Answered step by step

Verified Expert Solution

Question

1 Approved Answer

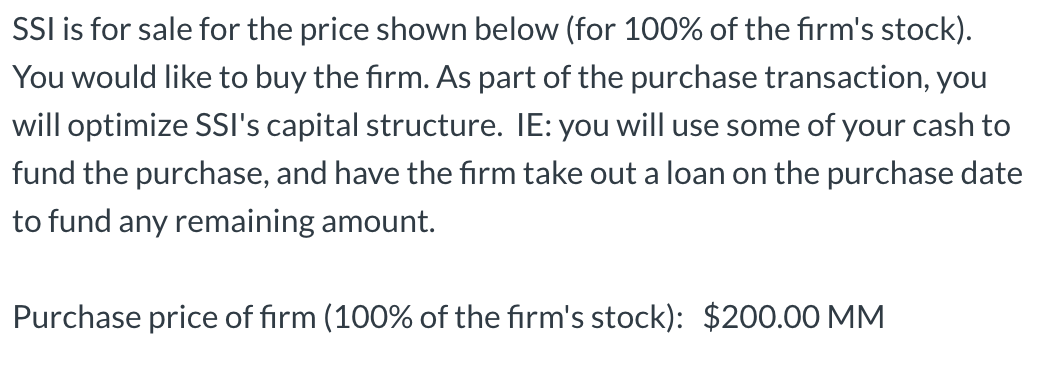

A. Based on your above analysis, what is the D/(D+E) ratio that you will set for the firm? (60%, 20%, 45%, 35%, 15%, 9%, 75%,

A. Based on your above analysis, what is the D/(D+E) ratio that you will set for the firm? (60%, 20%, 45%, 35%, 15%, 9%, 75%, 55%)

B. How much of your cash will you use to fund the purchase?

C. How large is the loan the firm will take out to fund the rest of the purchase?

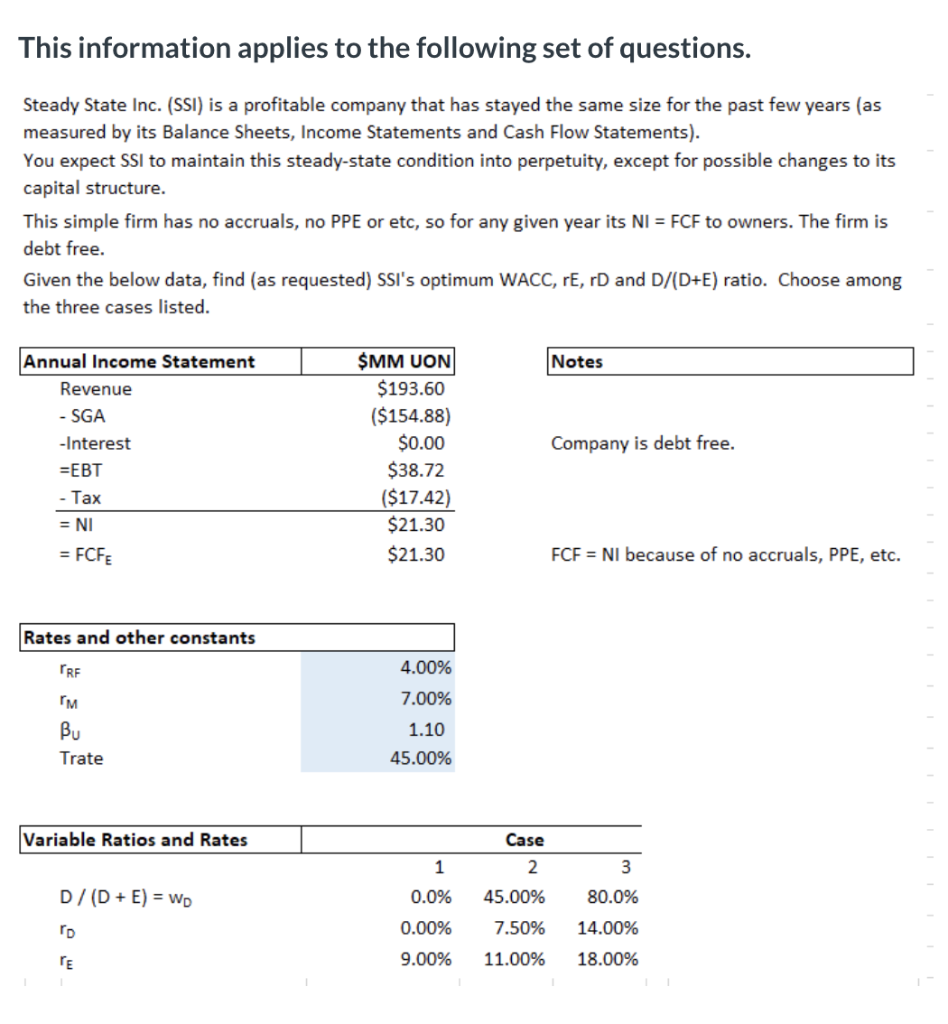

This information applies to the following set of questions. Steady State Inc. (SSI) is a profitable company that has stayed the same size for the past few years (as measured by its Balance Sheets, Income Statements and Cash Flow Statements). You expect SSI to maintain this steady-state condition into perpetuity, except for possible changes to its capital structure. This simple firm has no accruals, no PPE or etc, so for any given year its NI = FCF to owners. The firm is debt free. Given the below data, find (as requested) ssi's optimum WACC, E, D and D/(D+E) ratio. Choose among the three cases listed. Notes Company is debt free. Annual Income Statement Revenue - SGA -Interest =EBT - Tax = NI = FCF $MM UON $193.60 ($154.88) $0.00 $38.72 ($17.42) $21.30 $21.30 FCF = NI because of no accruals, PPE, etc. Rates and other constants PRE rm 4.00% 7.00% 1.10 45.00% Bu Trate Variable Ratios and Rates Case D/D + E) = WD 0.0% 0.00% 9.00% 45.00% 7.50% 11.00% 80.0% 14.00% 18.00% SSI is for sale for the price shown below (for 100% of the firm's stock). You would like to buy the firm. As part of the purchase transaction, you will optimize SSI's capital structure. IE: you will use some of your cash to fund the purchase, and have the firm take out a loan on the purchase date to fund any remaining amount. Purchase price of firm (100% of the firm's stock): $200.00 MM This information applies to the following set of questions. Steady State Inc. (SSI) is a profitable company that has stayed the same size for the past few years (as measured by its Balance Sheets, Income Statements and Cash Flow Statements). You expect SSI to maintain this steady-state condition into perpetuity, except for possible changes to its capital structure. This simple firm has no accruals, no PPE or etc, so for any given year its NI = FCF to owners. The firm is debt free. Given the below data, find (as requested) ssi's optimum WACC, E, D and D/(D+E) ratio. Choose among the three cases listed. Notes Company is debt free. Annual Income Statement Revenue - SGA -Interest =EBT - Tax = NI = FCF $MM UON $193.60 ($154.88) $0.00 $38.72 ($17.42) $21.30 $21.30 FCF = NI because of no accruals, PPE, etc. Rates and other constants PRE rm 4.00% 7.00% 1.10 45.00% Bu Trate Variable Ratios and Rates Case D/D + E) = WD 0.0% 0.00% 9.00% 45.00% 7.50% 11.00% 80.0% 14.00% 18.00% SSI is for sale for the price shown below (for 100% of the firm's stock). You would like to buy the firm. As part of the purchase transaction, you will optimize SSI's capital structure. IE: you will use some of your cash to fund the purchase, and have the firm take out a loan on the purchase date to fund any remaining amount. Purchase price of firm (100% of the firm's stock): $200.00 MMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started