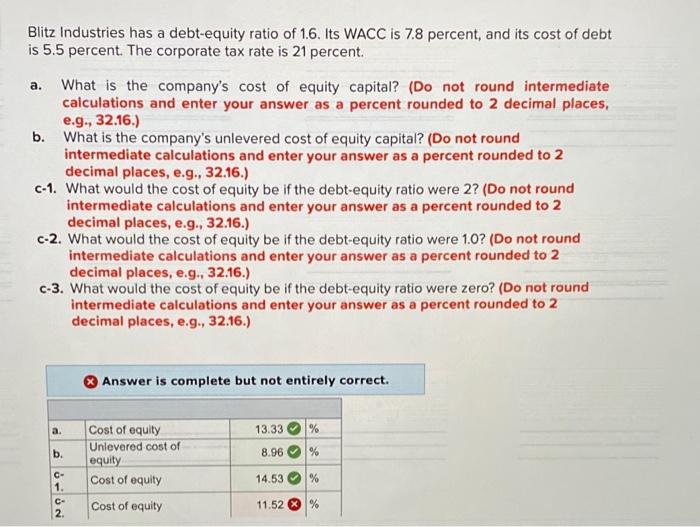

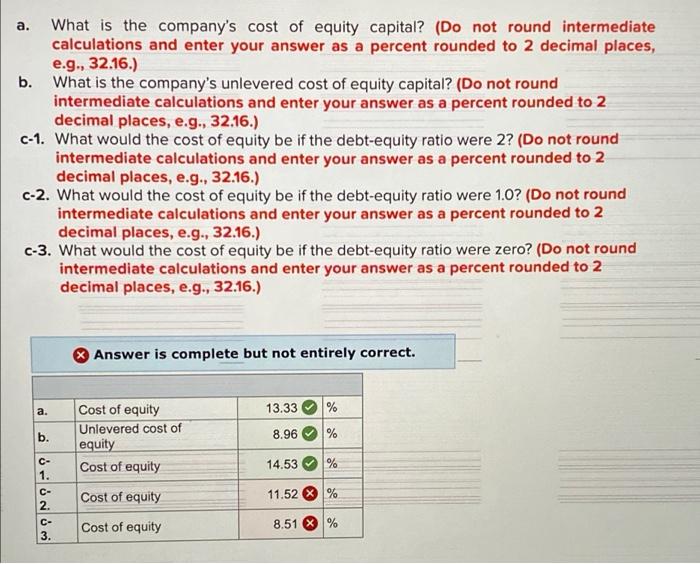

a. Blitz Industries has a debt-equity ratio of 1.6. Its WACC is 7.8 percent, and its cost of debt is 5.5 percent. The corporate tax rate is 21 percent What is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company's unlevered cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. What would the cost of equity be if the debt-equity ratio were 2? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) c-2. What would the cost of equity be if the debt-equity ratio were 1.0? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-3. What would the cost of equity be if the debt-equity ratio were zero? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. 13.33 % b Cost of equity Unlevered cost of equity Cost of equity 8.96 14.53 % Cost of equity 11.52 % a. What is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company's unlevered cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. What would the cost of equity be if the debt-equity ratio were 2? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. What would the cost of equity be if the debt-equity ratio were 1.0? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) C-3. What would the cost of equity be if the debt-equity ratio were zero? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. 13.33 % b. Cost of equity Unlevered cost of equity Cost of equity 8.96 % 14.53 % Cost of equity 11.52 % 8.51 Cost of equity X %