Answered step by step

Verified Expert Solution

Question

1 Approved Answer

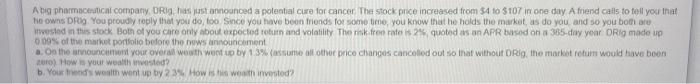

A big pharmaceutical company, DRIg, has just announced a potential cure for cancer. The stock price increased from $4 to $107 in one day. A

A big pharmaceutical company, DRIg, has just announced a potential cure for cancer. The stock price increased from $4 to $107 in one day. A friend calls to tell you that he owns DRIg. you probably replied that you do, too. since you have been friends for sometime, you know that he holds the market, as do you, and so you both are invested in the stock. Both of you only care about expected return and volatitlity. The risk-free rate is 2% quoted as an APR based on a 365 day year. DRIg made up .09% of the market portfolio before the news announcement.

Abig pharmaceutical company, Rigs just announced a potential cure for cancer The stock price increased from $4 to $107 in one day A friend calls to tell you that to owns Di You proudly toply that you do, too. Since you have been friends for some time, you know that he holds the market as do you and so you both are rested in this stock Both of you are only about expected return and volatility The riskfron rates is 24 quoted as an APR based on 385-day year Rig made up 009% of the market portfolio before the news announcement a. On the amount your over up by 13% assume all other price changes cancelled out so that without Rig, the market retum would have boon uro) How is your wealth invested? b. Your rend's wealth went up by 23% How it worth invested A.) on the announcement your overall wealth went up by 1.3% (assume all other price changes cancelled out so that without DRIg, the market return would have been zero.) How is your wealth invested? (in percentage)

B.) your friends wealth went up by 2.3%. How is his wealth invested?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started