Answered step by step

Verified Expert Solution

Question

1 Approved Answer

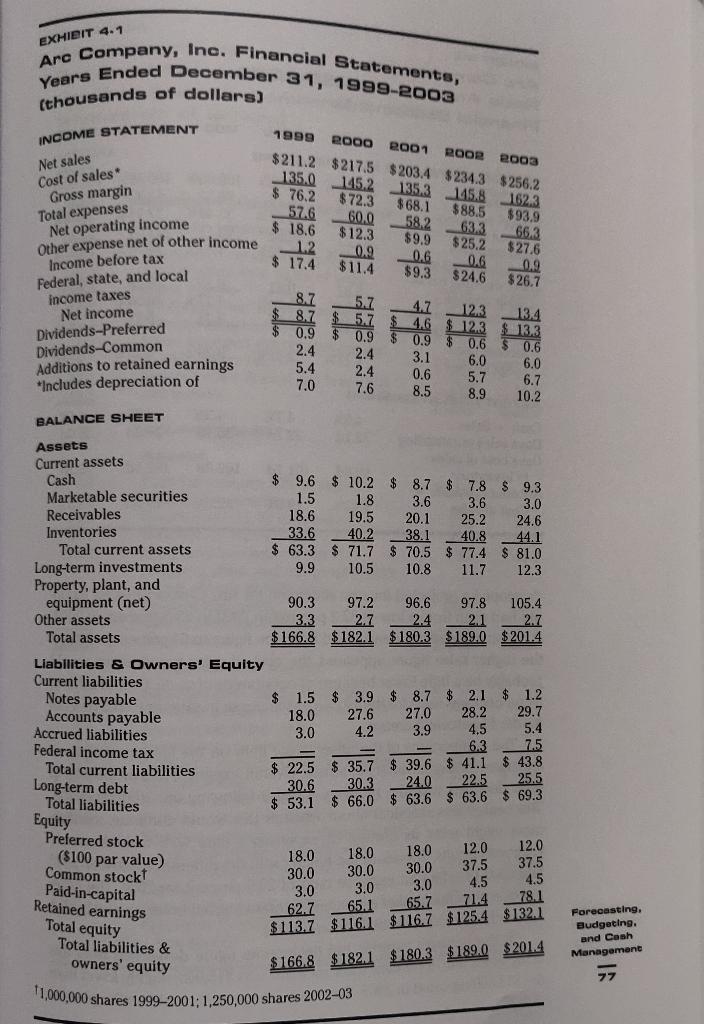

A basic accounting equation is Assets less Liabilities equals Equity. The owners equity increases each year from 1999-2003. How is that possible when the assets

A basic accounting equation is Assets less Liabilities equals Equity. The owners equity increases each year from 1999-2003. How is that possible when the assets for 2001 are down from the previous year? What other issues do you observe in regard to this information? What would you do if you do not have sufficient background to understand financial statements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started