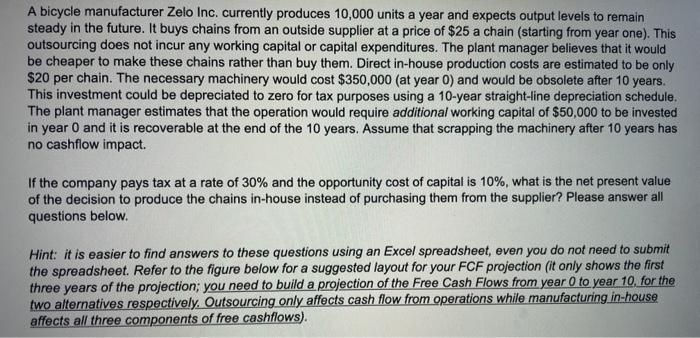

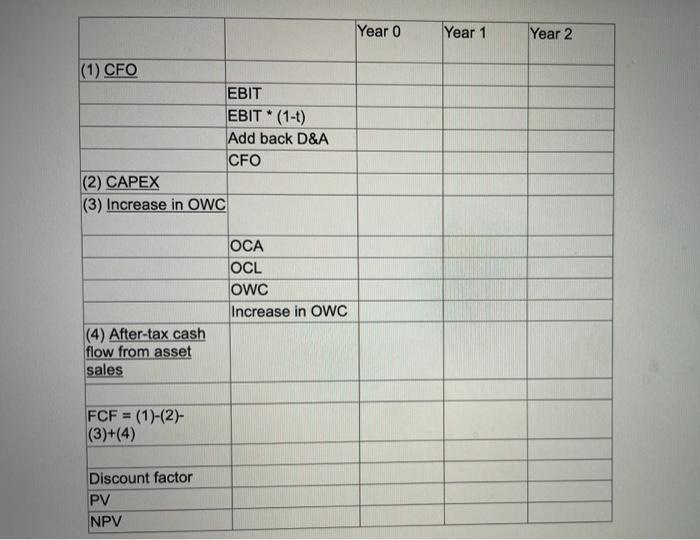

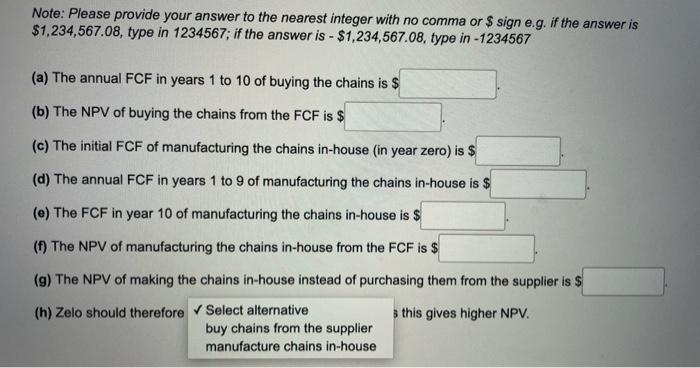

A bicycle manufacturer Zelo Inc. currently produces 10,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $25 a chain (starting from year one). This outsourcing does not incur any working capital or capital expenditures. The plant manager believes that it would be cheaper to make these chains rather than buy them. Direct in-house production costs are estimated to be only $20 per chain. The necessary machinery would cost $350,000 (at year 0) and would be obsolete after 10 years. This investment could be depreciated to zero for tax purposes using a 10-year straight-line depreciation schedule. The plant manager estimates that the operation would require additional working capital of $50,000 to be invested in year 0 and it is recoverable at the end of the 10 years. Assume that scrapping the machinery after 10 years has no cashflow impact. If the company pays tax at a rate of 30% and the opportunity cost of capital is 10%, what is the net present value of the decision to produce the chains in-house instead of purchasing them from the supplier? Please answer all questions below. Hint: it is easier to find answers to these questions using an Excel spreadsheet, even you do not need to submit the spreadsheet. Refer to the figure below for a suggested layout for your FCF projection (it only shows the first three years of the projection; you need to build a projection of the Free Cash Flows from year 0 to year 10, for the two alternatives respectively. Outsourcing only affects cash flow from operations while manufacturing in-house affects all three components of free cashflows). (1) CFO (2) CAPEX (3) Increase in OWC (4) After-tax cash flow from asset sales FCF = (1)-(2)- (3)+(4) Discount factor PV NPV EBIT EBIT (1-1) Add back D&A CFO * OCA OCL OWC Increase in OWC Year 0 Year 1 Year 2 Note: Please provide your answer to the nearest integer with no comma or $ sign e.g. if the answer is $1,234,567.08, type in 1234567; if the answer is - $1,234,567.08, type in-1234567 (a) The annual FCF in years 1 to 10 of buying the chains is $ (b) The NPV of buying the chains from the FCF is $ (c) The initial FCF of manufacturing the chains in-house (in year zero) is $ (d) The annual FCF in years 1 to 9 of manufacturing the chains in-house is $ (e) The FCF in year 10 of manufacturing the chains in-house is $ (f) The NPV of manufacturing the chains in-house from the FCF is $ (g) The NPV of making the chains in-house instead of purchasing them from the supplier is $ (h) Zelo should therefore Select alternative s this gives higher NPV. buy chains from the supplier manufacture chains in-house