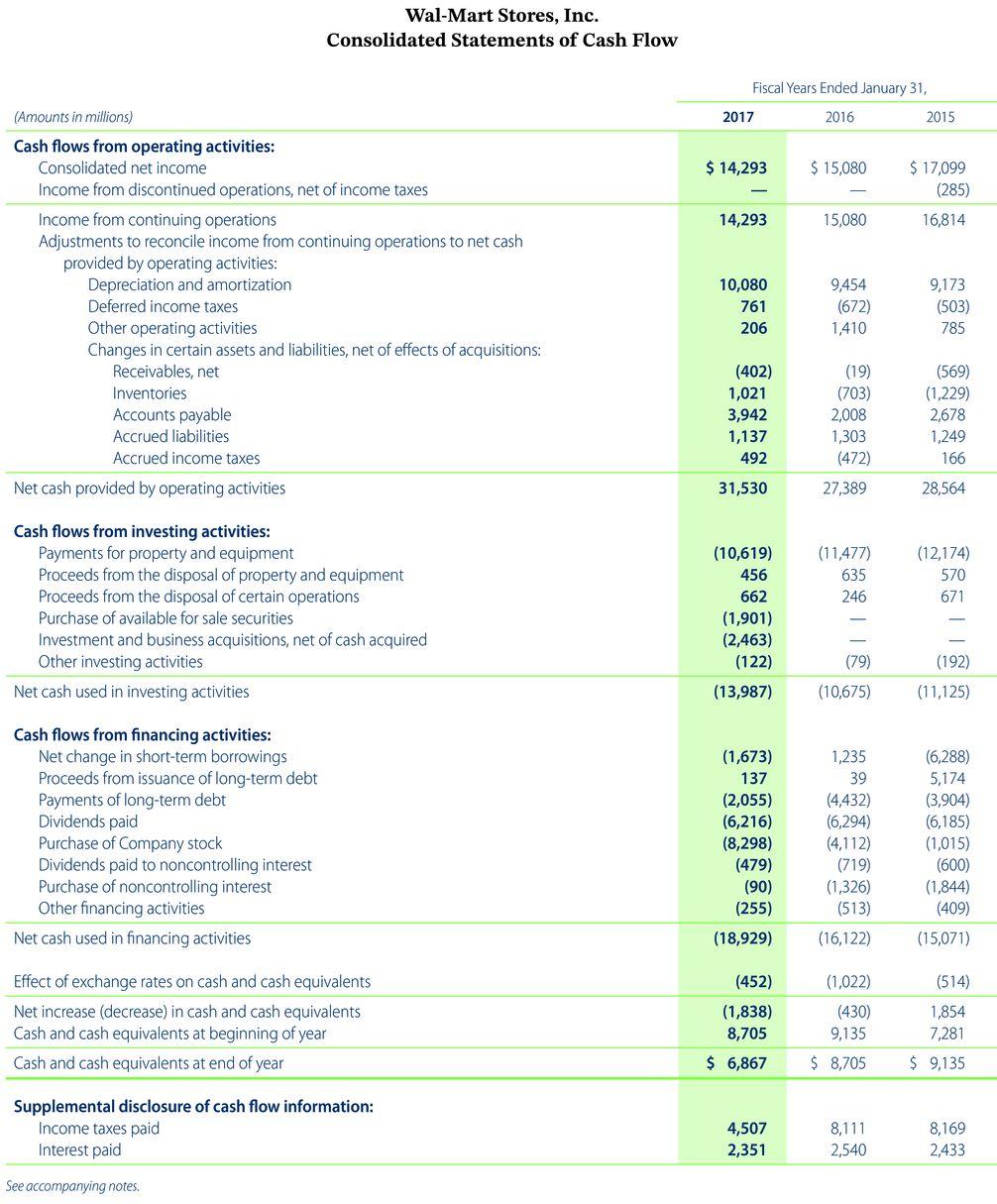

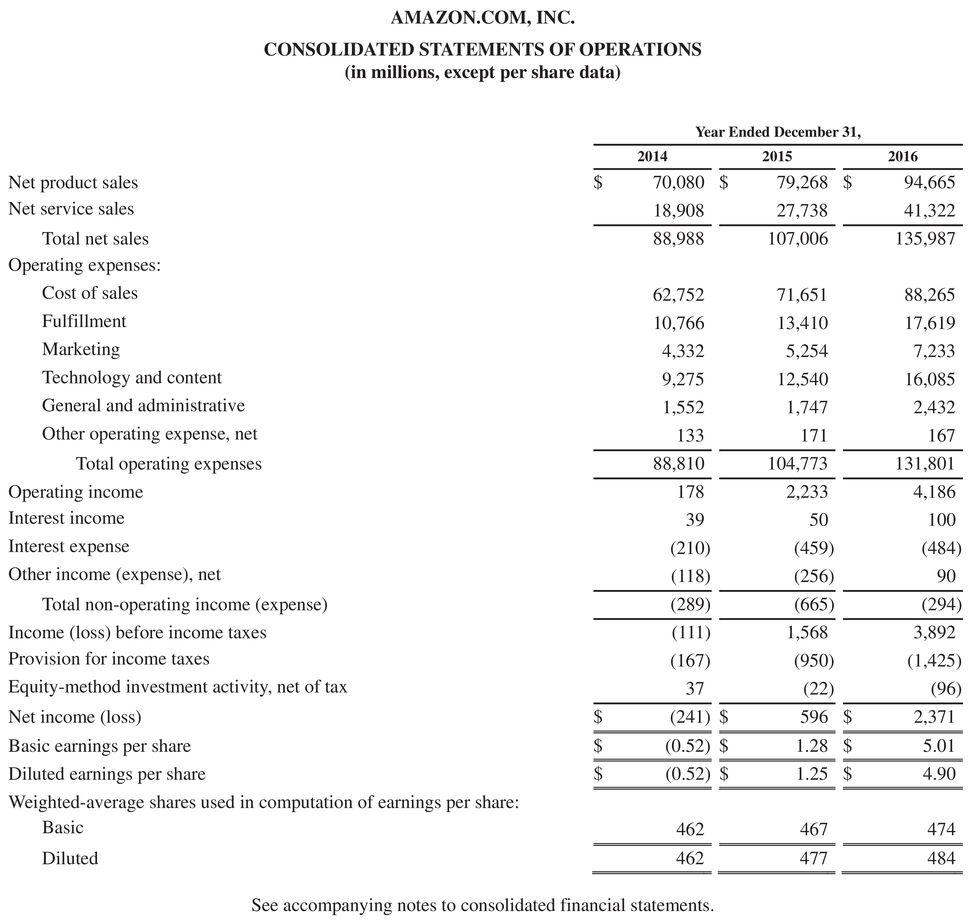

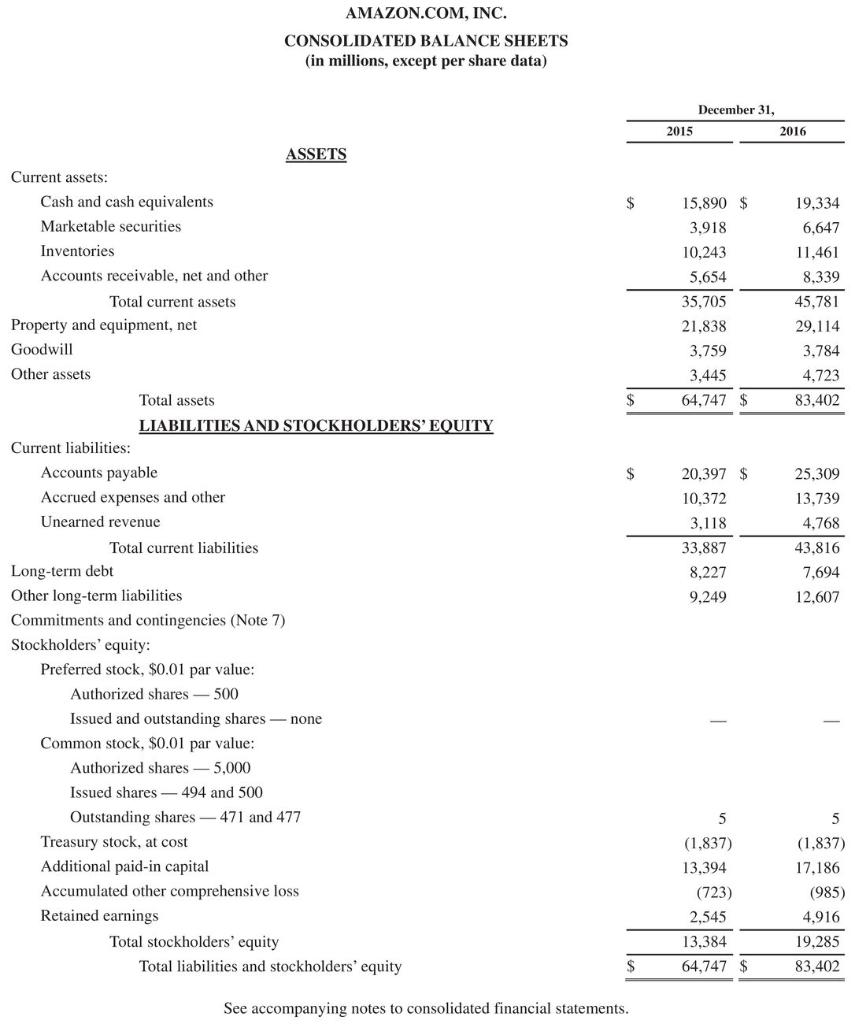

A. Based on the information contained in these financial statements (For Amazon use values for December 31. 2016 and for Wal-Mart use values for January

A. Based on the information contained in these financial statements (For Amazon use values for December 31. 2016 and for Wal-Mart use values for January 31, 2017.), determine the following values for each company.

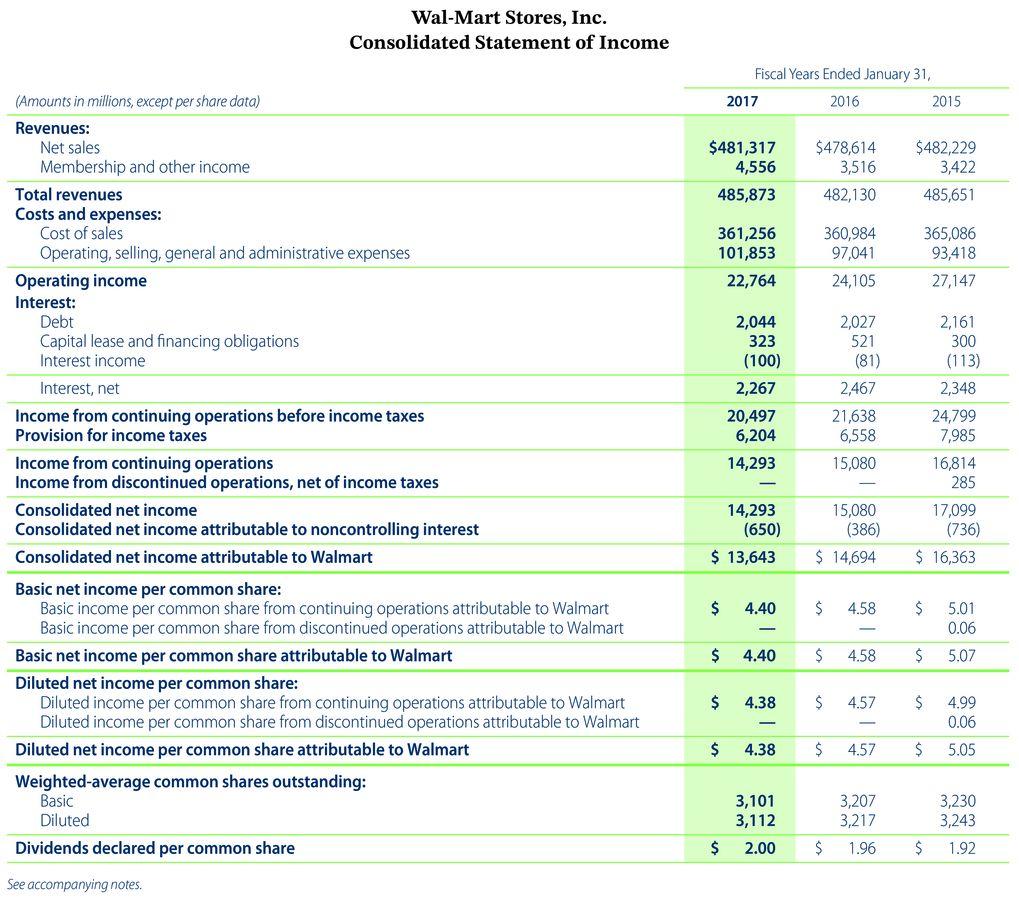

(1) Profit margin for 2016.

Profit margin

A. Amazon.com

B. Wa-Mart Stores

(2) Gross profit for 2016.

A. Amazon

B. Walmart stores

3. Gross profit rate for 2016

A. AMazon

B. Walmart

4. Operating income for 2016

A. Amazon

B. Walmart

5. Percentage change in operating income from 2015 to 2016

Amazon

Walmart

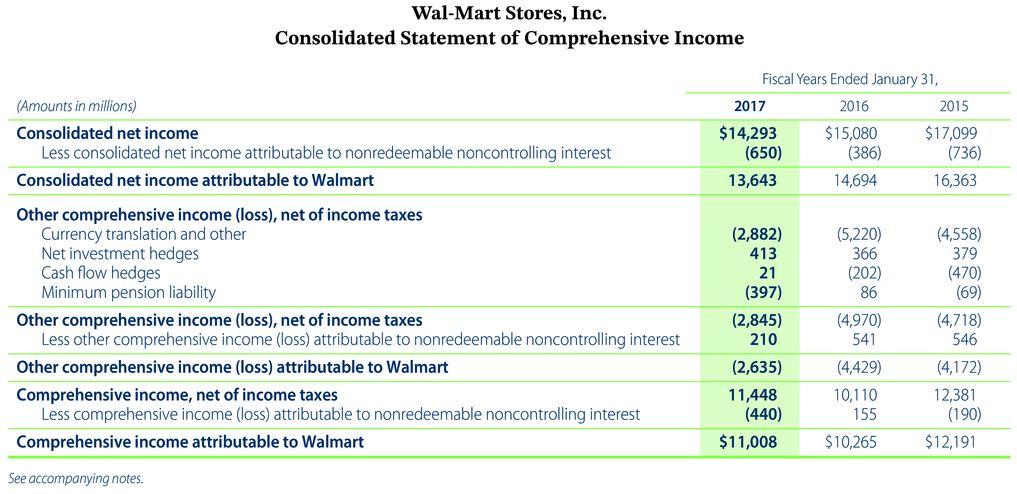

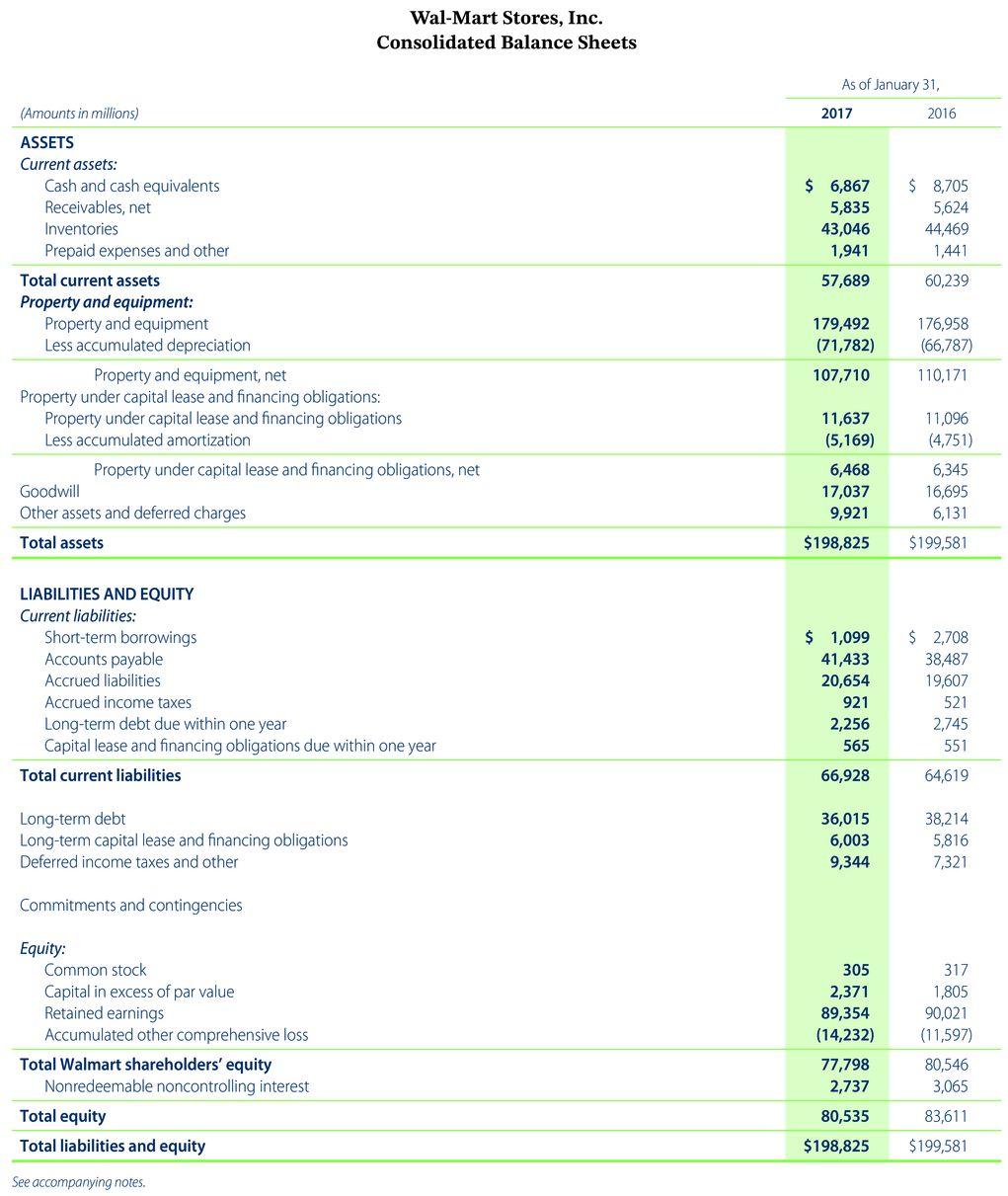

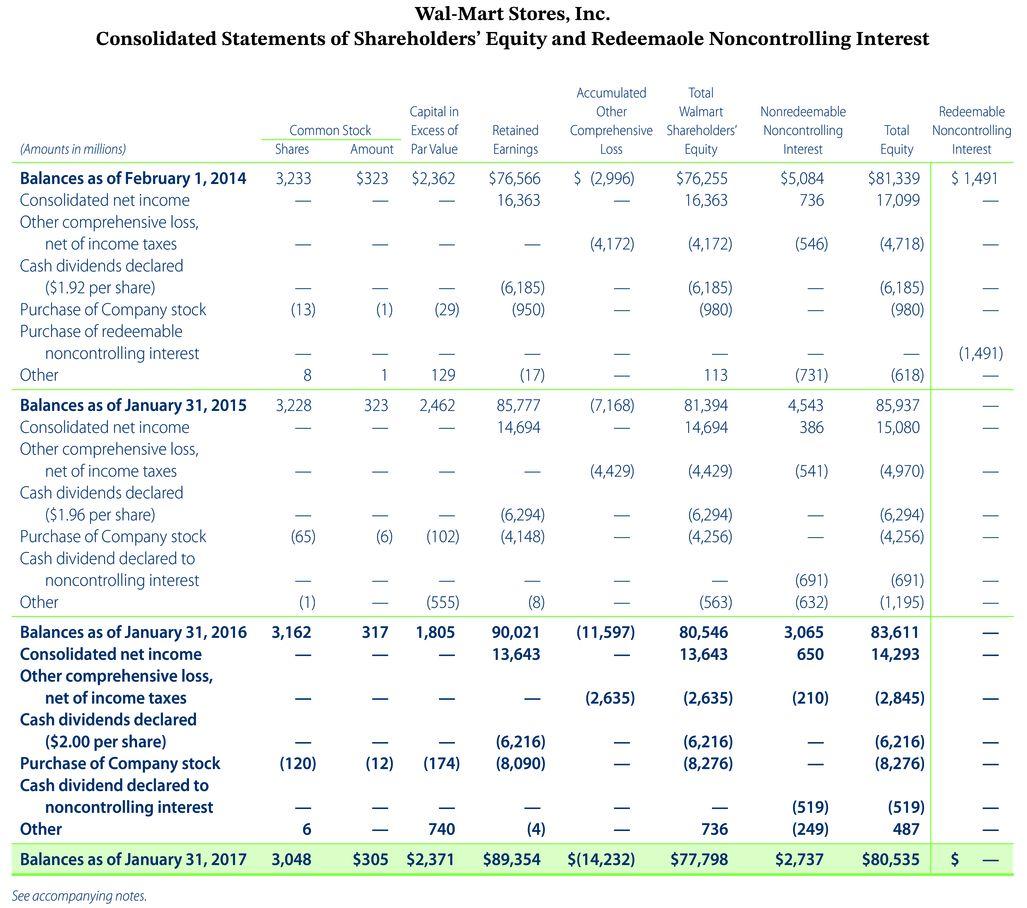

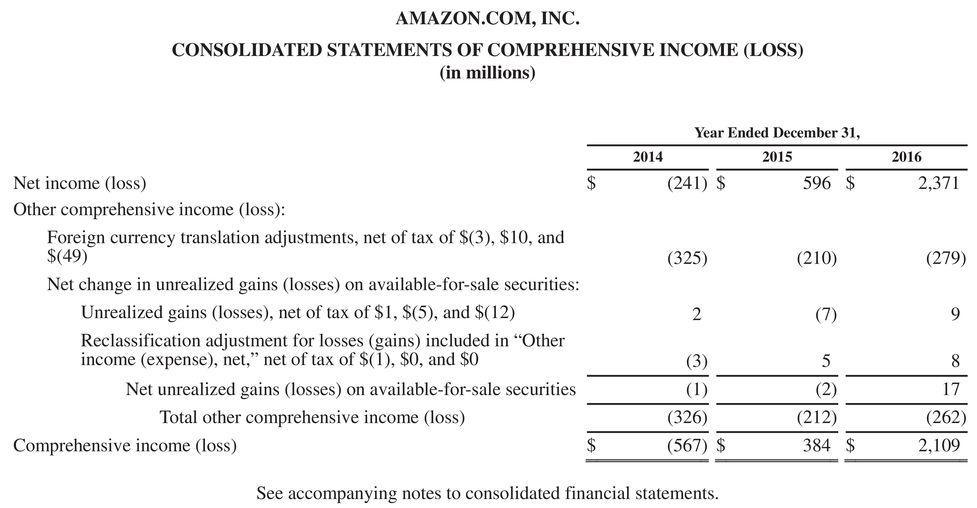

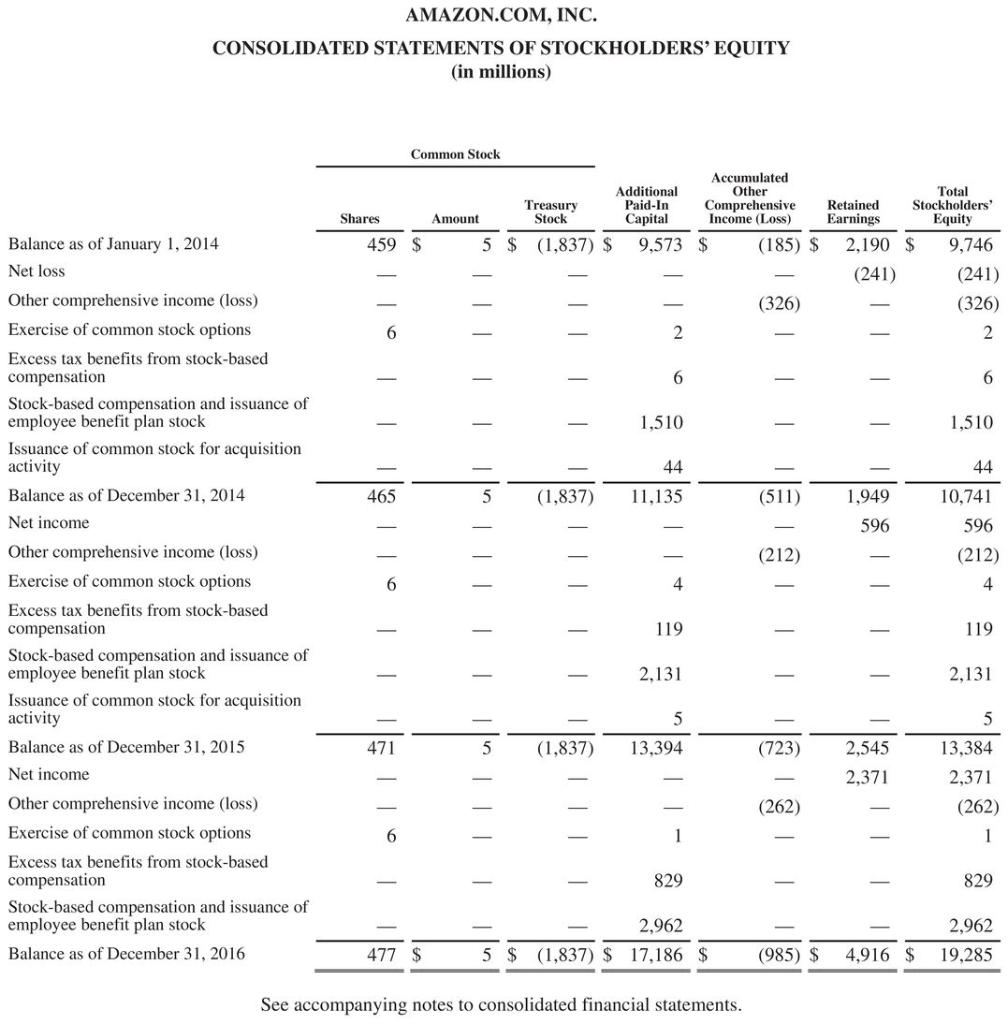

Wal-Mart Stores, Inc. Consolidated Statement of Comprehensive Income Wal-Mart Stores, Inc. Consolidated Balance Sheets LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities Long-term debt Long-term capital lease and financing obligations Deferred income taxes and other \begin{tabular}{rr} $1,099 & $2,708 \\ 41,433 & 38,487 \\ 20,654 & 19,607 \\ 921 & 521 \\ 2,256 & 2,745 \\ 565 & 551 \\ \hline 66,928 & 64,619 \\ 36,015 & 38,214 \\ 6,003 & 5,816 \\ 9,344 & 7,321 \end{tabular} Commitments and contingencies Equity: \begin{tabular}{lrr} Common stock & 305 & 317 \\ Capital in excess of par value & 2,371 & 1,805 \\ Retained earnings & 89,354 & 90,021 \\ Accumulated other comprehensive loss & (14,232) & (11,597) \\ \hline Total Walmart shareholders' equity & 77,798 & 80,546 \\ Nonredeemable noncontrolling interest & 2,737 & 3,065 \\ \hline Total equity & 80,535 & 83,611 \\ \hline Total liabilities and equity & $198,825 & $199,581 \\ \hline \end{tabular} See accompanying notes. Wal-Mart Stores, Inc. Consolidated Statement of Income Fiscal Years Ended January 31, (Amounts in millions, except per share data) Revenues: See accompanying notes. Wal-Mart Stores, Inc. Consolidated Statements of Shareholders' Equity and Redeemaole Noncontrolling Interest 1 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Year Ended December 31, Net product sales Net service sales Total net sales Operating expenses: See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in millions) nsive income (loss): rency translation adjustments, net of tax of $(3),$10, and in unrealized gains (losses) on available-for-sale securities zed gains (losses), net of tax of $1,$(5), and $(12) ification adjustment for losses (gains) included in "Other (expense), net," net of tax of $(1),$0, and $0 tet unrealized gains (losses) on available-for-sale securities Total other comprehensive income (loss) income (loss) See accompanying notes to consolidated financial statements. AMAZON.COM. INC. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) See accompanying notes to consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started